Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

TAX BACK ON DENTAL TREATMENT ABROAD

Options

-

04-03-2021 10:22pm#1HI

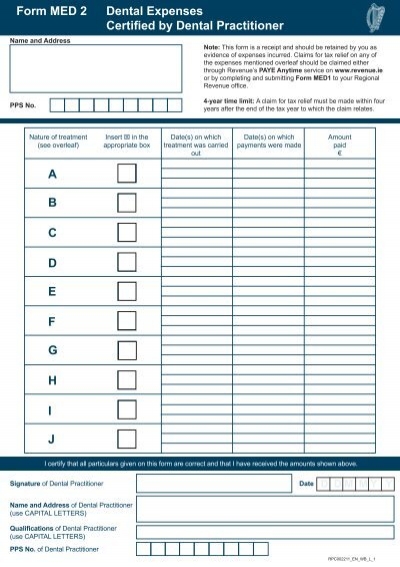

I had dental work done in turkey last year . It qualifies as non routine treat mine and now I’m looking to get the desired 20% back in tax. Can someone please tell me how I go about getting the tax back . I’m aware of med2 forms but I’m unsure if Turkish dentist can fill them out .0

Comments

-

HI

I had dental work done in turkey last year . It qualifies as non routine treat mine and now I’m looking to get the desired 20% back in tax. Can someone please tell me how I go about getting the tax back . I’m aware of med2 forms but I’m unsure if Turkish dentist can fill them out .

Turkey is not in the EU, you are out of luck.0 -

-

Join Date:Posts: 20795

-

Yes you can claim for non routine dental work carried on anywhere in the World provided the dentist is qualified in the country in which you received treatment. Med 2 must be completed by the dentist.

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exemptions/health-and-age/health-expenses/dental-expenses.aspx

Non-routine dental care outside Ireland

You can claim for non-routine dental treatment performed outside of Ireland. To qualify for relief, the dentist must be a qualified dentistry practitioner under that country's laws. You must have the dentist complete a Form Med 2 for your claim.

0 -

Spanish Eyes wrote: »Yes you can claim for non routine dental work carried on anywhere in the World provided the dentist is qualified in the country in which you received treatment. Med 2 must be completed by the dentist.

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exemptions/health-and-age/health-expenses/dental-expenses.aspx

Non-routine dental care outside Ireland

You can claim for non-routine dental treatment performed outside of Ireland. To qualify for relief, the dentist must be a qualified dentistry practitioner under that country's laws. You must have the dentist complete a Form Med 2 for your claim.

Thanks for clarifying the apparent tax position.

Other posters should really get their facts right.1 -

Advertisement

-

Thanks for clarifying the apparent tax position.

Other posters should really get their facts right.

You will have to contact Revenue to see if they have updated their acceptance criteria for tax relief on medical/dental expenses. It certainly used to be restricted to treatments within the EU as medical/Dental qualifications from EU states were recognised in each country in the bloc, whereas they are only recognised for certain countries outside it, and there are taxation agreements in the EU which allow reliefs in other countries. A quick call to Revenue by anyone interested in travelling abroad will clarify this for the country they are travelling to. The “facts” may still be right, certainly that paragraph indicates that the clinician providing the treatment must be registered with the relevant professional body rather than an unqualified/unregistered practitioner.0 -

Thanks for clarifying the apparent tax position.

Other posters should really get their facts right.

Thanks for that. For the last 20 years as a dentist I have had to fill in my PPS number on the med 2 form and treatment relief was only allowable outside the state with the EU common taxation policy. This may have changed recently without me know but its very resent if thats the case. I am very glad the taxpayer is subsidising money spent abroad outside the EU now, fantastic.

Thank for clarifying, I will make sure to check in with you before giving any more free dental advice here, as I have done for about 15 years. 0

0 -

I am very glad the taxpayer is subsidising money spent abroad outside the EU now, fantastic.

Having trouble understanding this point . I assume OP is a tax payer , so how are other tax payers " Subsidising" a tax claim he is trying to get ? .0 -

I am very glad the taxpayer is subsidising money spent abroad outside the EU now, fantastic.

Having trouble understanding this point . I assume OP is a tax payer , so how are other tax payers " Subsidising" a tax claim he is trying to get ? .

Because we are allowing the person pay less tax for spending money that has left the state. Money that stays in the state gets taxed again and can pay for all the things we enjoy. The dentists profit, the staffs wages, the labs profit and wages, the landlords rent, the rates etc.etc all taxed again and again, along with the VAT on everything that money buys.

While its good to relieve dental treatment for the individual receiving the treatment that is money the state is not getting. If the dental work is done outside the state that money is gone for the benefit of everyone else.

EU common taxation policy offset this aspect within the EU.0 -

Because we are allowing the person pay less tax for spending money that has left the state. Money that stays in the state gets taxed again and can pay for all the things we enjoy. The dentists profit, the staffs wages, the labs profit and wages, the landlords rent, the rates etc.etc all taxed again and again, along with the VAT on everything that money buys.

While its good to relieve dental treatment for the individual receiving the treatment that is money the state is not getting. If the dental work is done outside the state that money is gone for the benefit of everyone else.

EU common taxation policy offset this aspect within the EU.

An example of the spending staying within the Irish economy would be the Irish dentists super flash car because the Irish dentist earns so (too) much. You know there is a reason a lot of patients go abroad (most to the north), Irish dentists are too expensive, earn multiples of their Northern Ireland equivalent. Same as pharmacies.0 -

Advertisement

-

An example of the spending staying within the Irish economy would be the Irish dentists super flash car because the Irish dentist earns so (too) much. You know there is a reason a lot of patients go abroad (most to the north), Irish dentists are too expensive, earn multiples of their Northern Ireland equivalent. Same as pharmacies.

Why do dentists earn “so (too) much”?

Firstly, I’m not a dentist so I don’t really care how much they are actually paid.

My assertion as to why dentists earning relatively high wages is as follows (no particular order):

1/ They have attended a difficult, technical degree which takes 5+ years

2/ they are conducting work that requires a high degree of skill and expertise

3/ many have overheads associated with running their own practice (staff, insurance, equipment, advertising, utilities etc.)

4/ there is a reasonable amount of risk and responsibility associated with what they do

5/ the supply of labour (dentists) is low enough such that the demand (customers) are willing to pay them the rates they charge. Granted people travel abroad, but likely not in sufficient numbers to drive prices down (yet?)

The above points are just off the top of my head, buts it’s all of those type of factors combined that make their wages relatively high compared to e.g. a bus driver, who has responsibility and risk but requires far less training and expertise to do their job.

As I mentioned, I’m not a dentist. My wages are however relatively high, but I possess highly technical and employable skills, I have years of experience in high value work environments, I have extensive experience delivering high value projects etc etc. None of that is free, it required me to spend time doing it, college, working crappy hours etc. So, naturally, I want to charge for it, and I charge a lot.

I never hear people who have high wages complain that they are paid too much, I expect it’s because most of them had to put in the work to get to that level.

I appreciate you may have an issue with dentists, but their wages reflect the skills they have and it’s value to their customers. The reason someone stacking shelves in a supermarket gets approximately minimum wage is because it’s a job that requires a low level of skill and there is a large supply of people that can do that job. I’ve done that job, so I’m fairly aware of how easy and how hard it can be.

Regarding the tax relief, I don’t see why someone spending money in Turkey/Antarctica/non-EU should get tax relief in that instance, the money does nothing for the Irish economy. It’s the same as someone buying a holiday home in Florida and claiming tax relief for it here... Subsidies from

Private health insurance I’ve no issue with, but the revenue should tell them to get lost.0 -

An example of the spending staying within the Irish economy would be the Irish dentists super flash car because the Irish dentist earns so (too) much. You know there is a reason a lot of patients go abroad (most to the north), Irish dentists are too expensive, earn multiples of their Northern Ireland equivalent. Same as pharmacies.

Don’t knock super flash cars until you have one, they are great.

But seriously, you might want to check out the websites of Clinics in the North, I think you’ll find there isn’t much of a difference in costs now. A lot of Clinics have left the NHS and focus now on private treatments which have led to an increase in their costs. Prior to that, Dentists received capitation and continuing care payments from the NHS, which when I worked in the UK in the 90s, was £1-£3 per month, per patient. They also received grants from the UK government for Clinic upgrades. The Clinic I worked in had 15k registered patients which earned the owner over £20k per month, irrespective of whether a single treatment was done, he drove a vintage sports car worth over £100k at the time.

I’ve never felt bad about spending my money earned as I please, and I’ve never had the slightest issue with people travelling abroad, nor whether they avail of tax relief.0 -

Don’t knock super flash cars until you have one, they are great.

Only thing better than having a flash car, is have 2 or 3 of them. :cool:

Look dentistry is often a begrudging spend for a lot of people, and one they cannot avoid. This instills irritation with dentists and dentistry as a profession as the focus of their ire. I get that. But luckily the majority of dental issues are preventable,

Dentists are generally extremely busy seeing their existing patients so where anyone has their dental work done impacts only on them, and matters not one bit to a dentist they have never met, or their previous dentist who has not thought about them for even a moment since their last appointment. There is the issue of high speed medical tourism but thats not really the discussion here.0 -

Iguarantee wrote: »I appreciate you may have an issue with dentists, but their wages reflect the skills they have and it’s value to their customers. The reason someone stacking shelves in a supermarket gets approximately minimum wage is because it’s a job that requires a low level of skill and there is a large supply of people that can do that job. I’ve done that job, so I’m fairly aware of how easy and how hard it can be.

All your points are very valid.

My point is that dentists and pharmacies in ROI charge too much. You only have to look across the border to understand this(even though the likes of Spain, Hungary etc are a fraction of ROI prices ignore for this argument as they are very different geographies). At least 50% less for complex procedures in Northern Ireland (I got braces there 25 years ago and my son is getting them right now and both cases half price to ROI), while those in the industry will argue rent insurance etc as being different these extra costs don’t account for the price difference. ROI dentists and pharmacies make MUCH MORE profits than their northern equivalents because they charge customers MUCH MORE. it’s that simple.

To further emphasise my point a lot of ROI dentists and pharmacists go to college and train on the UK so their qualifications are the exact same as their neighbours who charge half their prices!

My point is it’s a bit rich a ROI dentist complaining that someone is getting tax relief from their expenses abroad when it’s most likely the case that the patient was forced to go abroad because of the profiteering of the ROI dental industry meant they couldn’t afford to use an ROI dentist.0 -

All your points are very valid.

My point is that dentists and pharmacies in ROI charge too much. You only have to look across the border to understand this(even though the likes of Spain, Hungary etc are a fraction of ROI prices ignore for this argument as they are very different geographies). At least 50% less for complex procedures in Northern Ireland (I got braces there 25 years ago and my son is getting them right now and both cases half price to ROI), while those in the industry will argue rent insurance etc as being different these extra costs don’t account for the price difference. ROI dentists and pharmacies make MUCH MORE profits than their northern equivalents because they charge customers MUCH MORE. it’s that simple.

To further emphasise my point a lot of ROI dentists and pharmacists go to college and train on the UK so their qualifications are the exact same as their neighbours who charge half their prices!

My point is it’s a bit rich a ROI dentist complaining that someone is getting tax relief from their expenses abroad when it’s most likely the case that the patient was forced to go abroad because of the profiteering of the ROI dental industry meant they couldn’t afford to use an ROI dentist.

Dental Clinics are micro businesses which operate on the same economic principles as any other business, charge too much and people won’t avail of your service, charge less than the market rate and you are not reaching earning potential. Should it be any other way?

Show me a Clinic that charges 50% less for complex treatments, I’ll show you someone who didn’t do their research to find better value closer to home. Link to an orthodontic clinic that charges 50% less than the average rate here please.

Incidentally, there is a very good reason why pharmacies charge more here for medication, and it is not just because the Pharmacists want more profit than their northern counterparts, google is your friend.0 -

ROI dentists and pharmacies make MUCH MORE profits than their northern equivalents because they charge customers MUCH MORE. it’s that simple.

This core part of your thesis is simple untrue. I know a lot of NI dentists, I trained with a lot of them and they all make great money. THeir practices are heavily subsidised buy the English taxpayer but they and the private ones (that are good( make great dosh.

There are a bunch of super cheap dental practices in the south if you look, and super expensive ones in the north if you look. But usually the narrative is better served comparing a specialist practice in dublin city center with a general mixed NHS practice up a laneway in rural Northern Ireland.

I have generally found people willingness to travel for dental work is inversely proportional to the value of their time.0 -

Dental Clinics are micro businesses which operate on the same economic principles as any other business, charge too much and people won’t avail of your service, charge less than the market rate and you are not reaching earning potential. Should it be any other way?

.

I am reading that as let’s charge as much as we can get away with. It’s that business model that is driving away so many patients, but you don’t care because your patient book is full of those willing to pay the high fees, right?

Just to clarify, we have a local dentist and he is fantastic at the routine stuff and we all visit him twice a year and no issue paying the fees. Its the complex stuff that are outrageous in ROI.

In our experience of braces, implant and a bridge our local dentist referred us to a specialist, we also priced a few others. Similar to when I got braces all those years ago we went with a great place in enniskillen. It’s under a 3 hour return drive away but we see it as a family day out and get to visit relatives on the way and they open Saturdays, a real customer focused place. COVID has made a little more challenging but no regrets. And unsurprisingly car park has a lot of southern registered cars.

So, to the two dentists above who obviously have a vested interest defending their industry; both the OP and thousands of other people each year realise a material enough saving to get their procedures done abroad (even after big time and travel costs), are you saying we are all wrong, are we all fools who didn’t price around?I have generally found people willingness to travel for dental work is inversely proportional to the value of their time.

IMO That’s a pretty arrogant attitude, you do realise that not everyone (esp those who are paying for their families) can afford the large fees and saying because they will (when it’s in reality they are forced) travel a few hours up the road a couple of times they have nothing better for doing!1 -

I am reading that as let’s charge as much as we can get away with. It’s that business model that is driving away so many patients, but you don’t care because your patient book is full of those willing to pay the high fees, right?

Just to clarify, we have a local dentist and he is fantastic at the routine stuff and we all visit him twice a year and no issue paying the fees. Its the complex stuff that are outrageous in ROI.

In our experience of braces, implant and a bridge our local dentist referred us to a specialist, we also priced a few others. Similar to when I got braces all those years ago we went with a great place in enniskillen. It’s under a 2 hour drive away but we see it as a family day out and get to visit relatives on the way and they open Saturdays, a real customer focused place. COVID has made a little more challenging but no regrets. And unsurprisingly car park has a lot of southern registered cars.

So, to the two dentists above who obviously have a vested interest defending their industry; both the OP and thousands of other people each year realise a material enough saving to get their procedures done abroad (even after big time and travel costs), are you saying we are all wrong, are we all fools who didn’t price around?

Interesting insight.

Don’t all businesses charge market rate? Why would any retailer/seller charge less than the price the market can bare, that would make absolutely no business sense. If patient books are full, and Clinics are full, isn’t that an indicator that the pricing is right? There will always be people who can’t/won’t pay and travel abroad, I have absolutely no issue with that, why would I if books are full?

Just had a look at Orthodontist prices in Enniskillen, they are not 50% of the costs in the South, actually they are around the same price. I’m happy to post the links if the mods allow it.0 -

I am reading that as let’s charge as much as we can get away with.

This is the fundamental underpinning of ever business ever.

You also mentioned in a previous post about prices in Spain, Hungary and the North.

Average Spanish wages are less than €2000 per month, similar in the North and in Hungary they're around €1000 per month. It's handy earning your money here and spending it in a country with lower living standards, of course everything will be cheaper when the reality is that average Irish salaries are among the largest on the planet.0 -

An example of the spending staying within the Irish economy would be the Irish dentists super flash car because the Irish dentist earns so (too) much. You know there is a reason a lot of patients go abroad (most to the north), Irish dentists are too expensive, earn multiples of their Northern Ireland equivalent. Same as pharmacies.

Do you do your job here for the same amount the job pays in Turkey?0 -

Advertisement

Advertisement