Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi all! We have been experiencing an issue on site where threads have been missing the latest postings. The platform host Vanilla are working on this issue. A workaround that has been used by some is to navigate back from 1 to 10+ pages to re-sync the thread and this will then show the latest posts. Thanks, Mike.

Hi there,

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

Gold

Comments

-

Hi guys,

Now that the price of gold is down, I'm thinking of buying some gold.

Do you know of any good site that can send gold to Ireland?

I found https://www.finegoldbars.co.uk/ so far, did any of you guys used this site? are they reliable? They seem to have a very good collection of gold bars and offer free secured delivery to Ireland, but I don't want to send them my money until I'm sure that they're legit.

There is also http://www.thegoldbullion.co.uk/ but not sure if they deliver to Ireland.

thanks!0 -

Here's a very interesting chart I came across, think it should be noted by people with skin in the game

http://www.macrotrends.net/1333/gold-and-silver-prices-100-year-historical-chart0 -

Value Hunter wrote: »Here's a very interesting chart I came across, think it should be noted by people with skin in the game

http://www.macrotrends.net/1333/gold-and-silver-prices-100-year-historical-chart

Sorry but that chart is invalid because the CPI is a bullsh!t way of measuring inflation. The best way to see if gold, or any asset, is in a bubble is to compare it to other assets such as stocks, real estate, commodities etc. If you do some research, you will realize that gold is undervalued versus the S&P, the Dow and is undervalued when priced using real inflation figures.0 -

Hi guys,

Now that the price of gold is down, I'm thinking of buying some gold.

Do you know of any good site that can send gold to Ireland?

I found https://www.finegoldbars.co.uk/ so far, did any of you guys used this site? are they reliable? They seem to have a very good collection of gold bars and offer free secured delivery to Ireland, but I don't want to send them my money until I'm sure that they're legit.

There is also http://www.thegoldbullion.co.uk/ but not sure if they deliver to Ireland.

thanks!

You should read through this thread because there is plenty of info regarding buying gold. I copied this from one of my older posts in this thread because I'm so nice Bullion Dealers in Ireland:

Bullion Dealers in Ireland:

http://www.bulliondirect.ie/

http://www.irishgoldbullion.ie/

There is no VAT on gold, as it is seen as an investment metal. However, if you are buying silver, which is the more attractive option for most people, there is VAT, and we all know that the VAT is very high here.

You can buy from bullion dealers in Germany, which have the lower 7% VAT rate. Geiger Edelmetalle (https://www.geiger-edelmetalle.de/shop_content.php/language/en/coID/9) has dealt with many people in Ireland (inlcuding myself) and had no problems with VAT when importing etc. However they have a limit on what they can sell abroad, which they have reached. If you buy from them in January, that quota will be reset.

For people interested in gold/silver investing, stay away from bullion bars and buy the 1oz bullion coins, American Eagles and Canadian Maples being the most liquid. The reason being, just say you buy a 50 oz silver bar at $1800. If silver goes up in price, just say to $150 (around 450%), that bar would now be valued at around 10 grand. A silver bar priced at $10,000 would be very hard to sell to someone on the street, therefore not liquid. Coins are also harder to counterfeit and are trusted more.

EDIT:

Look at the silver forum for lots of info: http://www.boards.ie/vbulletin/showthread.php?t=2055514901

EDIT:

Limits on what Geiger can sell was mentioned above but this is from last year so I don't know if they have reached their limit this year yet. You will have to contact them about that.0 -

You should read through this thread because there is plenty of info regarding buying gold. I copied this from one of my older posts in this thread because I'm so nice

EDIT:

Limits on what Geiger can sell was mentioned above but this is from last year so I don't know if they have reached their limit this year yet. You will have to contact them about that.

Thanks a lot!

One last question ( and thanks in advance) : the difference between the selling price and the buying price is sometimes big, which make the gain from a potential sell not very high. Do you have any recommendation on the best place to sell bullion gold?

Thanks again0 -

Thanks a lot!

One last question ( and thanks in advance) : the difference between the selling price and the buying price is sometimes big, which make the gain from a potential sell not very high. Do you have any recommendation on the best place to sell bullion gold?

Thanks again

To be honest, I don't worry about the "spread" between selling and buying prices because I'm holding for the long term, which I suppose you are also.

You can sell gold easily to any of the bullion gold dealers (2 mentioned above) here in Ireland who will pay you spot price plus a bit extra.

PM me if you want any more information, it'd be no bother at all.

EDIT:

If you are trying to choose between gold or silver, I'd personally go with silver as it is very undervalued versus gold (1/65th of price which is abnormally low) and versus other assets, the Dow in particular.0 -

Sorry but that chart is invalid because the CPI is a bullsh!t way of measuring inflation. The best way to see if gold, or any asset, is in a bubble is to compare it to other assets such as stocks, real estate, commodities etc. If you do some research, you will realize that gold is undervalued versus the S&P, the Dow and is undervalued when priced using real inflation figures.

Yes the CPI isn't perfect but to claim the chart as completely invalid is a bit much, I suspect you've become too emotionally attached to your position in gold0 -

Value Hunter wrote: »Yes the CPI isn't perfect but to claim the chart as completely invalid is a bit much, I suspect you've become too emotionally attached to your position in gold

Well, it is very misleading. Shadow stats use real inflation figures:

Edit:

To say gold is in a bubble is ridiculous. Of all the financial assets in the world, 1% are in gold - it is severely under-owned. When gold peaked the 80's, 26% of all financial assets were in gold. Therefore, you cannot compare the peaks in any way.0 -

Well, it is very misleading. Shadow stats use real inflation figures:

Edit:

To say gold is in a bubble is ridiculous. Of all the financial assets in the world, 1% are in gold - it is severely under-owned. When gold peaked the 80's, 26% of all financial assets were in gold. Therefore, you cannot compare the peaks in any way.

Shadow stats is a widely discredited inflation measurement, its worrying that people take it seriously. All it does is pluck a figure out of the sky ( I believe an additional 1.5% annually) and adds in onto the CPI

http://azizonomics.files.wordpress.com/2013/06/alt-cpi-home2-1.gif

Regardless of the drawbacks of the CPI (I agree it is flawed) the fact remains that 99% of the financial community accept it as the recognised standard, as such they work and base there decision upon information such as the chart I initially provided, although you mightn't think it correctly priced (which I agree to a certain extent with) it provides an acceptable basis for every professional financial institute to use. It would be impossible to fight the tide of all these institutions if your using a different historical valuation comparison.

I dont believe Gold is a bubble anymore, I think its well and truly popped at this stage. I'd get interested when it drops to within a reasonable margin of production costs, it will be hard to go lower than it costs to produce!0 -

Advertisement

-

euroboom13 wrote: »sorry i thought my advice was mainly dont buy gold?

Any type of gold? ETFs, mining stocks, physical bullion?

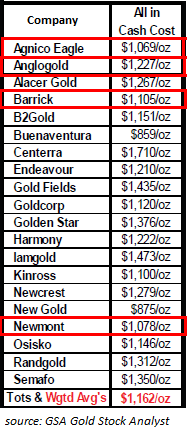

As mentioned before, the cost of mining gold is approx. $900 to $1200 per oz. Depending who you believe. Mining companies will be taking a hit on the drop in the gold price. Production is going to fall. I hope they stop mining gold altogether

Again, I will say my concern regarding gold is for the physical stuff. There is a massive correction in the gold price. Not worried at all. The roller coaster stock market is not for me and offers me entertainment more than anything. Don't have the money or the knowledge to dip my toe in it anyway.

In regards to your comments in this thread, I'm not expecting you to predict the future. I would appreciate some factual evidence to back up your claims. "Look at what is happening in the Middle East" and "just don't buy gold", are not going to sway my views for holding physical gold for the long term.0 -

SyntonFenix wrote: »Any type of gold? ETFs, mining stocks, physical bullion?

As mentioned before, the cost of mining gold is approx. $900 to $1200 per oz. Depending who you believe. Mining companies will be taking a hit on the drop in the gold price. Production is going to fall. I hope they stop mining gold altogether

Again, I will say my concern regarding gold is for the physical stuff. There is a massive correction in the gold price. Not worried at all. The roller coaster stock market is not for me and offers me entertainment more than anything. Don't have the money or the knowledge to dip my toe in it anyway.

In regards to your comments in this thread, I'm not expecting you to predict the future. I would appreciate some factual evidence to back up your claims. "Look at what is happening in the Middle East" and "just don't buy gold", are not going to sway my views for holding physical gold for the long term.

Holding gold long term is never going to be a risky investment ,just like property or land.Its the short term pain and the better buying opportunity that is being missed,which needs to be considered.

As i said before the production costs are inflated now also due to over demand and higher oil prices.If we get a drop in oil prices ,we will see gold rich oil barons selling gold to replace profits on a collasping income.Imf have predicted this.The Middle east has being trying to increase (oil)demand after a fall out with royal dutch shell.Iran tried to do a deal with N korea to stabalise demand.I have only studied this briefly but have read enough to be cautious of putting any money in these areas.America has increase production and storage in the past few years,in my opinion in preparation for or to avoid, another major oil crises.

If world powers are hedging in some way a possible dispute ,i for one aint going to try and predict.But my study into this area has thought me that the last thing the middle east will want to happen right now is for either oil/or gold to continue going south,and from watching americas actions of late ,south is where they and europe would like to see things go!!

As for what type of gold i am talking about, to me there is only one type,call a spade a spade.0 -

SyntonFenix wrote: »Any type of gold? ETFs, mining stocks, physical bullion?

As mentioned before, the cost of mining gold is approx. $900 to $1200 per oz. Depending who you believe. Mining companies will be taking a hit on the drop in the gold price. Production is going to fall. I hope they stop mining gold altogether

Again, I will say my concern regarding gold is for the physical stuff. There is a massive correction in the gold price. Not worried at all. The roller coaster stock market is not for me and offers me entertainment more than anything. Don't have the money or the knowledge to dip my toe in it anyway.

In regards to your comments in this thread, I'm not expecting you to predict the future. I would appreciate some factual evidence to back up your claims. "Look at what is happening in the Middle East" and "just don't buy gold", are not going to sway my views for holding physical gold for the long term.

sorry just one more thing,there is facts/charts and links to prove and equally disprove everything i have said and you have said.What i have tried to do is generate a view by researching what i can.I consider a strong point of view a better guidance than any one piece of evidence,and i dont mean that as a cope out.The internet/media is full of misguidance.0 -

euroboom13 wrote: »

As i said before the production costs are inflated now also due to over demand and higher oil prices.If we get a drop in oil prices ,we will see gold rich oil barons selling gold to replace profits on a collasping income.Imf have predicted this.The Middle east has being trying to increase (oil)demand after a fall out with royal dutch shell.Iran tried to do a deal with N korea to stabalise demand

I don't know where you come up with this stuff0 -

euroboom13 wrote: »

As i said before the production costs are inflated now also due to over demand and higher oil prices.If we get a drop in oil prices ,we will see gold rich oil barons selling gold to replace profits on a collasping income.Imf have predicted this.The Middle east has being trying to increase (oil)demand after a fall out with royal dutch shell.Iran tried to do a deal with N korea to stabalise demand

I don't know where you come up with this stuff

Good.My research has evaded you!

(sorry "oil rich barons"=states over dependent on high oil prices)

Listen last point if you believe oil prices are at a reasonable price and that gold should be worth a months wages an ounce.I am wasting your time.

As for geo-politics it is only a guessing game(for a mere civilian) but very interesting times and gold price fluctuations is pivitol to all nations trade.So what minor hits small investors are feeling here ,is absolutely distroying certain trade agreements.I am making wild asumptions but they are well grounded and researched.

I cannot add anything solid ,only extreme caution ,when it comes to 2 commodities that are completely related to what makes nations powerful!Todays price fluctuations are power related.How ,you tell me!

my only advise here "stay clear of Gold" for now0 -

euroboom13 wrote: »

there is a time for safety and a time for bravery ....risk is is undervalued now....come out and play leave gold for dentures.....get some risk in

we have just experinced the depression (similar 1929/33)we`re now heading for an asset boom with increasing interest rates and high inflation (food/fuel driven)....high rents/ low property values...lower gold prices higher fuel prices.....

GOLD aint high risk (wont fall or rise much more than 50%) Little riskier than long term fixed accounts,but that aint RISK ...

....if u believe that this crisis will go on indefinitely stay with gold.....if u believe like me that change is nigh....speculate ....the tide is changing direction (what worked the last 5yrs wont work the next 5).......

wheres gold going........into european stock? safe haven exit time?

if i had gold.

1)id sell @1400$(or maybe less)

2) id buy in again, if it went to $1500(small sacrifice)

3)if not id enjoy the slide and buy in @$1000(or less)

but i dont own it or want it,bad investment now!

and those with the "fever "will ignore this.....

damage limitation........my investment plan is stay clear of gold......my post was to incourage caution......i`ts not going to 1500 for sometime so the negative end of my post will never happen....

while ye boys are busy patting each others backs in ur air raid shelters ,the smart ones are picking up cash up off the ground in the equity field......

...war is over ,get back to the upward only reality our goverments refuse to leave behind......(or fill ur boots with that safe haven stuff and perish )

rant over

but seriously ....get in front of something new,dont copy old winners....dangerous and cowardly

sorry wrong quote....agree with cavehill red.....to others

"upward only reality".....goverments need positive growth....otherwise there debt increases......crack up

....it IS how it works inflation most be greater than interest rates...

So what we`re seeing now doesnt work for goverment debt...hence the struggle...but it will be fixed and equities will be the winner.

my equity is mainly bank related......zero return high risk....slow burner but WILL be where everyone runs to in a couple of years ...

Not looking for any reassurance on my investments.......just knocking the edges off bullish gold bugs....time WILL prove

Property market was on the high end of a 20 year boom.....similar to gold....I`m telling people to get in at the bottom of a collasped european stock market ......zero similarity to (2008).........buy more gold/bitcoin you deserve it ...treat yourself

for the record my view is....and not looking for debate

oil down to less than...$80

gold less than $1000

equities =dow j up ..17000..$ back to e1.40

ftse up...7500

iseq up

financial crisis in the middle east..(saudi,iran....caused by cheap oil,and poor gold prices,,,income stolen)

One things for sure we are at the most interesting time in history for investing....and it is a complete unknown future..(last monday gold drop for example).....and it is good to see a variety of views trying to figure this one out.....there is going to be alot of fortunes made and lost in the coming months....there is no safe havans.... every market is volitile$$$...i am staying clear of(oil/gold/cash)

cost of producing gold is also inflated.

I believe ,something real will happen in the middle east when oil hits $80 a barrel,.....

(U.S. is increasing storage and production<shale talk>,price war coming....middle east oil boom is being slowly crippled by smart finance.... n korea wanted to help middle east by maintaining demand ....hence missile crisis propaganda by our news stations.....).....gold and oil slump is just what western society needs to break up middle east oil monopoly.....

OIL GOLD slump ahead.....perfect storm....

i could be wrong but i`m not going to loose money...Good luck

not interested in a im right/your wrong debate

i think (i will repeat)that gold values have increased 4x since Gordon Brown and that fed printing will not impact gold because it is already overpriced....so investors whom correctly believe that increased currency means higher commodity prices will be wrong.....commodities values are falling and currency printing is in full swing?.....strange but true....its not a profit taking fall as we are being led to believe ,it is a commodity price collaspe with QE increasing..

and that is why i am staying away from all commodities now.....it is not a normal time....and dangerous to presume it is.....

It is easy to say fed qe causes gold price inflation but the truth is the opposite is happening.....

Very sorry to tell you that i dont have bloomberg and have Never watch that tripe(or stations like it) for longer then 5 minutes.....and can honestly say that i haven`t watched or listen to public media in a very long long time.....

I will also say my views are normally opposite to media stations...but i cant comfirm that

I do believe i am right that qe is not having the desired effect on gold prices.(i may not stay right ,but have been proven right for the last 6 mnths)

I am convinced in my own head that gold prices will continue to slide along with brent crude and that the imf report on saudi has warned about this..

I dont want a debate because i agree that what is happening now should push gold prices up but what should happen and what ishappening is 2 very different things.

I believe gold has reached unsustainable high`s prior to crisis and that is why qe(what ever type ,dosen`t matter) is not effecting it.Oil is also too high,hence why there is a boom in exploration companies and old unprofitable finds are being toted as saleable...petrol at pumps has gone from 30pence to 160cents in 15 years,(gold has had a simillar story)

Your right and I am trying to put some sence to why youve been proven wrong the past year.

NEVER WATCHED BLOOMBERG seriously never

I am a very long time out of school and dont have good writing skills but am passionate about whats happen right now so i will make more of an effort

When i read his posts a wonder is he trying to sell me silver.

If its so good fill your boots.

I will try and find a link shortly(nov 2012) but what it was saying was that if oil price`s hit $80 a barrel its debt levels would be unsustanable and would have to enter a program similar to the piigs.

I thought you meant that gold would be a hedge against buying power errosion,if it is a trickle down effect ,why not invest in stocks and benefit from dividends and price increases before it reaches gold and oil?That would make more sence!

What you seem to be saying above is buy stocks now and gold/oil latter?Which i would agree with!

here`s a cnn referance to break even oil prices...Have read it personally out of the imf report but haven`t the pataints to find it!

I saw some striking numbers this week: Look at the "break-even" costs for the world's top oil producers. That is the minimum price at which these countries need to sell oil so that they can balance their budgets.

Russia now needs oil at $110 a barrel to manage its finances. For Iraq, the number is $100. Even Saudi Arabia now needs oil to trade around $80 a barrel just to balance its budgets. The numbers are also high for Algeria, Qatar, and Oman. Only a decade ago Saudi Arabia was able to balance its budget with oil prices averaging around $25 a barrel.

silver/gold/oil is risk at this moment in time.....I would worry if i was holding any....A friend of mine whom wouldn`t listen ,risked 50,000 on gold as a long play and today it is only worth 35,000.....He is holding tight but isn`t having a worry free time at all,infact the opposite..If

he bought silver he would be as bad off.

Or he could have bought equity which is having its moment right now.

No worry free investments now,safe haven`s included.

The problem is there are alot of orchards my friend and america have found some new ones and the old middle east oil monopoly is getting sqeezed.Middle east maybe stalling production to hold prices but america have hughly increased production and storage.

Now if oil and gold markets fall ,middle eastern oil nations will require a good old debt restructure/privatisation program,handing monopoly back to opec.(iran already tried to do a supply deal with n korea to keep up demand but for some reason n.korea got cold feet and chickened out.)

I for one wouldnt like to bet against this senario happening.

Recovery stocks are undervalued and stagnant ,they only appear to be rising because of qe.They are the only investment that seem to be moving with qe.They are definitely not rising like hot air, and preparing for major crash.Interest rates will go up to pull back unsustanible growth but all major economies are lowering interest rates ,so nobodies to worried a bout an overheated stock market yet only you.When they start to rise interest rates dramatically maybe i will sell but not till then.

The way currency/bonds /commodities /stock /work ,over 10 ,15,20 yrs ,is that eventually they are all goin up (if theyre still around),compared with previous years!

RANT

Interest rates on borrowings and inflation have alot to do with the apparent upward only movement(in time)

Goverments debt which, in this world is the biggest borrower,needs inflation to be greater than the interest borrowed.(so that ,even if the debt gets bigger,it gets erroded by inflation,...the debt never gets paid..the interest is covered by inflation....

Now heres the trap.Volitily(50% swing)

You can buy any investment on any day and as long as it is still on this earth in 20 yrs it will be worth more!

Life is too short for that in my opinion ,so i try to predict whats having a really bad day, but will be here in 20 years.So that when its cycle is in favor, i will not only profit on the normal upward movement but that by predictings its low, i will also profit on VOLITILY

Gold silver oil is nowhere near a low point.it is at a very healthy midway between high and possible low.

If i invest now i risk a paper loss or a better buying point.

Some stock is on the floor now and will be here in 20 yrs.

I feel that there is a better place for capitol now.

Every investment type has a bad day, banking stock,property,european gov bonds,gold silver.......I buy on that day.....Banking stock is my tip...

Pension funds ,corporations Hedgefunds will all return to this area within 5yrs....Not all banks will survive but the ones that do will be in a bigger pond....( if u bought property in 2006 u could have to wait till 2026,to get a return,but if u buy in 2016 u could make a killing by 2026)

Gold had a high last year ,if it had a good low last year, i would buy.

Rant over

I do beleive that inflation will go out of control,but with gold already at an inflated price it will not be a good hedge.Thats what is different in this crisis.

All stock are priced in $$??

I dont own any $$ stock?

Ever heard of the euro/ pound sterling/yen?

And on that note i give up,UR RIGHT/i`m wrong

Good luck

Codswollop.... my god....

"it is better to remain silent and be thought a fool than to speak and remove all doubt" abe Lincoln

"A man should be judged on what he has done and not what he is going to do"!Henry Ford

This thread is over one year old and for the past year i have been consistant!Now is the time for risk not safety!

In the past year stocks have risen considerably/gold has fallen considerably.

Where i have no doubt that you will be correct in the future and gold will go to $2000.I have proven to be very accurate in my predictions this past year.

Not only have you been wrong in your valuation of gold but also in your value on my advice("added nothing"!)

I am sorry if my post are poorly writin but as for value ,it holds its own. \

This post was set up to discuss peoples feelings about gold!I know it was only set up to cheerlead gold bugs!My unimportant feelings have been to warn people of the pitfalls i saw(correctly)!

I hope some open minded people have profited!

As for your childish,personal attack,it proves to me what type of people like investing and why it is so easy for me to profit from investing time and time again!

Believe your own views and make me even wealtier.

Thank you very much

I don`t study trading graph or any magic formulas that others use.I study history,world politics and world markets.I read peoples views on how the world works and try to predict what is coming down the road.I study whats happening in the world now , everyday,not by watching bloomberg but through twitter and other ways.I read every financial biography i can get my hands on.I study every period of major world events from 1815 to now.High finance and world politics,is my interest.

I believe that the wrong road to follow in investing is the obvious one!

I can tell be your threads (and the above question)that you but allot of strength into studying graphs,annual reports and trading tools which i believe to be very misleading.

In your last attack you said you where uninterested in my unimportant feelings and then you ask me more on my personal investment knowledge!!!lets just say i come from a very satisfactory speculative background

before you continue. Your arguments is why i don`t like to debate,not because i feel i am right.My opinions are allways open

I am speculator,my investment trend at the moment and for the past 4yrs is european banks and recovery stocks,most are doing well apart from one disaster.My "safe haven" investment is debt free property(has an income and capital gain unlike gold).My portfolio is my portfolio and do not need or want to promote it in anyway.I only post when a get annoyed with cheerleading,like what happened with the property market.

bank of ireland 5000 to 50000 shares 16 cent would be nice ,anything below 23 cent a good bet for an irish recovery...Stay clear of aib/ptsb till state exit if ever.

pure punt 1000euros on inm 35000 shares IF it recovers you will see a 5x on your punt within 6 months(or get wiped)

barclay/soc gen needs to fall back but good buys in long run!

any banks right now are well priced for a cap gain and dividends will return

READ...history

Your gold evidence is very main stream which worries me. QE means higher prices but not in Gold this time, WHY?

I said gold was half way between being too expensive and being too cheap.$1000 relatively cheap $1700 expensive..I have never owned Gold as an investment because it has only one upside which is capitol gain.I am a seculator and like to get in as close to bottom or not at all.With gold only having a cap gain potential, time is everything.

Every shopping centre i goto there is a man buying your unwanted gold.The discovery channel is on about gold everytime i switch it on .Max kieser is on twitter flat out on bout GOLD...

Mainstream....

stock market is over inflated but only in certain area`s.Banking stock way under valued after BANKING crisis

Just proved that most people can`t get there head round how expencive gold is.!!!how does that make a bull market.

gold $1285

silver $19.72

oil $102.5

post gone quite!

There is no reason left to say gold/silver is a safe investment.....

Great investment if bought at the rigth time ,which is NOT this year!

i would love to hear from honest traders whom got this wrong and have taken a less bullish stance!

I only had one warning about gold ,which was ,that qe should normally mean higher commodity prices ,but that this time it wasnot going to happen that way.

So everyone that was cheering on gold should have some caution.

gold prices are not following qe.

The reason is gold has already been over priced ,and increasing the money supply is only reducing the fall.

Stocks are only regrouping ,strong rally coming after the summer.

Stocks are well up this year still,gold aint!

Buffet didnt get rich by telling people what he is doing or going to do.He only broadcasts for his own financial gain not yours.Try to see what lower gold and oil prices would mean to the global markets and i dont think you will go to far wrong.

Thats just what i see.Not trying to convince anyone but i am warning gold bugs all year. Since $1700 and still see further decline.

I like your conviction.

I think the next month wont be pretty for anyone(especially stocks) but stocks will by far out shine everything else this year and has already!

LONG term everything that survives goes up!medium term if you buy too high you may miss a better opportunity.Short term everythings a gamble!

We are further away from a complete market or currency crash than we were in 2007/8/9.

Considering that the banks havent really started lending again,i think the 1 in 4 morgage arrears is not a bad starting point.The number one buyer for property in this country is a morgaged buyer.As soon as the banks are prepared to lend back into the market on a scale similar to 2003/4/5 ,all percieved difficulties will be remedied.

It is quite obvious that any decline happening in the $ is being well enginneered and not a crisis driven fluctuation as previously witness.

Gold in my opinion is a weapon of global trade,which the middle east have been using to protect oil payments.Gold has risen so much in the past decade that if there were a fall in price it would ,in hind sight , make the west energy bill very cheap.An oil bill paid for with gold at $1700 is going to look like a steal at $1200.THAT is what is happening with gold(and trade).Relatively speaking we will have Haved our energy bill.

Gold down not up!

1)All currencies are completely aware of possible collaspe,which makes it extremely less likely than when they were hit by The major banking crisis!

2)There is no morgaged backed property market at the moment.When the time is right for property inflation,investors and banks will jump in.We are nearly at that point where inflation and interest rates start to recover,making investment attractive.Negative equity will reduce quickly,morgage debt will be more attractive to honour.Interest rates will go up ,along with rent yields (and inflation).[/I]

f3)ed is more interested in the value of the $ than qe.

.

4)US energy is going through a complete change.Ramped up production and storage.Why?In my opinion it is preparing for a price war.gold/oil prices are completely related to this.That is why i wont be getting involved with either at this time![/I]

5)I see major financial crisis in the middle east first.We are already seeing increased political change.Final changes will happen when gold and oil prices bottom out!

All i know is what is happening now ,only makes sence ,if you factor in the middle east and why it is still booming(high gold/high oil).[/I]

This is why i dont like debating on here.Its like debating with a 14 yr old.

If you believe that you`ve spotted a major flaw in the $ that the fed havint picked up on yet ,fair play to you ,i`ve underestimated you, and for that i will appologise in the future!

Interest rates are a central banks(fed) way of tackling inflation,if the fed decides its time to rise them, i am sure it wont cause a dollar collaspe.

Falling poperty markets have a promblem with neg equity,rising ones dont!!

Sorry for not stating the OBVIOUS crisis i was merely pointing out the exception (mid east),which was my point!

As for reference,why?and do you think you will get a guide book!

The value the fed want the dollar to be dosent have to be a high value ,they may and do now want a low value.So what you foundseriously wrong was your asumption that value meant higher value!!You are melting your own pixie head but i will gladly take the blame!

$1230 gold

at what price is it ok to adkwowledge that caution should have been taken!

Caution was well adviced on this post.

And this advise is still being discredited as unfounded!

While advise from gold/silver sales websites is being promoted and heralded as wisdom!!!

sorry i thought my advice was mainly dont buy gold?

Holding gold long term is never going to be a risky investment ,just like property or land.Its the short term pain and the better buying opportunity that is being missed,which needs to be considered.

As i said before the production costs are inflated now also due to over demand and higher oil prices.If we get a drop in oil prices ,we will see gold rich oil barons selling gold to replace profits on a collasping income.Imf have predicted this.The Middle east has being trying to increase (oil)demand after a fall out with royal dutch shell.Iran tried to do a deal with N korea to stabalise demand.I have only studied this briefly but have read enough to be cautious of putting any money in these areas.America has increase production and storage in the past few years,in my opinion in preparation for or to avoid, another major oil crises.

If world powers are hedging in some way a possible dispute ,i for one aint going to try and predict.But my study into this area has thought me that the last thing the middle east will want to happen right now is for either oil/or gold to continue going south,and from watching americas actions of late ,south is where they and europe would like to see things go!!

As for what type of gold i am talking about, to me there is only one type,call a spade a spade.

sorry just one more thing,there is facts/charts and links to prove and equally disprove everything i have said and you have said.What i have tried to do is generate a view by researching what i can.I consider a strong point of view a better guidance than any one piece of evidence,and i dont mean that as a cope out.The internet/media is full of misguidance.

Good.My research has evaded you!

(sorry "oil rich barons"=states over dependent on high oil prices)

Listen last point if you believe oil prices are at a reasonable price and that gold should be worth a months wages an ounce.I am wasting your time.

As for geo-politics it is only a guessing game(for a mere civilian) but very interesting times and gold price fluctuations is pivitol to all nations trade.So what minor hits small investors are feeling here ,is absolutely distroying certain trade agreements.I am making wild asumptions but they are well grounded and researched.

I cannot add anything solid ,only extreme caution ,when it comes to 2 commodities that are completely related to what makes nations powerful!Todays price fluctuations are power related.How ,you tell me!

my only advise here "stay clear of Gold" for now

All your "advice" in one place.0 -

Advertisement

-

0

0 -

Silver up 5% today, proves that it can rise just as fast as it falls.0

-

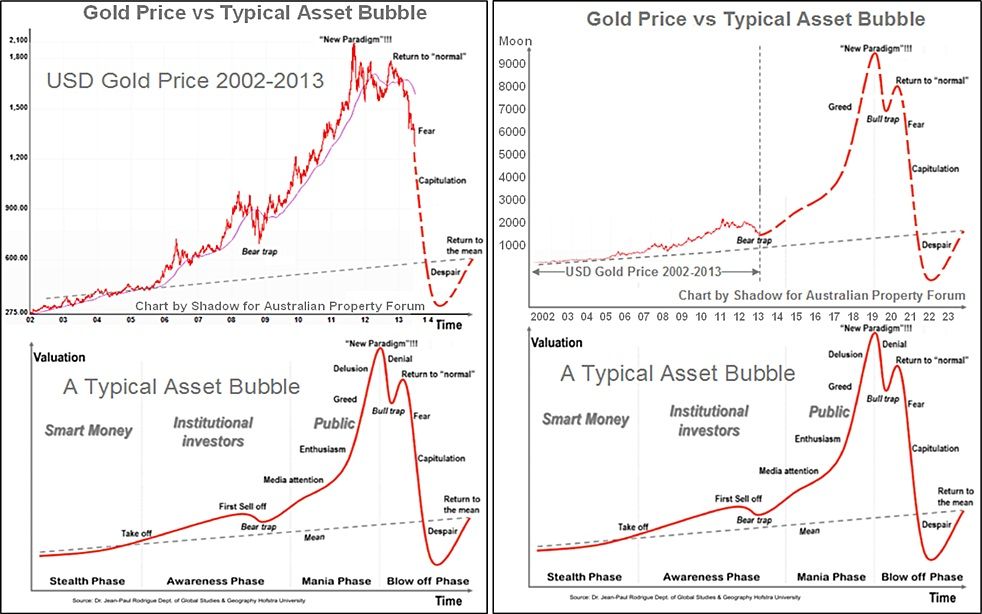

I found this very intriguing chart on APF, comparing the gold price movement over the past few years to the famous 'typical bubble' pattern chart that we've all seen before.

One view says the gold bubble has already burst.

The other view says the gold bubble has just finished the bear trap phase and now prices will really take off!

What do you guys think is the more likely scenario?

Gold is a classic bubble - it follows the typical pattern precisely. Goldbugs. The time to panic... is now. 0

0 -

^^^ Re graphs

Well, just from the labels in the graphs, you can be sure that we are in the bear trap stage and the bubble hasn't burst.

The bottom graphs are split into 3 important parts: Smart Money, Individual Investors and Public.

By using common sense, you will realise that gold is not in a bubble, because the mainstream public has not jumped on the gold bandwagon yet. 1% of global financial assets are held in gold, 1%! How could something that is only owned by 1% of all investors be in a bubble? Stocks before the 2000 bubble were held by nearly 30% of investors, and we all now about the mania here in Ireland with property before the bubble popped in 2008.

When the next leg-up in gold happens, that's when the mania will start and everyone will start talking about gold. That is when people will be lining up to BUY GOLD outside jewellers, NOT TO SELL THEIR GOLD.

The most important word here is PUBLIC! The PUBLIC are SELLING GOLD to jewellers for cash and have been doing so for years. When the PUBLIC starts BUYING, then you should get ready to sell.

Common sense, a bubble in gold right now doesn't make sense.0 -

Got some nice graphs form the site previous poster linked from:

^ In the last bubble, the bear trap was at 820 and the bubble popped at 2383 (adjusted for CPI inflation). The asset bubble repeats and repeats across all asset classes, gold is not an exception. As you can see, the bear trap started from 1800 this time, and the bubble phase will follow this.

Gold has been following the worldwide expansion of money supply for a long time now, we should see a big shift upwards in gold soon to correct the recent negative correlation, unless you believe Bernanke, AND ALL THE OTHER CENTRAL BANKS, will do the right thing and not only reduce money printing, but reduce their balance sheets also. :cool:0 -

Advertisement

-

When the next leg-up in gold happens, that's when the mania will start and everyone will start talking about gold. That is when people will be lining up to BUY GOLD outside jewellers, NOT TO SELL THEIR GOLD.

The most important word here is PUBLIC! The PUBLIC are SELLING GOLD to jewellers for cash and have been doing so for years. When the PUBLIC starts BUYING, then you should get ready to sell.

That was January 1980.

India has been doing this for years, world's second highest consumer of gold. It's not unusual there. China, the highest consumer of gold in the world, is not going to slow down since it has a ever increasing middle class.

In the Western world, I don't think you're going to find many people in lines outside jewellers these days. Why? You can order online now, discretely, delivered straight to your door, neighbours don't have to know. YouTube has every video you want to watch regarding investing and buying physical bullion. Unlike in January 1980.

In other words, the que outside the jewellers might be happening right now, via the internet.0 -

SyntonFenix wrote: »In other words, the que outside the jewellers might be happening right now, via the internet.

If it was, physical demand would be much higher than right now, and there would be a physical shortage. You can't really count India in your argument because they have always bought gold, independent of economic situations. Yes, China is growing all the time in regards to gold demand but it's not having the desired effect of a global demand by consumers.

When inflation hits consumers in the next 1-2 years, THAT is when gold and silver will become very attractive to the public.0 -

If it was, physical demand would be much higher than right now, and there would be a physical shortage. You can't really count India in your argument because they have always bought gold, independent of economic situations. Yes, China is growing all the time in regards to gold demand but it's not having the desired effect of a global demand by consumers.

When inflation hits consumers in the next 1-2 years, THAT is when gold and silver will become very attractive to the public.

Apparently India and China can be part of my argument regarding physical demand.

http://in.reuters.com/article/2013/05/17/column-russell-gold-asia-idINDEE94G03M20130517

http://www.mineweb.com/mineweb/content/en/mineweb-gold-analysis?oid=193192&sn=Detail

http://www.gold.org/media/press_releases/archive/2013/05/gdt_q1_2013_pr/

http://www.rediff.com/money/slide-show/slide-show-1-gold-demand-in-india-rises-by-27-pc-wgc/20130516.htm

http://www.ibtimes.co.uk/articles/468133/20130516/world-gold-council-demand-trend-etf-jewellery.htm#

http://www.bloomberg.com/news/2013-05-08/gold-drops-for-third-day-as-spdr-assets-shrink-to-four-year-low.html

http://www.gold.org/investment/statistics/demand_and_supply_statistics/

Some homework for you. How many walk-in stores/companies sell physical gold in Ireland?0 -

I respectfully disagree. The public is not interested in owning gold and silver except for the odd bit of jewellery. When inflation hits, interest rates will go up and the public with cash will be happy with higher interest on savings. People want cash they can access easily, that's short term savings. If they're thinking long term they have a pension. That's the real world.When inflation hits consumers in the next 1-2 years, THAT is when gold and silver will become very attractive to the public.0 -

When inflation hits, interest rates will go up and the public with cash will be happy with higher interest on savings.

Interest rates cannot go up without a major worldwide financial crisis. The world is simply too indebted at the moment and any increase in interest rates will have very negative effects globally.

People need to understand that the Fed, and other central banks, cannot exit their current monetary policy. It WILL end badly with very serious consequences. The world economy depends on low interest rates and QE to stay alive, take this away and everything crashes. If the Fed chooses to continue money printing and low interest rates, hyperinflation is inevitable.

Don't believe that the dollar and the current monetary system will last forever, because that's impossible. We have come to the stage where central banks are printing money in massive proportions, which ONLY HAPPENS when there is a monetary system crisis and a collapse is inevitable. All currencies fail, and the world has never been in position when basically every currency is fiat.0 -

SyntonFenix wrote: »Apparently India and China can be part of my argument regarding physical demand.

http://in.reuters.com/article/2013/05/17/column-russell-gold-asia-idINDEE94G03M20130517

http://www.mineweb.com/mineweb/content/en/mineweb-gold-analysis?oid=193192&sn=Detail

http://www.gold.org/media/press_releases/archive/2013/05/gdt_q1_2013_pr/

http://www.rediff.com/money/slide-show/slide-show-1-gold-demand-in-india-rises-by-27-pc-wgc/20130516.htm

http://www.ibtimes.co.uk/articles/468133/20130516/world-gold-council-demand-trend-etf-jewellery.htm#

http://www.bloomberg.com/news/2013-05-08/gold-drops-for-third-day-as-spdr-assets-shrink-to-four-year-low.html

http://www.gold.org/investment/statistics/demand_and_supply_statistics/

Some homework for you. How many walk-in stores/companies sell physical gold in Ireland?

Sorry, I think you're getting me the wrong way. Of course India and China are very important in the gold market. However, when this market enters bubble phase, the mainstream public will start buying and the media will start covering it the way it did with stocks and property. It is not enough to say "people could be buying it online". In all bubbles, you KNOW loads of people are buying the asset. Gold being included in only 1& of all financial assets is NOT enough. In bubble phase it is mentioned in newspapers, the news, radio every week as it becomes more popular. The media has never liked gold because it pays no dividends etc. - the time is coming when the media will be praising gold and telling people to buy it, the bubble phase.

This bubble phase could be just around the corner, oil corrected 37% in 2007 before entering the phase, in 1998 the NASDAQ dipped 40% before blowing off. What I'm worried about is knowing when to sell when it actually happens, I guess I'll play it by ear. :P0 -

However, when this market enters bubble phase, the mainstream public will start buying and the media will start covering it the way it did with stocks and property.

The media has never liked gold because it pays no dividends etc. - the time is coming when the media will be praising gold and telling people to buy it, the bubble phase.

This bubble phase could be just around the corner, oil corrected 37% in 2007 before entering the phase, in 1998 the NASDAQ dipped 40% before blowing off. What I'm worried about is knowing when to sell when it actually happens, I guess I'll play it by ear. :P

I see your point. But I don't agree.

I don't think we're going to see a media frenzy stating to buy gold. The world has been educated from the Jan 1980 bubble. The 1980 bubble price went to $2200 or there abouts, adjusted for inflation. The smallest hint that this will happen again and every man, woman and their dog that owns gold is going to off load it.0 -

SyntonFenix wrote: »I see your point. But I don't agree.

I don't think we're going to see a media frenzy stating to buy gold. The world has been educated from the Jan 1980 bubble. The 1980 bubble price went to $2200 or there abouts, adjusted for inflation. The smallest hint that this will happen again and every man, woman and their dog that owns gold is going to off load it.

Yes, that would be correct in a normal scenario. But in the scenario in which there is a currency crisis, which I believe is just around the corner, people would be actually buying gold. I think inflation is going to be a very serious problem in the near future and when people see the prices of petrol, food and energy rising all around them and wake up to the fact that their currency is worthless, they will have no choice to protect their savings with tangible assets.0 -

Yes, that would be correct in a normal scenario. But in the scenario in which there is a currency crisis, which I believe is just around the corner, people would be actually buying gold. I think inflation is going to be a very serious problem in the near future and when people see the prices of petrol, food and energy rising all around them and wake up to the fact that their currency is worthless, they will have no choice to protect their savings with tangible assets.

Correct. Correct and right.

One of the reasons why everyone should hold a small amount of physical gold/silver.

However, that scenario would mean bad times. Especially in Ireland. It's not that bad though. I won't be donning my tin foil hat just yet

"There is no single agency responsible for major emergency management in Ireland".

Seriously. Have a look.

http://ec.europa.eu/echo/civil_protection/civil/vademecum/ie/2-ie-1.html

0 -

0

-

Advertisement

-

But in the scenario in which there is a currency crisis, which I believe is just around the corner, people would be actually buying gold. I think inflation is going to be a very serious problem in the near future and when people see the prices of petrol, food and energy rising all around them and wake up to the fact that their currency is worthless, they will have no choice to protect their savings with tangible assets.

So let me understand this, we have an imminent currency crisis, people will wake up one morning and see that their currency is worthless, instead of spending their worthless currency on stuff they might need to get them through the day, stuff like petrol, food and energy, they will rush out with their worthless currency to buy Gold (and presumably silver) which will at that stage have rocketed through the roof. Is that a reasonable summation? And one final question, can you tell me when this will happen so I can rush out on the eve and buy as much gold and silver as I can lay my hands on? [/QUOTE] 0

[/QUOTE] 0 -

[/QUOTE]So let me understand this, we have an imminent currency crisis, people will wake up one morning and see that their currency is worthless, instead of spending their worthless currency on stuff they might need to get them through the day, stuff like petrol, food and energy, they will rush out with their worthless currency to buy Gold (and presumably silver) which will at that stage have rocketed through the roof. Is that a reasonable summation? And one final question, can you tell me when this will happen so I can rush out on the eve and buy as much gold and silver as I can lay my hands on?

I'm not talking about hyperinflation straight away, I'm talking about a 20-30% inflation on most consumer goods. People would still have money for gold (middle class obviously) and at this stage would have woken up to the fact that their currency is not a store of wealth.

Currencies WILL be worthless, but there is quite a bit of time between now and then to prepare by protecting your wealth.0 -

I'm not talking about hyperinflation straight away, I'm talking about a 20-30% inflation on most consumer goods. People would still have money for gold (middle class obviously) and at this stage would have woken up to the fact that their currency is not a store of wealth.

As just mentioned. The first thing on people's minds will not be what jeweller am I going to camp outside for an ounce of gold that is going to cost me $1500. Too late at that stage.Currencies WILL be worthless, but there is quite a bit of time between now and then to prepare by protecting your wealth.

Yes, at the moment QE will bring down the value of currencies. But there will be a revaluation phase if and when this occurs, like during the Weimar Republic in the 1920s.

http://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic0 -

-

We've already had a currency crisis, and the only people buying gold were the usual tinfoil,beans and ammo types. The rest of us were doing what normal people do, and that's putting money into foreign bank accounts or buying shares or property.But in the scenario in which there is a currency crisis, which I believe is just around the corner, people would be actually buying gold.

Anyone who took the advice of the goldbugs is now sitting on big, maybe massive losses. And yet we still hear them telling vulnerable people that gold is a "safe" place to put money.0 -

We've already had a currency crisis, and the only people buying gold were the usual tinfoil,beans and ammo types. The rest of us were doing what normal people do, and that's putting money into foreign bank accounts or buying shares or property.

Anyone who took the advice of the goldbugs is now sitting on big, maybe massive losses. And yet we still hear them telling vulnerable people that gold is a "safe" place to put money.

So you don't think the current bond bubble will blow up then?0 -

We've already had a currency crisis, and the only people buying gold were the usual tinfoil,beans and ammo types. The rest of us were doing what normal people do, and that's putting money into foreign bank accounts or buying shares or property.

Anyone who took the advice of the goldbugs is now sitting on big, maybe massive losses. And yet we still hear them telling vulnerable people that gold is a "safe" place to put money.

Nice bit of generalizing there, good stuff.

If someone has gold why do you think thats where they have everything parked? I know plenty of "normal people" with gold.

I´d love to write more but I´ve to go and cajole some pensioners into buying gold.0 -

Who knows and who cares. There'll be another crisis along the year after that and life will go on. Anyone who has been invested and hiding in gold for fear of the crisis du jour has missed out on one of the greatest stock market rises in history, and it's possibly too late now to get involved.So you don't think the current bond bubble will blow up then?0 -

Who knows and who cares. There'll be another crisis along the year after that and life will go on. Anyone who has been invested and hiding in gold for fear of the crisis du jour has missed out on one of the greatest stock market rises in history, and it's possibly too late now to get involved.

Fine, that's your opinion. I am of the opinion that the correct decisions were not made in the early 2000's by central banks and again in 2008. We know that QE is not helping normal people on the street and the jobs that are being created in the US are a joke (the unemployment rate used by the US us bullsh!t, like the CPI). Debt is supposed to be paid down during recessions, not accrued.0 -

Advertisement

-

DON`T BUY GOLD in short or did you think i said buy!!SyntonFenix wrote: »All your "advice" in one place.

If so i oppologise and admit my HUGH error0 -

hhhmmmm it is strange even when good advise is proven correct how some people still like to make out what they were told was totally unfounded and easy to ignore....the future is bright!:)for few.....at lasts all the village idiots are in the one place ..GOLD......good luck0

-

euroboom13 wrote: »hhhmmmm it is strange even when good advise is proven correct how some people still like to make out what they were told was totally unfounded and easy to ignore....the future is bright!:)for few.....at lasts all the village idiots are in the one place ..GOLD......good luck

Yes, you were correct about the recent drop in PM's. However, the people in this thread are more interested in protecting their wealth for the medium to long-term. Your advice would have been applauded on a traders thread/forum but this is not the thread for that.0 -

However, the people in this thread are more interested in protecting their wealth for the medium to long-term.

If people on this thread are more interested in protecting their wealth for the medium to long-term, why oh why were they buying silver (or gold) 8 months ago at 50% more than it would cost them now (and enthusiastically encouraging others to follow suit). Am I missing something?0 -

short term = lossYes, you were correct about the recent drop in PM's. However, the people in this thread are more interested in protecting their wealth for the medium to long-term. Your advice would have been applauded on a traders thread/forum but this is not the thread for that.

medium term down=loss

long term = up ....if you bought @>$1200 up

protect your wealth by avoiding high prices ,where ever they pop up and taking advantage of lows.....let the queen worry about real wealth preservation,trying to preserve any wealth less than 5k /10k,aint worth taking out of the bank....you will never get any real wealth ,without taking real risk...real risk is doing what most ridicule and sticking with it regardless!!

High risk ,high return ,isnt always as risky ,if you see a rebound ,on previously loved stock!!!

or buy gold ,i couldnt care less....."euro equity boom 2013"0 -

euroboom13 wrote: »hhhmmmm it is strange even when good advise is proven correct how some people still like to make out what they were told was totally unfounded and easy to ignore....the future is bright!:)for few.....at lasts all the village idiots are in the one place ..GOLD......good luck

Gold has been up for 12 years in a row, I hope your position wasnt a long term one, you are in for your first correct year in 13.0 -

Advertisement

-

If people on this thread are more interested in protecting their wealth for the medium to long-term, why oh why were they buying silver (or gold) 8 months ago at 50% more than it would cost them now (and enthusiastically encouraging others to follow suit). Am I missing something?

You are living in the past.0 -

If people on this thread are more interested in protecting their wealth for the medium to long-term, why oh why were they buying silver (or gold) 8 months ago at 50% more than it would cost them now (and enthusiastically encouraging others to follow suit). Am I missing something?

Do you have crystal balls?0 -

Do you have crystal balls?

Just the ordinary ones as far as I know (but thankfully both still working).

The reason that I point out (to DarkDusk) the nearly 50% drop in the last 8 months approx is because of the definitive ebullient statements he/she made back then. Here are a couple of examples: 'If Obama is elected, silver will rise above 35$', 'I'm very surprised that I called the bottom so accurately', 'An even better opportunity to buy (physical)', there is no IN MY OPINION or IT IS MY BELIEF in those statements, and he/she is still making pretty much similar definitive statements.

Now back then I had no idea what was going to happen to the price of Silver, maybe it was going to go to the $150 predicted or maybe it was going to tank to the 50% it subsequently did, I simply didn't have a clue.

Today I have no idea what is going to happen to the price of Silver, maybe it is going to go to the $150 predicted or maybe it is going to tank by another 50%, I simply don't have a clue.

I find it difficult enough to predict what I will be doing this afternoon.0 -

euroboom13 wrote: »hhhmmmm it is strange even when good advise is proven correct how some people still like to make out what they were told was totally unfounded and easy to ignore....the future is bright!:)for few.....at lasts all the village idiots are in the one place ..GOLD......good luck

You've resorted to name calling and condescending remarks on other peoples valid and factually based opinions.

Your posts continue to show your lack of common sense, common courtesy to others and basic grammar.

I still believe this is just a major correction before a sharp rise in the gold price. Why do I think that? For the following reasons;- QE in countries throughout the world (at least 30 countries apparently)

- Sovereign debt

- The slowdown of gold production due to low price of gold

- Currency debasement

- Potential hyperinflation

- Unallocated gold securities, ETFs etc.

- Gold stockpiling by central banks

- Historical storage of wealth

- Historical hedge against financial uncertainty

- A form of currency and money for thousands of years

What you, and other anti-gold people like you, are failing miserably at, is disproving all the above points.0 -

Not sure I'm allowed post other sites here but I will post 25 on this thread might be interesting to the current debate going on here...

I'm not really in either camp and usually lurk but I enjoy the good debates..

https://bitcointalk.org/index.php?topic=228351.msg2407125#msg24071250 -

Advertisement

Advertisement