Advertisement

Help Keep Boards Alive. Support us by going ad free today. See here: https://subscriptions.boards.ie/.

https://www.boards.ie/group/1878-subscribers-forum

Private Group for paid up members of Boards.ie. Join the club.

Private Group for paid up members of Boards.ie. Join the club.

Hi all, please see this major site announcement: https://www.boards.ie/discussion/2058427594/boards-ie-2026

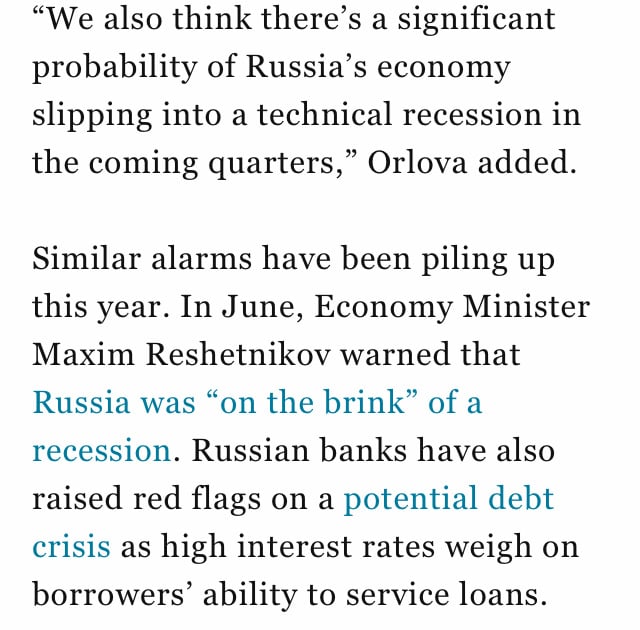

A global recession is on the horizon - please read OP for mod warning

Comments

-

-

-

-

-

-

Advertisement

-

-

-

-

-

-

Advertisement

-

-

-

-

-

-

-

-

-

-

-

Advertisement

-

-

-

-

-

-

-

-

-

-

Advertisement

-

Advertisement