Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

So a Memestock was my first Stock. What Now?

Options

Comments

-

This website seems useful as a starting position (if you haven't already seen it) https://www.itinvestor.co.uk/Thanks for the heads up. Doing a bit if research here into the INV Trusts.0 -

Lamar Thoughtless Napkin wrote: »Capital Gains Tax (CGT).

Regardless of how much (or little) profit you made you will still need to make a return to Revenue regarding this by the 31st October 2022.

There is a personal exemption of €1,270. This means if you made a profit (i.e. sale price minus what you paid) of less than this you will not need to pay any CGT. However, you will still need to include this in your return next year. If you made more than the exemption you will need to pay CGT of 33% on anything above €1,270. (i.e. don't include the first €1,270 when calculating.). If you paid commission etc. on the transactions you can deduct them also. You must pay this CGT by December 15 2021 (this year!). You will not need an accountant or anything to do this, it is a very straightforward calculation, loads of detail on the Revenue website and on ROS and you can ring them too for help.

Is there a joint assessment CGT credit of €2540? Or do shares need to be jointly owned to qualify for it?0 -

My understanding (*not a tax expert klaxon*) is that the €1270 is a personal exemption and cannot be transferred.Black_Knight wrote: »Is there a joint assessment CGT credit of €2540? Or do shares need to be jointly owned to qualify for it?

However, if your spouse has eligible CGT losses (after offsetting against her own gains, if any) you can offset them against a gain you make yourself.

I am not married so I have not looked into this in any great detail.0 -

Right, so after a great deal of consideration and research, this is my plan. Posting this both for feedback, and in the hope someone might get something useful out of it (in line with the aim of this thread).

What is my Goal?

My goal is simply to have gained more on what I have invested than if I just stuck it into the bank. I already have excellent pension arrangements. This money would be a "bonus" to have in the future and is separate from other "needed" funds which have/will be budgeted for accordingly. In other words, if I lose it all, while it would suck beyond belief, I would not have to cancel or rearrange life plans. I am 30 now, it would be a nice dream to have a decent "bonus" pile of cash when I am 50.

What is my timescale?

I intend to buy and hold long term, performance will be judged over the course of 5/10/15/20 years. GME has taught me that short plays are not for me, unless I want to watch tickers all day and get no work done!

How Much Will I Invest?

I am purchasing (hopefully) a new house this year so funds for the stock market will be limited. I will probably just buy a couple of hundred quids worth of each, and once I have my house bought commence sustainable regular monthly top ups going forward which will increase as time goes on, in line with my income.

What Investment Trusts/Stocks Will I buy??

I have identified 5 investment trusts and 1 stock which will be my initial holdings, in three broad categories. There is some overlap within the catagories, but the catagorisation is largely in line with the stock/trust mentality.

Defensive:

1. [URL="http://tools.morningstar.co.uk/uk/cefreport/default.aspx?SecurityToken=E0GBR004CX]2]0]FCGBR$$ALL"] (CGT) Capital Gearing Trust[/URL]

2. [URL="http://tools.morningstar.co.uk/uk/cefreport/default.aspx?SecurityToken=F0000008LG]2]0]FCGBR$$ALL"](RICA) Ruffer Investment Company Limited[/URL]

Value:

3. [URL="http://tools.morningstar.co.uk/uk/cefreport/default.aspx?SecurityToken=E0GBR00R16]2]0]FCGBR$$ALL"](AGT) AVI Global Trust PLC[/URL]

4. (BRK.B) Berkshire Hathaway Inc Class B

Growth:

5. [URL="https://tools.morningstar.co.uk/uk/cefreport/default.aspx?SecurityToken=E0GBR00PWQ]2]0]FCGBR$$ALL"](MNKS) Monks Investment Trust[/URL]

6. [URL="https://tools.morningstar.co.uk/uk/cefreport/default.aspx?SecurityToken=F000000JUY]2]0]FCGBR$$ALL"](JMG) JPMorgan Emerging Markets Inv Trust [/URL]

Each of the above are reputable organisations, all with decent records. As a group, I think it strikes a good diversification balance, although I would appreciate any opinions. I expect the Defensive 2 to protect my investment, with a good chance of modest gains. I don't think I will go too drastically wrong with the Value 2, and could make some decent gains here all going well. With the Growth 2, who knows? I was tempted to go for Scottish Mortgage but it is a bit too risky, Monks seems to be a watered down version, but still has a great record. I wanted some good exposure in emerging markets, China in particular. JP Morgan's offering seemed the best, especially as I did not want two trusts run by Baille Gifford in my portfolio.

Between the six there is some overlap in their holdings. I have tried to minimize this, but obviously I will have to keep an eye on things.

On whether I add any more stocks or trusts over time, that option remains open, but if I do it will be on a value investing style basis, and carefully considered. I will resist jumping on momentum stocks. But even if I add nothing, I think it is a decent portfolio.

What Broker Will I Use?

This was a hard one. When looking at a broker I had some strict requirements:

1. They must offer Investment Trusts.

2. They must be low cost or commission free if possible, particularly early on due to modest starting sums.

3. They must be safe and secure.

4. The should allow share transfers to other brokers.

4. Preferably, they should offer fractional shares.

DEGIRO is a very popular broker and the first one I looked at. However, they do not offer investment trusts and do not offer fractional shares. While cheap (they seem to be the cheapest of the non "zero commission" brokers) they are not free. They are very reputable, secure and allow you to move your shares to another broker.

Trading212: These are "free", allow fractional shares and offer Investment Trusts. While regulated and anything going wrong is unlikely, they are not around as long as some other "proper" brokers and some have expressed worry over what would happen to your shares if they went down the tubes (who really owns the asset, how clearly are your holdings demarcated from everyone else's etc.). This is perhaps an unlikely scenario, however a serious concern is that they do not allow you to transfer your shares to another broker, so if you decided to move you have to sell everything and move the cash, this can have serious tax implications of course. They also allow you to lodge funds from your debit card.

Etoro: Basically has the same good and bad points as Trading212.

Revolut: Similar good and bad points as T212 and Etoro, but way less stocks available, no investment trusts.

Interactive Brokers: These have investment trusts, very reputable (perhaps the most?), allow fractional, allow transfer to other brokers, but, while low cost, they are the most expensive on this list.

I have decided that long term Interactive Brokers suit me best. However, their costs (basically €10 a month minimum, perhaps more depending on number of trades) will not work for me at the start, for the first 12/18 months due to irregular/low amounts investing each month due to house purchase. So my plan is to start with Trading 212 in the beginning and then shift to Interactive Brokers after I get settled with my house, gradually if needed, in line with using my CGT allowances to avoid paying CGT. This should be easily achievable over the short term as I would not expect massive gains due to modest starting sums.

So to Conclude...

I think the above is a reasonable (dare I say sensible?) plan, with reasonable stocks, that give a good chance of decent returns over the long term and hopefully mitigates reasonably well against the risk of losing everything. Any and all opinions appreciated, I have probably missed something! Right now I am just waiting on T212 to allow sign ups again so I can get started!0 -

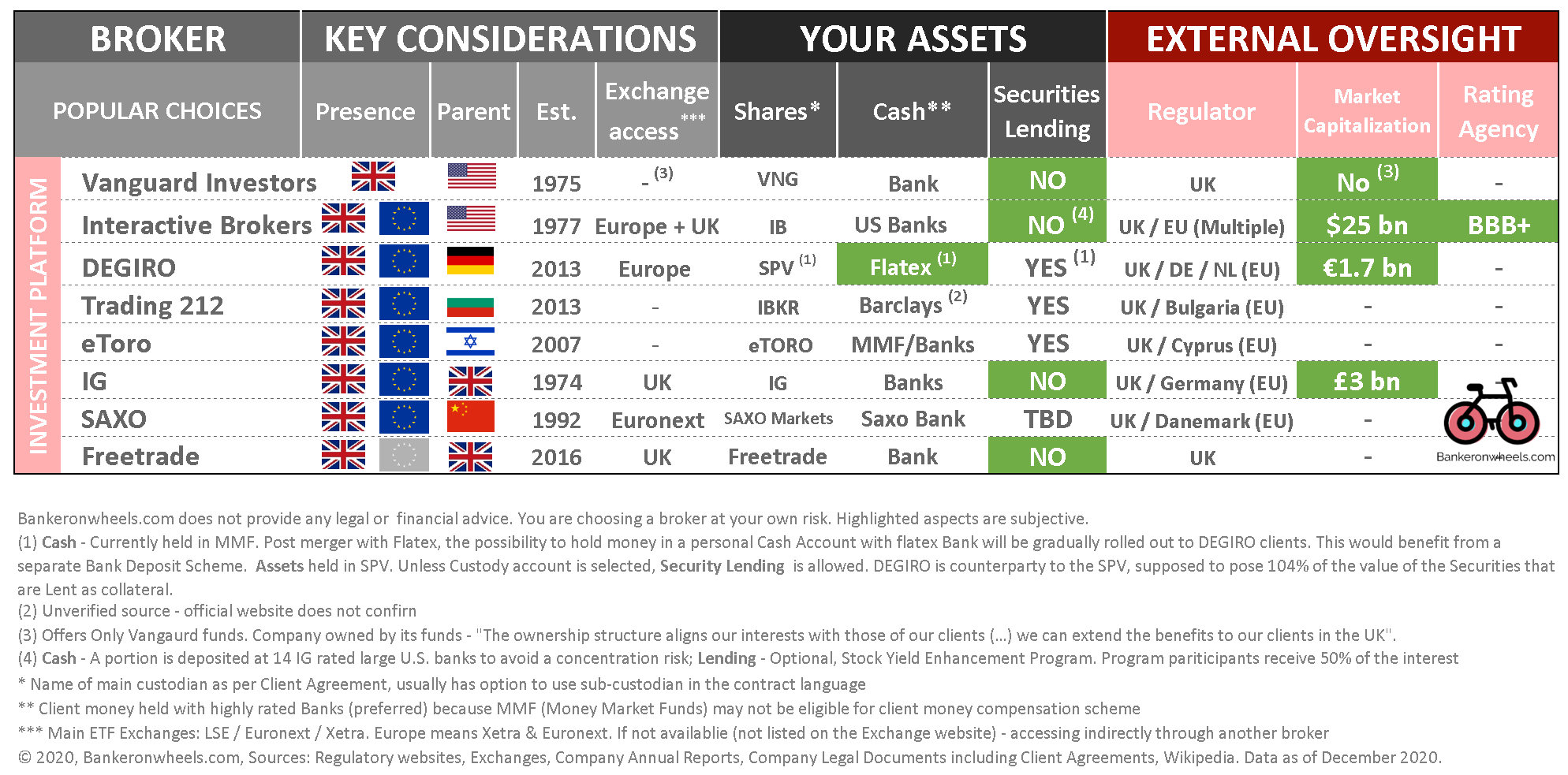

For those concerned about broker long term safety/viability, I found this article useful:

https://www.bankeronwheels.com/how-to-choose-a-safe-stock-broker/

Interactive Brokers seem to be the most secure, largely because they are the largest and most transparent, due to the fact that they are publicly traded and agency rated (the thinking being that public scrutiny should keep stuff safe/flag issues - in theory). So I think a monetarily small portfolio (under 20k, the amount covered by the Investment Compensation Scheme) with Trading212 is ok (stocks ultimately held with Interactive Brokers, but conceivably T212 could mess up something) with larger sums done directly with IB makes sense.0 -

Advertisement

-

Opened an account with Interactive Brokers today, seemed very painless, ID etc. approved in minutes. Transferred a grand in to get started (from Revolut) which may take a couple of days to reach my IB account.

Soured on Trading212, just taking too long to open to new members (guaranteed they will start accepting new members any second now!) and when I considered their FX fees, and lodgement fees (from a Card) as well as other factors discussed previously (share lending etc.) I decided to just bite the bullet and go with IB. I will let people know how I get on, it seems very good so far, oodles of information. There is an online portal for simple trades (will use this most often I'd say) and there is also a "workstation" that you download, this seems very complicated and something like you see day-traders use. There is also a mobile app (not used yet).

You can also log into a "virtual" account and use that to mess around.

With the tiered pricing it is not that expensive, and for my uses cheaper than DEGIRO would be (if it had the trusts I wanted!).0 -

Lamar Thoughtless Napkin wrote: »Opened an account with Interactive Brokers today, seemed very painless, ID etc. approved in minutes. Transferred a grand in to get started (from Revolut) which may take a couple of days to reach my IB account.

Soured on Trading212, just taking too long to open to new members (guaranteed they will start accepting new members any second now!) and when I considered their FX fees, and lodgement fees (from a Card) as well as other factors discussed previously (share lending etc.) I decided to just bite the bullet and go with IB. I will let people know how I get on, it seems very good so far, oodles of information. There is an online portal for simple trades (will use this most often I'd say) and there is also a "workstation" that you download, this seems very complicated and something like you see day-traders use. There is also a mobile app (not used yet).

You can also log into a "virtual" account and use that to mess around.

With the tiered pricing it is not that expensive, and for my uses cheaper than DEGIRO would be (if it had the trusts I wanted!).

I'd suggest trying the Trader Workstation, it's not overly complicated (even I can use it somewhat), download it anyway and have a look0 -

-

Money hit my IB account first thing this morning. Very impressed with IB, took less than 24hours to get approved, set up and funded.Lamar Thoughtless Napkin wrote: »Opened an account with Interactive Brokers today, seemed very painless, ID etc. approved in minutes. Transferred a grand in to get started (from Revolut) which may take a couple of days to reach my IB account.

Soured on Trading212, just taking too long to open to new members (guaranteed they will start accepting new members any second now!) and when I considered their FX fees, and lodgement fees (from a Card) as well as other factors discussed previously (share lending etc.) I decided to just bite the bullet and go with IB. I will let people know how I get on, it seems very good so far, oodles of information. There is an online portal for simple trades (will use this most often I'd say) and there is also a "workstation" that you download, this seems very complicated and something like you see day-traders use. There is also a mobile app (not used yet).

You can also log into a "virtual" account and use that to mess around.

With the tiered pricing it is not that expensive, and for my uses cheaper than DEGIRO would be (if it had the trusts I wanted!).

One thing to be careful of is that by default the pricing structure seems to default to "fixed" rather than the cheaper, for my uses (and most people I would think) tiered pricing plan. Having changed to tiered in the account settings, this will not take effect until the next working day, so no stock buying for me today!

They offer a virtual "paper" facility so I will play around with that. Have been looking at the Trader Workstation, it is actually easy enough to use, I will have no need for 90% of the functionality of it, but it does seem more stable than the web based client (although that could be my browser).0 -

Lamar Thoughtless Napkin wrote: »Money hit my IB account first thing this morning. Very impressed with IB, took less than 24hours to get approved, set up and funded.

One thing to be careful of is that by default the pricing structure seems to default to "fixed" rather than the cheaper, for my uses (and most people I would think) tiered pricing plan. Having changed to tiered in the account settings, this will not take effect until the next working day, so no stock buying for me today!

They offer a virtual "paper" facility so I will play around with that. Have been looking at the Trader Workstation, it is actually easy enough to use, I will have no need for 90% of the functionality of it, but it does seem more stable than the web based client (although that could be my browser).

Looking at IB myself to consolidate my accounts, am currently on both Degiro and T212 and have particular things I don't like about both.

So for an individual tiered account you are looking at $10 per month minus commission fees which i assume is another word for transaction fees (hopefully correctly) which are €1.25 to €29 (0.05%) , do you pay anything else?, is the UK and US market pricing data real time or delayed, also do they do year end tax statements for CGT?Have a weather station?, why not join the Ireland Weather Network - http://irelandweather.eu/

0 -

Advertisement

-

It is delayed, 15 mins I believe. You can subscribe to live data (which seems expensive) or you can "pay as you go" for a snapshot of data for a trade.Looking at IB myself to consolidate my accounts, am currently on both Degiro and T212 and have particular things I don't like about both.

So for an individual tiered account you are looking at $10 per month minus commission fees which i assume is another word for transaction fees (hopefully correctly) which are €1.25 to €29 (0.05%) , do you pay anything else?, is the UK and US market pricing data real time or delayed, also do they do year end tax statements for CGT?

For my uses (buying to hold) I don't see why I wouldn't use a free live service like Yahoo or something, to get the figures to inform my purchase and tailor it accordingly - so I have not looked properly at the exact costs of live data and snapshots.

As for reports, there is a whole section where it seems you can generate pretty much any report you can think of. Once I have purchased some shares I will play around with it and let you know what I think, although I will maintain a spreadsheet I have designed for these records. I would be amazed if the report functionality on IB would not suffice by itself for what you want, I just like to have manual backups myself.

As for costs, my understanding is that the $10 (USD this is important) is the headline monthly charge, and that commissions are offset against this. So for example, a UK purchase for me will cost 0.050%, with a minimum of GBP 1.00 (Around €1.20 today, or around $1.40, which will be offset against the monthly $10.00). So my understanding is that if I make a few trades a month the $10.00 will be absorbed. When I have over 100K (ha!!) the $10.00 is waived (it appears to be waived for the first three calendar months). Important to note that if your account balance is under 2k the charge is $20.00 a month. (So I have three months to reach 2k overall which should be easily doable with my planned "top ups", provided everything doesn't go to hell!)

As for other charges (will leave aside "optional" ones like live data) and stuff that there may be for margin, option type things (which I have no interest in) there do not seem to be many:

1. Withdrawal Fees: You get one free one per calendar month, any more than that and there is a fee which varies depending on currency and how you want to receive the money.

2. Archived Statements: There is a charge for these (for ones that are not available through your account. You account goes back 4 years for daily statements, and 5 for annual. Should not be an issue, just print them off yearly).

3. FX fees. I am not exactly sure how this works yet, everywhere says some variation of "very good/low". My base currency is in Euro, most of my trading will be in GBP. I lodged 1k in Euro from Revolut, I will see how the fees work out to convert. If there are in any way substantial I will see if I can preconvert to GBP in Revolut and lodge in pounds to IB and see what happens. It appears the costs for spot currency changes are as follows: 0.20 basis point * trade value, with a minimum of 2.00 USD. I think this charge is also offset against the $10.00 a month, but am not sure, will see in practice. I think DEGIRO charge spot rate plus 0.1% and T212 0.15%

I believe a basis point is 1/100th of 1%.

So IB may be cheaper to exchange, especially if it is a larger sum? Does that sound right? Anyway for IB it looks like around €2 to change €1k to GPB, at what seems a great rate, no idea if that is good or not!

Next week I will see if I can lodge directly in GBP, or some USD, and see if it auto converts to my accounts base currency (Euro) or just arrives as I sent it, thus avoiding any fee.

Hope this was helpful!0 -

Thanks very much for that brilliant detailed reply, thats super helpful

Have a weather station?, why not join the Ireland Weather Network - http://irelandweather.eu/

0 -

Investment Trusts

Some have found what I have posted previously a help, so I thought I would elaborate more on the subject of Investment Trusts, the ones I have picked, and why. Again the caveat that while I have done some research, I am very much a newbie at this, don't take anything I say, especially opinion, as gospel. I am just saying what I am doing, and why. Ask me in ten years if I was more right than wrong!

The "safest" way for lay people to invest may be in funds/ETFs. These are basically instruments that track an index. So for example you might invest in one which tracks the S&P500 (The biggest American companies, as an EU citizen you can't really invest in this but anyway) so as the market goes up or down so does your ETF. You can just buy it and leave it to do its business, you don't need to keep an eye on things the way you would if you invested in a particular company. However there is a major problem with this strategy, namely the Irish tax laws, specifically "deemed disposal". Basically, every 8 years you have to pay a tax of 41% on any growth/profits and the same rate on exit.

This tax rate is pretty crippling, and certainly damages compounding.

Investment Trusts are the next best thing (and better in some ways). Basically, Investment Trusts are closed end funds, sort of holding companies that are actively managed by a board etc. There are lots of different types with different priorities and philosophies. The manager, depending on the rules of the Trust, can invest in a whole range of things, from shareholdings in particular stocks to bonds, commodities, cash, real estate etc. Most will either use or have the option of using "gearing" (borrowing/leverage). These ITs often have a base index they aim to "beat", which many ITs have a great record of doing. If your IT manager is good/lucky you can make very good gains above what you might in a comparable index, obviously the opposite applies too. Many pay good dividends. The downside is that the company charge a higher fee (usually) from the assets under control than happens with open ended funds/ETFs, but this would seem to me to be a small quibble, especially as IT's are treated, tax wise, the exact same as regular stocks. That is, you pay income tax as normal on dividends and the normal Capital Gains Tax when you sell. This is a massive advantage in two ways: CGT is 33% (less than for an ETF) and if you make a loss you can carry it forward and offset it against any future Capital Gain you may have. You cannot do this if you make a loss on an ETF.

I have checked the tax status of IT's in some detail. Revenue have never said that they should be treated the same as regular stocks. In practice they are. In theory, Revenue could change the rules and say they should be subject to deemed disposal, but this is very unlikely for two reasons: The first is that tax is being paid on an ongoing basis on any dividends. Secondly, is the way in which the IT's trade, they are subject to a premium or discount.

Premium and Discount

This is a very important factor to be aware of. IT's have a Net Asset Value (NAV) which is the real world value of their holdings. So lets say an IT owns only ten stocks, the entire value of which on the open market is £1,000,000. The value of the IT share that you buy on the stock market is not necessarily reflective of that value. Lets say it has ten shares, you would think that the value of the share would be £100,000. But not necessarily. The shares of the IT can trade at a premium or a discount to the NAV. So in our example the shares might trade at £90,000 or £110,000 giving it a discount/premium to NAV of -/+ 10%.

This means there is a great opportunity to essentially pick up shares for less than they are worth now and money can be made if the discount to NAV narrows, even if the underlying value of the shares the IT holds stay the same. You could also "overpay" by buying at a premium. You might think this sounds straightforward, and you should just buy whatever has the biggest discount and don't buy anything at a premium. No, not so fast, you need to investigate. There are often very good reasons for there to be a discount or premium. The NAV is not static, and can go down as well as up.

That said, sometimes discounts are caused by market panic over short term issues, so you can pick bargains up here.

There is also great opportunity (which appeals to me) to pick up particularly good bargains by buying Value orientated IT's at a discount to NAV. In theory, if I buy one of these at a discount, I am buying a company that has made investments that it felt were at a "discount" to their real worth, so I am getting a "double discount" which could give me great returns.

Some ITs try to make sure there is no or a very small premium or discount to NAV. They do this by issuing more shares when there is a premium, and buying shares back when there is a discount.

On the subject of investing styles (lots of variations I am being simplistic here):

Value Investing: Investors with this philosophy (put simply and in general) basically try and figure out the intrinsic value of a stock, and buy it if the market price is significantly below what the investor thinks the Intrinsic Value is. This Intrinsic Value calculation is usually based on fundamentals of a company, incorporating discounted cash flows. The idea is that the rest of the market will eventually figure out that the company is worth more than it is trading at, and the price will increase. This is the old-school approach to investing, the type of which Warren Buffet and co have famously used.

Growth Investing: This is basically investing in companies (often new or small) that have great potential to grow rapidly. TESLA and new tech companies I suppose are examples of this where loads of people have made massive amounts of money. This is the style of investing that has been the most successful in recent years (by a good margin).

Portfolio Picks and Rationale

I have tried to put together a balanced portfolio, in terms of geography, philosophy and investment areas/types. Some might find it helpful to put up a little more about the ITs I have picked, and why.

1. CGT

Capital Gearing Trust defines its objective as follows:

To preserve the real wealth of shareholders and to achieve absolute total return over the medium to longer term through investment in quoted closed-ended funds and other collective investment vehicles, bonds, commodities and cash.

Basically, I picked this as CGT has very low volatility, and weathers storms pretty well. This is a defensive investment which while it won't achieve massive growth, should the market go south it should protect my investment better than most. I am classifying this as "low risk" as per my risk appetite. Currently trading at a typical small premium and produces a dividend yield of 0.54.

2. RICA

Ruffer Investment Company defines its objectives as follows:

The principal objective of the Company is to achieve a positive total annual return, after all expenses, of at least twice the Bank of England Bank Rate by investing predominantly in internationally listed or quoted equities or equity related securities (including convertibles) or bonds which are issued by corporate issuers, supranationals or government organisations.

Another defensive pick, but a little different. This has somewhat of a Value tilt, and, amazingly, actually increased in value in March of 2020 when everything else was collapsing. Again the aim here for me is modest growth in good times, and protection of my investment in bad. Another "low risk". Currently trading at a premium of around 4% and produces a dividend yield of 0.66.

3. TMPL

Temple Bar Investment Trust defines its objectives as follows:

To provide growth in income and capital to achieve a long term total return greater than the benchmark FTSE All-Share Index, through investment primarily in UK securities. The Company's policy is to invest in a broad spread of securities with typically the majority of the portfolio selected from the constituents of the FTSE 350 Index.

I went back and forth on this one. It preformed horrendously during Covid, but since the company replaced its manager it has rebounded very well. This is a committed Value style trust, concentrating on the UK. I think the UK is very undervalued at the moment and there are great opportunities over the long term. I have included this as Value style trust, and for UK exposure. It is currently trading at a small discount of around 2% (it was 15 not too long ago!) and produces a dividend yield of 3.35.

4. AGT

AVI Global Trust defines its objectives as follows:

Established in 1889, the Company’s investment objective is to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value.

Unique

A concentrated portfolio combination of family-controlled holding companies, closed-end funds and asset-backed opportunities, unlikely to be found in other funds or indices.

Diversified

A concentrated portfolio of high conviction ideas, yet with broad diversification to sectors and companies through the holding structures of the portfolio companies.

Engaged

Seeking out good quality companies and engaging to improve shareholder value.

Active

Finding complex, inefficient, and overlooked investment opportunities.

Global

Bottom-up stock picking that is benchmark agnostic – seeking the best equity opportunities across the globe.

This is a bit of a different one. It is a Value style, that has a good amount invested in family holding companies. Potential for a very diversified investment here, with a substantial "double discount" as AGT is trading at a current discount of 9%. Current dividend yield is 1.8.

5. MNKS

Monks Investment Trust defines its objectives as follows:

The Trust aims for long-term capital growth which takes priority over income. This is pursued through applying a patient approach to investment, principally from a differentiated, actively managed global equity portfolio containing a diversified range of growth stocks – companies with above average earnings growth – which we expect to hold for around five years on average. Investments are made on an unconstrained basis. The portfolio, which includes stocks with a range of different growth profiles, will typically contain 100+ stocks from around the world and Monks should not be viewed as a proxy for any index.

Went back and forth over whether to pick this or its stablemate Scottish Mortgage (SMT). Both are Growth style, SMT has better historic performance (although MNKS is no slouch). What settled it is that too much of SMT is unlisted investments, and it is too top heavy in stocks like Tesla. MNKS is a bit of a watered down version of SMT with less volatility. I included MNKS in my portfolio as a Growth style investment, riskier but may provide higher returns than others in my portfolio. Currently trading at a small premium of around 2% and has a dividend yield of 0.18.

6. JMG

JPMorgan Emerging Markets IT defines its objectives as:

This Company aims to maximise total returns from Emerging Markets and provides investors with a diversified portfolio of shares in companies which the manager believe offer the most attractive opportunities for growth. The Company can hold up to 10% cash or utilise gearing of up to 20% of net assets where appropriate.

Another growth style, this time with focus on China and emerging markets which I wanted exposure to. Higher risk than some others, but could provide handsome returns. Has a current dividend yield of 1.07.

7. PCT

Polar Capital Technology Trust defines its objectives as:

Polar Capital Technology Trust plc provides investors with access to the potential of companies in the global technology sector. Managed by a team of dedicated technology specialists, PCT has grown to become a leading European investor with a multi-cycle track record – a result of the managers’ approach to investing, with the ability to spot developing technology trends early on and to invest in those companies best placed to exploit them.

Another Growth IT, it has provided amazing returns over the past few years. Included this as I wanted dedicated Tech exposure. Went back and forth on PCT vs ATT but because PCT is more geographically diversified and trading at a discount of around 8% below NAV I decided on PCT. A riskier investment, but should tech continue to boom it could continue to provide fantastic returns. Provides zero dividend.

8. BRK.B

About:

Berkshire Hathaway, Inc. engages in the provision of property and casualty insurance and reinsurance, utilities and energy, freight rail transportation, finance, manufacturing, and retailing services. It operates through following segments: GEICO, Berkshire Hathaway Reinsurance Group, Berkshire Hathaway Primary Group, Burlington Northern Santa Fe, LLC (BNSF), Berkshire Hathaway Energy, McLane Company, Manufacturing, and Service and Retailing. The GEICO segment involves in underwriting private passenger automobile insurance mainly by direct response methods. The Berkshire Hathaway Reinsurance Group segment consists of underwriting excess-of-loss and quota-share and facultative reinsurance worldwide. The Berkshire Hathaway Primary Group segment comprises of underwriting multiple lines of property and casualty insurance policies for primarily commercial accounts. The BNSF segment operates railroad systems in North America. The Berkshire Hathaway Energy segments deals with regulated electric and gas utility, including power generation and distribution activities, and real estate brokerage activities. The McLane Company segment offers wholesale distribution of groceries and non-food items. The Manufacturing segment includes industrial and end-user products, building products, and apparel. The Service and Retailing segment provides fractional aircraft ownership programs, aviation pilot training, electronic components distribution, and various retailing businesses, including automobile dealerships, and trailer and furniture leasing. The company was founded by Oliver Chace in 1839 and is headquartered in Omaha, NE.

This is not an Investment Trust. Berkshire should need little introduction, it is Warren Buffet's holding company. As detailed above it directly owns some amazing companies, and also holds stocks of a number of others. I included this for more concentrated exposure on US companies, with a Value style. It has huge cash reserves which is attractive too. Currently I think it is a bit undervalued, evidenced not least by continuing massive buybacks. Over the long term I hope it will continue to deliver modest to decent returns, and be less volatile than some, particularly in a bear market. It provides no dividend.

Obviously anyone thinking of investing in these should do their own research. I found the annual reports, and videos of annual briefings really helpful, as well as a few podcasts with interviews of the relevant investment managers.

Regarding my portfolio, I may add positions in certain individual companies, or add more ITs over time (particularly in specialist areas) but I see no reason why I should have to remove (barring something exceptional happening or a new better player arriving on scene) any of my holdings (I want to make as few CGT returns as possible!). I think this portfolio gives me a very good chance of achieving my goal, which is to make more on my money than if I just stuck it into the bank. I know it means little, but if I had this portfolio over the past five years I would have absolutely smashed that objective.0 -

Just to add, the most user friendly site I found to track IT's, including discount/premium is https://www.trustnet.com/. You can set up a watchlist, alerts etc. All for free.0

-

Lamar Thoughtless Napkin wrote: »Just to add, the most user friendly site I found to track IT's, including discount/premium is https://www.trustnet.com/. You can set up a watchlist, alerts etc. All for free.

I've found this very good too, you can sign up for updates on whatever trusts you like, I find their daily emails full of really useful articles and news -https://citywire.co.uk/investment-trust-insider/news

This forum is another useful link I like - https://www.lemonfool.co.uk/viewforum.php?f=54Have a weather station?, why not join the Ireland Weather Network - http://irelandweather.eu/

0 -

Thanks for these, I wasn't familiar with that forum (more reading!I've found this very good too, you can sign up for updates on whatever trusts you like, I find their daily emails full of really useful articles and news -https://citywire.co.uk/investment-trust-insider/news

This forum is another useful link I like - https://www.lemonfool.co.uk/viewforum.php?f=54 ) 0

) 0 -

Lamar Thoughtless Napkin wrote: »Just to add, the most user friendly site I found to track IT's, including discount/premium is https://www.trustnet.com/. You can set up a watchlist, alerts etc. All for free.

Yep I think this is the best to explore ITs.

And there is a decent list of suggestions by categories here: https://whichinvestmenttrust.com/trusts-we-like/

Morningstar UK also rates the management teams (for what it is worth).0 -

Lamar Thoughtless Napkin wrote: »

3. FX fees. I am not exactly sure how this works yet, everywhere says some variation of "very good/low". My base currency is in Euro, most of my trading will be in GBP. I lodged 1k in Euro from Revolut, I will see how the fees work out to convert. If there are in any way substantial I will see if I can preconvert to GBP in Revolut and lodge in pounds to IB and see what happens. It appears the costs for spot currency changes are as follows: 0.20 basis point * trade value, with a minimum of 2.00 USD. I think this charge is also offset against the $10.00 a month, but am not sure, will see in practice. I think DEGIRO charge spot rate plus 0.1% and T212 0.15%

I am actually curious about this as I am seriously thinking of opening an IB account.

If I get it right, you either need to manually pre-convert the amount or to use a margin account if you want to buy a GBP security with your EUR account.

Could you confirm if this is your experience if you don't mind?

Thanks!0 -

Yes I believe this is the case, you have to manually convert it (within IB) before buying, or borrow the GBP against the value in Euro you own.I am actually curious about this as I am seriously thinking of opening an IB account.

If I get it right, you either need to manually pre-convert the amount or to use a margin account if you want to buy a GBP security with your EUR account.

Could you confirm if this is your experience if you don't mind?

Thanks!

I will be spending 1k tomorrow (So about £850.00) and will let you know how it works out, I will manually convert it before buying.

Next week I will lodge some Dollars from Revolut and see what happens.0 -

Lamar Thoughtless Napkin wrote: »Yes I believe this is the case, you have to manually convert it (within IB) before buying, or borrow the GBP against the value in Euro you own.

I will be spending 1k tomorrow (So about £850.00) and will let you know how it works out, I will manually convert it before buying.

Next week I will lodge some Dollars from Revolut and see what happens.

Cheers.

I can see how some people (especially professional traders) might like this. But I have to say this is on area I am not so keen about related to IB. I’d much prefer just maintaining a EUR balance with automatic conversions as required to execute the trades (the way DEGIRO and most brokers targeting individuals are doing it).

From my perspective this would be easier, and possibly cleaner from a CGT calculation perspective.0 -

Advertisement

-

Right so I made some purchases this morning, here is what it cost me:

First I changed (sold Euro) €980.00 and got £839.91. This was a great rate. I paid a commission of €1.68 (i.e. the $2.00).

I then made 9 UK Investment Trust buys in 7 UK trusts. I messed up a little here and basically bought £100.00 (roughly) of each, then spent another £150.00 (roughly) topping up two stocks. This means I made two unnecessary trades and wasted money. Ah well.

I spent a total of £821.94 on the stocks themselves (i.e before commission/fees).

I am a little confused about what currency commissions and fees are displayed in, I am pretty sure they are in GBP (as that is the currency they are traded in) but don't take that as gospel. I paid a total commission on the stocks of £9.35, with total fees (Stamp Duty Reserve Tax? Fee works out at 0.5%) of £3.62 for a total cost of £12.97, giving me a total cost basis for these stocks of around £836.00.

I have paid total commissions of €1.68(about £1.44) + £9.35 = £10.79 which is around $15.00 This comfortably covers the $10.00 a month charge (which is not charged for the first 3 months anyway).

So to conclude, between commissions and fees, for 9 stock purchases and 1 fx trade, it cost me around €17.00 (around 4 of that being what I think is tax).

Or another way to look at it, is that I spent around €975.00 today (have a remaining cash balance of €25) and €17.00 of that €975.00 were "costs" which works out at 1.74% of what I spent (I think I have that right?).0 -

Just to add, on the reporting front you can generate tax documents, and it has a facility to factor in FIFO which means I have probably wasted my time making a complicated spreadsheet, ah well!!0

-

No, I'm afraid not you have to pay tax, and should have, by the sounds of it, paid it years ago.shtpEdthePlum wrote: »I got in to crypto six years ago. I made substantative profits off initial investment. I took profits out for car insurance and maybe some other things I needed at the time but reinvested the rest.

It is only now occurring to me that I need to pay taxes on the profits. Is there any way I can just give all the money to charity or something and not have to figure out how much I owe. I don't actually need the money any more, it was just a hobby. I currently have around 25k in various coins and some fiat.

I would actually forfeit the money rather than going back through the hundreds and possibly thousands of individual transactions and figuring out if it was a profit or loss and how much, because that is absolutely sh!t craic. Stupid prick government ruling every action we ever take.

I would talk to an accountant about how to get you back to compliance.0 -

shtpEdthePlum wrote: »Can I just assume it's all a profit and hand the relevant amount to the revenue.

I really could not be bothered dealing with this, I don't want it.

The laws around this were very unclear at the time and I was young so I didn't even realise there were laws around it.

I'm willing to give the government the whole thing just to be able to forget about it.

Our CGT laws are abusive and overly complicated, but even if it was all a profit with an initial acquisition cost of 0, you would not have to pay everything as tax. “Only” 33% minus your yearly allowance.

IMO if you go to Revenue and hand them money telling them it is all profits and they can have it, it will actually cause trouble for you. I.e. they will likely ask you to clarify where this profit comes from before accepting your money.

Do you still have access to you transactions history on the exchange(s) on which you were trading? If yes you can import the whole history on a service like Koinly and it will calculate your tax liabilities automatically (for a fee) and produce a nice PDF report which you can provide to Revenue if they ask. This is pretty easy and works well if you still have all your transactions history as CSV files (it will work across multiple exchanges as well). If you don’t have the documentation anymore, you should probably talk to a tax professional.

Note that if you haven’t made any large disposals over the years* and have just been holding, you actually aren’t behind with your tax obligations as it is only at disposal time that CGT is due. If you have made large disposals though, you might have outstanding CGT liabilities for previous years (and to be clear, trading one cryptocurrency for another one is a disposal as far as CGT calculation is concerned).

* I.e. if your gains didn’t go above your yearly CGT exemption for any of the past years0 -

You won't end up in jail. How many years ago are we talking?shtpEdthePlum wrote: »That is phenomenal advice. Thanks a million. So 33% minus allowance. Dark cloud lifted, I can actually enjoy investing again! Lesson learned.

Probably have to pay a fine actually though for the profits from years ago, will I? Could I end up going to jail? Balls0 -

shtpEdthePlum wrote: »That is phenomenal advice. Thanks a million. So 33% minus allowance. Dark cloud lifted, I can actually enjoy investing again! Lesson learned.

Probably have to pay a fine actually though for the profits from years ago, will I? Could I end up going to jail? Balls

Oh actually I just had a look and I think they might be under the allowance. I will speak to an accountant.

No worries.

I was actually adding a note at the end of my original post at the same time as you replied. I think it adresses this.

Basically as long as your total profit across all assets disposals (not just cryptocurrency) for a given year is below €1,270, you don’t owe any tax (but see my comment on trading between cryptos).

And no you’re not going to jail :-) Even if you had a few thousands euros of CGT in arrears, for Revenue this is a small amount in the grand scheme of things and if you come to them explaining you didn’t know and want to clear your balance, they’ll probably just apply a small fine for delayed payment. But yeah maybe talk to a professional and go into the details of your situation with them.0 -

Had a go at trying to send "pre converted" currency (USD) to IBKR. It very much seems possible, just a case of putting in the right bank details. However, I am always nervous of messing this type of thing up, and transferring to an American account is a bit different than just putting in a BIC and IBAN. It seems straightforward enough, but I didn't chance it, especially seen as I will have to pay $10 a month either way, it seemed too much fuss to avoid the fee on exchange, only to have to pay it anyway! However, if you plan on making lots of trades each month, transferring directly with your currency of choice from Revolut is possible, and would save you money.

Just on the point of commissions, it is a little sad that because of them , you will start off in the red :-(. Hopefully it won't take long to go green! IBKR is a little awkward to use, to log in you get a text and have to put a code in each time. This makes sense and is secure, but is a little annoying if you just want to see how your portfolio is doing (although that said it has great tools that breakdown in detail your holdings, even on an individual basis, it breaks down ITs like funds so you can see what sectors, countries etc.) I have a spreadsheet with live prices which tracks things for me, but I also put my portfolio and transactions into WallMine which is very good with charts and stuff just to see how you are getting on at a glance.0 -

Right, so I have established a holding in each of my eight holdings, with a total cost of around €1,120. Its not split exactly evenly, in Euro terms each has a minimum of €108.00 with PCT, BRKB and AGT being the largest holdings I have.

I will have around €300 a month to invest, so I plan to make 3 €100.00 investments a month in a strict order, regardless of market price (within reason).

There is a good argument that the best way may have been to invest the money differently, perhaps to invest in a single stock at €1,000 a time. I decided against this for a few reasons: I want to have the money in the market ASAP, by regularly investing I can get the merits of averaging, I don't want to save up a larger sum then start second guessing about what stock to buy (this is the main reason, if I just think "I am spending x on a, b and c this month" I think I will be more inclined to regularly invest and stick to it over the long term, mentally I will just find this easier). I think this way of regular, small monthly investments may work best for me, but others may find other ways better.

In the longer term I may add some more holdings (trusts focused on real estate or debt perhaps) but for now I am just going to stick with my 300 or so a month and see how it goes. (The 300 is not an arbitrary number, but rather a small percentage of disposable income I have. This will rise over time)

I am thinking of posting here now and again about how I get on, in the hope that it may be interesting/helpful for people here (even if it is just to see how not to do things!). However, I don't want to go ahead posting self indulgently, so please let me know if you think occasional updates on progress, if I change the portfolio etc. would be helpful/of interest.0 -

Lamar Thoughtless Napkin wrote: »Right, so I have established a holding in each of my eight holdings, with a total cost of around €1,120. Its not split exactly evenly, in Euro terms each has a minimum of €108.00 with PCT, BRKB and AGT being the largest holdings I have.

I will have around €300 a month to invest, so I plan to make 3 €100.00 investments a month in a strict order, regardless of market price (within reason).

There is a good argument that the best way may have been to invest the money differently, perhaps to invest in a single stock at €1,000 a time. I decided against this for a few reasons: I want to have the money in the market ASAP, by regularly investing I can get the merits of averaging, I don't want to save up a larger sum then start second guessing about what stock to buy (this is the main reason, if I just think "I am spending x on a, b and c this month" I think I will be more inclined to regularly invest and stick to it over the long term, mentally I will just find this easier). I think this way of regular, small monthly investments may work best for me, but others may find other ways better.

In the longer term I may add some more holdings (trusts focused on real estate or debt perhaps) but for now I am just going to stick with my 300 or so a month and see how it goes. (The 300 is not an arbitrary number, but rather a small percentage of disposable income I have. This will rise over time)

I am thinking of posting here now and again about how I get on, in the hope that it may be interesting/helpful for people here (even if it is just to see how not to do things!). However, I don't want to go ahead posting self indulgently, so please let me know if you think occasional updates on progress, if I change the portfolio etc. would be helpful/of interest.

I think its good of you to disclose what you are doing so regular updates would be interesting to see. You currently explain your thought process around what you are doing which makes it even more interesting.

This being the internet, someone saying you're doing it wrong, you should have done A, B, C months ago etc or that there's no need for another thread like this probably are never too far away but so what. You'll definitely learn something in this process and even if it's only a defacto diary of your movements and thoughts around them which you will look back as time passes, then that might not be a bad thing either.

Good luck with it.0 -

Advertisement

-

Thanks all. Just to comment again on lodging funds with IB, today I converted EUR to GBP in Revolut and transferred the GBP to IB directly. This worked much better, not only did I save the commission fee, but it transferred within ten minutes rather than the 12 hours the EUR transfers took. The only snag was that IB give you a BIC and IBAN and Revolut asked for Account and Sort Code - easily solved of course as these are in the IBAN.0

Advertisement