Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Economic Destruction.

Options

Comments

-

Yes they are the most well respected commentators in the world, the thing is none of them are predicting the collapse of fiat currency, they echo to certain degrees widely held views that the strength of the dollar and it's position as a global reserve currency is under threat.

They can't predict a collapse, they are essentially diplomats, their language is cautious but they are being as extreme as decency allows. Every one of them questions the feds handling of the situation. It hasn't changed the actions of the fed, therefore if this current fiscal policy is adhered to then ultimately it will lead to what they say, the end of the dollar as reserve currency. To me that is a collapse in faith of a fiat currency, the ramifications of this would be catastrophic. I concede you the point that they are not specifically stating utter collapse but I believe I said there were lines to be read between.I don't mean to be personal but when I see the whole "the Fed is privately owned" nonsense it smacks of CT. It is a blatant misrepresentation of the truth, while the federal reserve banks are private institutions they are controlled by the board of governors which is publicly appointed with all surplus fed funds remitted to the US Treasury.

I detest being labelled a conspiracy theorist, NWO and the jewish zionists etc are nothing but populist tripe, however, I do read about the Bilderberg group, because they are real and don't publish minutes. I find this somewhat suspicious but I don't believe they run the world. This is not theory, they exist and I'm of an inquisitive nature, this does not mean I can be tarred with the large brush that is wielded here. Nobody can argue humanity hasn't got a dark side and history has shown us many examples of abuse of power by our elected officials, (I won't insult your intelligence by providing links), a degree of mistrust is a good thing IMO.

My concern over the fed being private is more to do with the revolving door policy of government and financial heavyweights moving from board to board with apparently no conflict of interest, there is a lot of circumstancial evidence that these positions are abused to profit institutions that are not related to governments, Goldman Sachs has a fair bit of pull around the US government and has for some time. They are far from honest as the abacus scandal, Greek euro entry, etc has shown. I think Landesbank are suing them now over something similar.

I have done a bit of research into the fed and apart from the usual suspects listed on conspiracy sites I have been unable to determine who owns this bank. I'm also aware that they are resistant to audit and are currently in court with Bloomberg to get something done about this. This doesn't mean I think they are corrupt or have some kind of game plan to rule the world, it merely makes me suspicious. There is a line between inquisitiveness and outright accusation, I don't believe I have crossed it. I will keep reading and researching this because that's what I do. Who recieves the 6% dividend of the surplus before handing it to treasury? Just how much gold do they really have? Why can't we see? If these questions were answered I would lose interest, the fact that they are not and I would like them to be doesn't make me a crackpot. I apologise for coming on so strong about this but I am a new member and have been referred to the conspiracy theory section 5 times already. I have neither theorised nor stated any conspiracy. I have merely mentioned 'the usual suspects' in the course of my points. I sit squarely on the fence with most marginal things like bilderburg. I have seen nothing to confirm or deny any theories. Things like the 9/11 inside job and zionist dominance are frankly an insult to logic and I do not partake in their discussion.

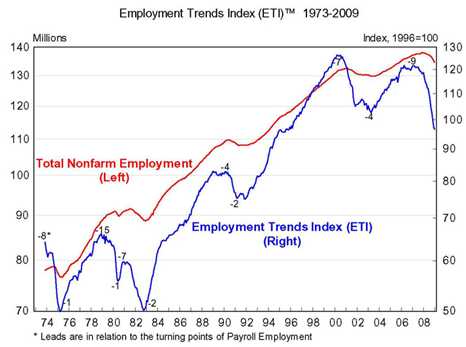

Just so you know, I skim read that article (mostly the quotes) about 5 minutes after watching zeitgeist. I am not a one track mind, while his taking apart of a lot of the quotes was masterful he failed (IMO) to take away any of their meaning or substance, a word here, a month there. These things were said by these people. The religious stuff I care not a jot about, as a fundamentalist atheist my only concern is the effect it can have on humanity and individuals. I think he might want to check some of his information with Richard Dawkins though, I read the god delusion some time ago and if I remember correctly he made quite a few of the same comparisons made in zeitgeist, this is not a man I would say is a conspiracy theorist, nor a lightweight academic. Some of the political and anti-semitism sources were enlightening and he indeed casts a lack of credibility over the film. The general thrust of the film is intact though in my view, the unsustainability of our current system and a need for monetary and societal reform. The fact it is so inflamatory and dumbed down is a reflection of the society we live in, it's target audience are the young and they are far from worldly wise these days.US jobs figures were down due to the ending of census work, private sector employment was up for the 9th month in a row but not by as much as had been expected. This sluggish growth combined with global factors has increased the chances of QE2, hence the increase in equities and commodities.

To turn it on its head, the figures were better before due to the census work, essentially seasonal jobs, not a good reflection on overall employment in the bigger picture. These figures are constantly revised downwards too so there is not much good news there. You are intelligent enough to know there are many ways to massage unemployment figures and they are widely employed, just look at the september figures here in Ireland, largely down because of the unemployed studying but sold as a positive sign of improvement, grossly misleading in my opinion.

These figures will increase the chance of QE2, this is a failed policy going double or quits and will ultimately lead to the dollar declining further, gold breaking free of manipulative shackles and will result in people losing the last threads of faith in this thoroughly debased currency, the rise in commodity prices is shocking (although not on the scale of 08 yet) and with pay likely to be frozen or even decreased, coupled with rampant unemployment then the stage is set for a perfect storm. In my opinion there is no way out. The dollar will lose all credibility.I'm sure you know what's going on here, China, Australia, Brazil, BOJ, BOE and the Fed are all trying to weaken their currencies to stimulate domestic employment. That does not equal the end of fiat currencies, though it probably means that holding gold is a good short term hedge until the situation is stabalised.

Agreed, but with all the bad news floating around and plenty more shocks to come this race to the bottom is the death throes of our very monetary belief system. We hear talk of a jobless recovery, a bump along the bottom, a v shaped, u shaped, w shaped recovery etc but there are NO signs of recovery I can see unless clutching at straws is going to become profitable.

This is before even entering into the realms of pension provisions, PFI initiatives, off balance SIVs, the securitization insurance products and the elephant in the room, peak (cheap) oil or its alternatives. Our system is just not sustainable and we are watching it fail. This is my belief. In a way I welcome it but I fear the stage of re-adjustment to whatever is next. My biggest concern is that the people we expect to get us out of this mess are the very ones who didn't see it coming. As El erian said, if they didn't see it coming, I don't think we should be listening, those that did are the ones we should be consulting.

Personally I started buying gold in 2007, we were about to open a family business with our savings and we junked it and bought some land and some gold. I've been buying it since with every spare cent, I also buy silver, platinum and palladium just in case we see recovery, (more demand as gold falls) this is purely for wealth protection. We also buy more non-perishable shopping than we need, just in case. It's going to take us a year to eat it all if nothing happens but with futures prices rising? It makes sense to me.

People laugh at me on forums when I say this, I was a boy scout once though and I never forgot the motto.

The one thing learning history has taught me is that I can learn from history, the future does not look rosy from where I'm sitting.

I'm not so stupid to believe I am right about all this though, it's my best uneducated guess, I'm open to new ideas. Do you see recovery? To take it back to the original posters question, will we see social unrest and chaos?

How will the dollar recover?0 -

Join Date:Posts: 13639

Sticky_Fingers wrote: »It is actually surprising how many people are unaware that the cash in their pockets has little to back it except other peoples belief that it is worth something. I'm sure that most think that there is physical wealth behind it like gold reserves or other assets instead of public confidence in the system.

As far as I'm aware China have been buying up any physical assets they can lay their hands on while it seems that the West is so far in debt to each other and countries like China that we are busy just keeping our heads above the water and can't afford to "buy" these assets.

But why would it be better if it was backed by some other physical item such as gold (paper is physical too). Gold is only worth what people believe it is worth too.

It's much better that the money is backed up by people's beliefs, misguided as they are. So all things being equal, it's better that the money in my pocket represents future goods and services than that it represents little pieces of shiny metal.0 -

TimeToShine wrote: »I'm in my first year of Economics and Finance so I'm a bit of an amateur, but I was just thinking.

Does anyone else think that at some stage in the foreseeable future people will realise that money is just...paper? Now I'm not expecting this to happen all at once, but I'd expect the "big" people such as the masterminds behind America and China to cop this and start spending all the money on cold hard goods, the public would pick up on this about 40 or 50 years later and civilisation as we know it would descend into chaos.

All wealth is just in the mind, in confidence. Take gold for example, a widely used store of wealth. Gold has very limited industrial applications and its main use is as a store of wealth. If people didn't believe it was worth something, it would be worthless. The more people that want gold to store their wealth the more valuable it becomes.

The economic system is a strange creation and fundamentally depends on the collective confidence of people.

On a more philosophical level it could be argued that the only valuable thing that exists is time, and you can't store that.0 -

johnnyskeleton wrote: »But why would it be better if it was backed by some other physical item such as gold (paper is physical too). Gold is only worth what people believe it is worth too.

It's much better that the money is backed up by people's beliefs, misguided as they are. So all things being equal, it's better that the money in my pocket represents future goods and services than that it represents little pieces of shiny metal.

Gold is a finite resource, all the gold mined would barely fill 3 swimming pools I believe. it is this scarcity that makes it valuable. Although gold can be debased, (filled with lead etc) it is much harder than the finite debasement of paper through inflation.

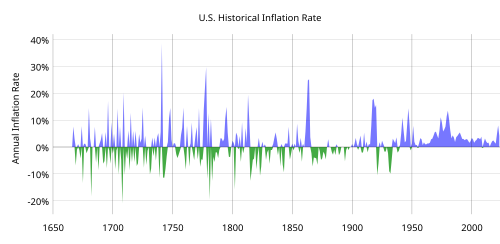

Remember, prices don't rise, inflation reduces the spending power of the money in your pocket. This is growth and as long as money is debt based (with interest payable on nearly all of it at production) then inflation must occur. We have now got to the point that the numbers are getting too big for us to comprehend. Check out this link.

http://www.pagetutor.com/trillion/index.html

What's next? Quadrillions, gazillions?0 -

Gold is a finite resource, all the gold mined would barely fill 3 swimming pools I believe. it is this scarcity that makes it valuable. Although gold can be debased, (filled with lead etc) it is much harder than the finite debasement of paper through inflation.

Remember, prices don't rise, inflation reduces the spending power of the money in your pocket. This is growth and as long as money is debt based (with interest payable on nearly all of it at production) then inflation must occur. We have now got to the point that the numbers are getting too big for us to comprehend. Check out this link.

http://www.pagetutor.com/trillion/index.html

What's next? Quadrillions, gazillions?

You're missing the point. Gold is only valuable because people place a value on it!0 -

Advertisement

-

oppenheimer1 wrote: »You're missing the point. Gold is only valuable because people place a value on it!

I understand that perfectly, I was merely pointing out WHY people place such value on it as opposed to paper currency.

Don't tell me that trillion dollar visual isn't cool though? Scary too!

I should add, I don't advocate a gold backed currency, I just believe that is what we are heading for. I couldn't care less. Just wish we could get on with it one way or another rather than prop up this current defunct approach.0 -

@scarab80

Printed the wiki entry on the fed last night for some bedtime reading, my that's a long wiki, maybe 40 pages. This made me laugh.Current functions of the Federal Reserve System include:[6][30]- To address the problem of banking panics

- To serve as the central bank for the United States

- To strike a balance between private interests of banks and the centralized responsibility of government

- To supervise and regulate banking institutions

- To protect the credit rights of consumers

- To manage the nation's money supply through monetary policy to achieve the sometimes-conflicting goals of

- To maintain the stability of the financial system and contain systemic risk in financial markets

- To provide financial services to depository institutions, the U.S. government, and foreign official institutions, including playing a major role in operating the nation's payments system

- To facilitate the exchange of payments among regions

- To respond to local liquidity needs

- To strengthen U.S. standing in the world economy

1. FAIL

2. OK

3. 50/50?

4. FAIL

5. FAIL

6a. FAIL

6b. FAIL

6c. FAIL

7. FAIL

8a & b. PASS

9. EPIC FAIL!

Not a good record really is it?0 -

Join Date:Posts: 13639

Gold is a finite resource,

There is a finite amount in the earth, but the amount that has been mined and refined grows on a daily basis. More than half of the total world's gold has been mined in the last 50 years.

But more importantly, more than half of all gold produced is used in jewelry and industry, so half of all gold produced each year is consumed rather than stored.all the gold mined would barely fill 3 swimming pools I believe.

There are approximately 150k tonnes or 4bn ounces of extracted gold in the world.

http://www.gold-eagle.com/editorials_05/zurbuchen011506.htmlit is this scarcity that makes it valuable.

Lots of things are scarce but that does not make them valuable. Things are only valuable if there is demand for them. The higher the demand relative to the supply increases the price, but this demand is not borne out of its scarcity.Although gold can be debased, (filled with lead etc) it is much harder than the finite debasement of paper through inflation.

Lets look at it another way then. Supposing we live in a world with the gold standard, and X amount of gold is a good represntation of Y amount of goods. Then a new good comes along which creates more wealth and makes our lives better. This creates Z wealth. We now have total gold of X for goods Y & Z, so unless we create more gold in the meantime, X will be be worth more goods for no reason other than we cannot easily increase the level of monetary tokens.

However, if Z doesn't create more wealth but in fact lets us make Y goods for less, then X is debased because X represents Y - Z.

Also, each year M amount of extra gold is mined, so even if there is no increase in goods, X + M = Y, so gold is further debased.

Gold's price can go up as well as down, and what gold affictionadoes don't realise is that gold itself is a good. It can be used as an effective currency because it is an easy good to trade, but the problem lies in that the economy does not have a stable level of production or demand.

So while inflation can eat away at the purchasing power of paper money due to overprinting, this is a political decision rather than an automatic consequence. An economy that got the balance right and only printed more money to reflect actual new wealth would be doing well.Remember, prices don't rise,

What, never?inflation reduces the spending power of the money in your pocket.

And deflation increases it.This is growth

No its not, growth and inflation are different. It may appear like nominal growth, but it is not real growth.and as long as money is debt based (with interest payable on nearly all of it at production) then inflation must occur

I'm sorry, I don't get this. You mean money created through banking? That doesn't mean it is debt based. But also, it doesn't mean that inflation must occur, so long as the amount of money created is proportionate to the amount of additional wealth in the country.We have now got to the point that the numbers are getting too big for us to comprehend.

So your point is that because you can't comprehend the level of money in the world that we should all go back to the gold standard?Check out this link.

http://www.pagetutor.com/trillion/index.html

What's next? Quadrillions, gazillions?

That's been around for a while. But comparing a trillion dollars to an individual is a bit of a nonsense. For example, if you were to compare one individual to €1tn worth of goods produced, you would get an even bigger scale. Compare 1 individual to 3,000 F16s and the imagery would be just as stark.0 -

johnnyskeleton wrote: »There is a finite amount in the earth, but the amount that has been mined and refined grows on a daily basis. More than half of the total world's gold has been mined in the last 50 years.

This is not true, since 2003 gold production has been in decline, many mines have taken the easy stuff and have gone from getting 12g per ton to 3g per ton. Many say peak gold has come, for sure as in oil, peak (cheap) production has been reached. It is similar to drilling 2km underwater for oil, or digging out tar pits. It's there but the production costs are much higher. Please check your figures, world gold council is a good start.

Gold is not consumed, this is an idiotic statement. What do you think is happening at the moment with all the 'we buy your gold' ads. They buy it at half value, pay for it to be refined back to bullion and make a handsome profit. It has NOT been consumed. It might be sitting in a jewellery box or round someone’s neck but it's not going anywhere. Nearly all of the gold ever mined can be accounted for. Losses are negligible. Some is in space, granted, but in tiny amounts.But more importantly, more than half of all gold produced is used in jewelry and industry, so half of all gold produced each year is consumed rather than stored.

You’re point?There are approximately 150k tonnes or 4bn ounces of extracted gold in the world.

http://www.gold-eagle.com/editorials_05/zurbuchen011506.html

There is around 161,000 tons mined to date.

First, 161,000 Tons translates to 160,227,200,000 grams.

We know that the density of gold is 19.3 g/cm3.

(160,227,200,000 / 19.3) = 8,301,927,461.14 cm3

Doing some maths, we translate the cm3 to ft3. One cubed foot is 28,316.8466cubed centimeters.

(8,301,927,461.14 / 28,316.8466 = 293,179.8 ft3)

An Olympic-sized pool has a volume of 88,000 ft3. So...

293,179.8 / 88,000 = 3.3315 Olympic Pools.

There is less than 1 ounce (troy) of gold on earth for each person, about 24 grams each at todays world population. Also, I would suggest when questioning a figure you should stick to the unit of measurement used.e.g. volume not weight.

Partially, yes it is. Platinum is scarcer and demands a higher price but gold is much harder to fake due to its density and colour, platinum, silver and palladium are faked by using alloys, gold is much harder to counterfeit.Lots of things are scarce but that does not make them valuable. Things are only valuable if there is demand for them. The higher the demand relative to the supply increases the price, but this demand is not borne out of its scarcity.

As for demand. Scarcity brings its own demand, find me a penny black stamp with a mis-print and I'll find you a buyer willing to pay a fortune for it. I'm sure there are plenty examples of scarce things that are not of value but provenance and history make gold intrinsically worth holding.

The basic flaw in this argument is the lack of this new good you speak of. What is it? An Ipad? Not being a materialistic man I’m afraid my expenditure goes mainly on food, shelter etc so this new good would have no effect on my needs whatsoever.Lets look at it another way then. Supposing we live in a world with the gold standard, and X amount of gold is a good represntation of Y amount of goods. Then a new good comes along which creates more wealth and makes our lives better. This creates Z wealth. We now have total gold of X for goods Y & Z, so unless we create more gold in the meantime, X will be be worth more goods for no reason other than we cannot easily increase the level of monetary tokens.

However, if Z doesn't create more wealth but in fact lets us make Y goods for less, then X is debased because X represents Y - Z.

Also, each year M amount of extra gold is mined, so even if there is no increase in goods, X + M = Y, so gold is further debased.

I’m afraid I got distracted at the ‘ what gold affectionadoes don’t realise’ statement. Just what are you inferring? Do you think people don’t do due diligence on investments? Who said I was an affectionado? I hold gold because I am worried we are heading into a financial meltdown and my judgement is that I’d rather exchange my gold for the next currency than my euros. To be frank, I got most of my gold for free, open a forex account, deposit money, buy gold against the dollar and wait for a price rise, I bet on 1380 on Friday but it didn’t make it that far, still, sell for paper profit, withdraw, spend on (cheap) gold in euro. Simplez. What was it you were saying I don’t realise?Gold's price can go up as well as down, and what gold affictionadoes don't realise is that gold itself is a good. It can be used as an effective currency because it is an easy good to trade, but the problem lies in that the economy does not have a stable level of production or demand.

So while inflation can eat away at the purchasing power of paper money due to overprinting, this is a political decision rather than an automatic consequence. An economy that got the balance right and only printed more money to reflect actual new wealth would be doing well.

As to the wonder economy who got the balance right. Please provide an example. Trichet will be warming up the presses now the euro is too strong. Mark my words.

There are exceptions that prove the rule.What, never?

Well yes, I assumed people would understand the basic theory of opposites.And deflation increases it.

And that is what we are seeing now around the world. Would you say the celtic tiger was real growth? We’ll see when it is fully corrected.No its not, growth and inflation are different. It may appear like nominal growth, but it is not real growth.

Nearly all money is created with interest on top, that’s why we have to have growth. If all debt was repayed there would be no money in circulation, this is of course impossible because of the interest. Why does the ecb have a target inflation rate of 2%?I'm sorry, I don't get this. You mean money created through banking? That doesn't mean it is debt based. But also, it doesn't mean that inflation must occur, so long as the amount of money created is proportionate to the amount of additional wealth in the country.

No, if you bothered to read my posts I believe I have been quite clear. I DO NOT ADVOCATE A RETURN TO A GOLD BACKED CURRENCY! I just believe that is what we will get. I believe I said this before more than once. I also said us, not I, so turning it into me not understanding is a cheap shot. No, I don’t believe the majority of the population of this planet can truly comprehend the amounts of money flying around. €4 trillion every 3 days traded on forex markets alone. Most don’t know what a cdo is, most don’t know what M1 money is, most have never heard of libor or vix etc. Go and ask ten random people tomorrow to explain compound interest (pretty basic) and see how you get on. Most take money for granted.So your point is that because you can't comprehend the level of money in the world that we should all go back to the gold standard?

I fail to see your point. ‘That’s been around for a while’ proves what? Pythagoras theorem isn’t a spring chicken either.That's been around for a while. But comparing a trillion dollars to an individual is a bit of a nonsense. For example, if you were to compare one individual to €1tn worth of goods produced, you would get an even bigger scale. Compare 1 individual to 3,000 F16s and the imagery would be just as stark.

It is meant only as a representation of how big that number is. In that sense it does its job quite admirably.

Now, I’ll state my position again.

I hold precious metals and land because I am worried due to the calamitous state of global commerce and the perilous state of currencies. I do not advocate a gold standard I am merely protecting myself and my family from the ravages of what I believe is about to come. History has proven gold to be the best thing to have in these situations and I trust history.

I believe the OP asked for thoughts on this. I’ve provided mine and people seem to take this as an opportunity to debate it. Fair enough but how about you answer the original question, give your point of view instead of just trying to take mine to pieces, (poorly I might add).0 -

The-Rigger wrote: »lol.

What a tit.

your entitled to your opinion mate, and he is entitled to do whatever he wants to do; just remember, there are no shops in the graveyard...0 -

Advertisement

-

They can't predict a collapse, they are essentially diplomats, their language is cautious but they are being as extreme as decency allows. Every one of them questions the feds handling of the situation. It hasn't changed the actions of the fed, therefore if this current fiscal policy is adhered to then ultimately it will lead to what they say, the end of the dollar as reserve currency. To me that is a collapse in faith of a fiat currency, the ramifications of this would be catastrophic. I concede you the point that they are not specifically stating utter collapse but I believe I said there were lines to be read between.

I would question the feds current course of action aswell, US banks are currently sitting on 1 Trn in excess reserves due to QE1. The fact that they are not lending is less a monetary issue and more to do with a general atmosphere of risk aversion. Unfortunately this is human nature, however as history has shown us this risk aversion will end and growth will begin again. The fed are just trying to speed up this transition. Inflation in the US is currently running at just above 1%, when these excess reserves are finally put to use the fed can intervene once again by contracting the money supply and helping holders of the dollar.

Why do you see the end of the dollar as global reserve currency as catastrophic, personally I think a basket currency basis for global reserve would be much healthier for both the US and global economies in the long run.I detest being labelled a conspiracy theorist, NWO and the jewish zionists etc are nothing but populist tripe, however, I do read about the Bilderberg group, because they are real and don't publish minutes. I find this somewhat suspicious but I don't believe they run the world. This is not theory, they exist and I'm of an inquisitive nature, this does not mean I can be tarred with the large brush that is wielded here. Nobody can argue humanity hasn't got a dark side and history has shown us many examples of abuse of power by our elected officials, (I won't insult your intelligence by providing links), a degree of mistrust is a good thing IMO.

I apologise for the presumption.My concern over the fed being private is more to do with the revolving door policy of government and financial heavyweights moving from board to board with apparently no conflict of interest, there is a lot of circumstancial evidence that these positions are abused to profit institutions that are not related to governments, Goldman Sachs has a fair bit of pull around the US government and has for some time. They are far from honest as the abacus scandal, Greek euro entry, etc has shown. I think Landesbank are suing them now over something similar.

Indeed GS are probably recognised as the closest thing to an embodiment of pure evil these days. However the Feb BOG are political appointees and who they are is a matter for the president and by extension the American people.I have done a bit of research into the fed and apart from the usual suspects listed on conspiracy sites I have been unable to determine who owns this bank. I'm also aware that they are resistant to audit and are currently in court with Bloomberg to get something done about this.

The fed district banks are owned by the banks in their district, they are not controlled by these banks though. All district banks and the board of governors are subject to full audit by independent accounting firms. There are some dispensations from regular auditing practice in order to preserve the independence of the fed from political interference.Who recieves the 6% dividend of the surplus before handing it to treasury?

The banks receive it as a return for the fed holding their capital reserves, probably seems high at the moment given current interest rates however remember that this rate is set in legislation and does not float with the fed rate.Just how much gold do they really have? Why can't we see?

You can see, $11bn..... http://www.federalreserve.gov/boarddocs/rptcongress/annual09/sec6/c3.htm

You are probably thinking about the gold held in Manhattan at the Fed offices. This is not their gold, it is held in trust mainly on behalf of foreign nations and Swiss banks (who do not report their gold holdings)To turn it on its head, the figures were better before due to the census work, essentially seasonal jobs, not a good reflection on overall employment in the bigger picture. These figures are constantly revised downwards too so there is not much good news there. You are intelligent enough to know there are many ways to massage unemployment figures and they are widely employed, just look at the september figures here in Ireland, largely down because of the unemployed studying but sold as a positive sign of improvement, grossly misleading in my opinion.

And the market is intelligent enough to know to look into these figures, you will see that they did not react to the inclusion of census figures, but instead base their decisions on the long term employment figures. Unfortunately in Ireland there is not the same public analysis of government figures that is carried out in the US.These figures will increase the chance of QE2, this is a failed policy going double or quits and will ultimately lead to the dollar declining further, gold breaking free of manipulative shackles and will result in people losing the last threads of faith in this thoroughly debased currency, the rise in commodity prices is shocking (although not on the scale of 08 yet) and with pay likely to be frozen or even decreased, coupled with rampant unemployment then the stage is set for a perfect storm. In my opinion there is no way out. The dollar will lose all credibility.

Commodities are a temporary store of wealth, which during periods of expected inflation rise beyond their real value, but will return to mean once economies return to normal. See oil in 2008, from $70/$80 up to $150 down to $30 and back to $70/$80. Currencies rise and fall, see the yen, however a complete collapse of a currency requires one of two things - an unmanangeable amount of foreign denominated debt or an inability to use the currency to purchase necessary imports. The US and the dollar faces neither of these problems as US debt is dollar denominated and the US is still one of the most prosperous countries in the world and more than able to purchase imports, moreover most of these imports are themselves denominated in dollars.Agreed, but with all the bad news floating around and plenty more shocks to come this race to the bottom is the death throes of our very monetary belief system. We hear talk of a jobless recovery, a bump along the bottom, a v shaped, u shaped, w shaped recovery etc but there are NO signs of recovery I can see unless clutching at straws is going to become profitable.

US GDP up between 2% and 3%, DowJones up 65% from it's trough, Unemployment down 0.5% from it's peak in Oct 2010. What more do you want to see?, it's not a stunning recovery but a long way from the collapse of the dollar.This is before even entering into the realms of pension provisions, PFI initiatives, off balance SIVs, the securitization insurance products and the elephant in the room, peak (cheap) oil or its alternatives. Our system is just not sustainable and we are watching it fail. This is my belief. In a way I welcome it but I fear the stage of re-adjustment to whatever is next. My biggest concern is that the people we expect to get us out of this mess are the very ones who didn't see it coming. As El erian said, if they didn't see it coming, I don't think we should be listening, those that did are the ones we should be consulting.

Hey we could be looking at fusion power within 50 years, what kind of a world will we be living in then. Add to that advances in genetic engineering and it's possible we have only begun to exploit the biological capacity of the planet.Personally I started buying gold in 2007, we were about to open a family business with our savings and we junked it and bought some land and some gold. I've been buying it since with every spare cent, I also buy silver, platinum and palladium just in case we see recovery, (more demand as gold falls) this is purely for wealth protection. We also buy more non-perishable shopping than we need, just in case. It's going to take us a year to eat it all if nothing happens but with futures prices rising? It makes sense to me.

People laugh at me on forums when I say this, I was a boy scout once though and I never forgot the motto.

I'm sorry you feel so pessimistic about the future of mankind, but life is for living and you should go out and live it instead of worrying about the holocaust around the corner that may never come. Human development has been inexorably and exponentially upwards since the neolithic revolution 10,000 years ago - absenting a period of religious irrationality in the 1st century - and there is no reason to think it is going to stop now. Be prepared by all means but don't forget to live your life.The one thing learning history has taught me is that I can learn from history, the future does not look rosy from where I'm sitting.

I'm not so stupid to believe I am right about all this though, it's my best uneducated guess, I'm open to new ideas. Do you see recovery? To take it back to the original posters question, will we see social unrest and chaos?

How will the dollar recover?

The dollar will recover the way it has always recovered, through US innovation and exports, helped by a weaker dollar.0 -

@scarab80

Printed the wiki entry on the fed last night for some bedtime reading, my that's a long wiki, maybe 40 pages. This made me laugh.

1. FAIL

2. OK

3. 50/50?

4. FAIL

5. FAIL

6a. FAIL

6b. FAIL

6c. FAIL

7. FAIL

8a & b. PASS

9. EPIC FAIL!

Not a good record really is it?

The Fed has presided over the most stable and sustained growth period in the history of the US.

0

0 -

I don't think I should bother showing up for my lectures tomorrow, I'll just stay and read this

0

0 -

The Fed has presided over the most stable and sustained growth period in the history of the US.

Correlation is not causation.TimeToShine wrote: »I don't think I should bother showing up for my lectures tomorrow, I'll just stay and read this

See above stats101 in one sentence

stats101 in one sentence  0

0 -

Lads, get out the DVD of "The Field". Sit back and enjoy a powerhouse performance by Richard Harris as the Bull McCabe. Study the ferocious maniac love of the "land".

Go out the next day of you have money to invest, and buy as much as you can.

Sure twill always be there, and no robbing, thieving, currency manipulating, dickhead, on a computer screen in the Fed, or the ECB, or some hedge fund can take it from you.

"Yearra, will you look at it Tadgh. My fathers, fathers, fathers, father took care of it. And your sons, sons, sons, sons son will take care of it too boy".

Quote from the bull McCabe.0 -

-

You're probably right, it's all just a big coincidence, we should go back to the gold standard.

I am not advocating going back to gold, I have many times illustrated my scepticism for gold and its current bubble.

There was alot more happening in all these countries during the 20th century...

..and how do you explain the large rises in economies during the 1946-1971 period under the Bretton Woods system where major currencies where pegged to the dollar which was fixed to gold in turn.0 -

Been a bit busy to reply, I will later.

For now some interesting reading. QE2 anyone?

http://ftalphaville.ft.com/blog/2010/10/12/367366/the-qe2-passenger-list/

I understand he is a politician so big tub of salt required but...

http://news.bbc.co.uk/2/hi/programmes/newsnight/9079654.stm0 -

I don't mean to be personal but when I see the whole "the Fed is privately owned" nonsense it smacks of CT. It is a blatant misrepresentation of the truth, while the federal reserve banks are private institutions they are controlled by the board of governors which is publicly appointed with all surplus fed funds remitted to the US Treasury.

The Fed is not unlike a Quango then or a semi-state like FAS?

"Surplus FED Funds" is a euphemism for what?0 -

I am not advocating going back to gold, I have many times illustrated my scepticism for gold and its current bubble.

There was alot more happening in all these countries during the 20th century...

..and how do you explain the large rises in economies during the 1946-1971 period under the Bretton Woods system where major currencies where pegged to the dollar which was fixed to gold in turn.

I'm saying that in a fixed monetary system economies tend to go boom to bust a lot more than one where the money supply is controlled. During the great depression the economy found an equilibrium point with under production and high unemployment. An exit from the gold standard clearly helped economies to grow. Now you don't want a fixed monetary system linked to gold (by the way gold is a possible bubble because money is no longer linked to it, if we still had a gold standard we would not see this spike in gold as people would already be holding it) and you don't seem to favour a managed monetary policy, what do you advocate?

Of course economic growth is not solely a function of monetary policy, technological advances are a much greater driver however I believe a managed monetary policy provides a stable environment in which this growth can take place and can help to reduce periods of over and under investment in the markets.

In relation to Bretton Woods, there was a booming American economy after the war and devestation in Europe. I believe the Marshall plan helped to address the imbalances between these 2 economies, the equivalent of increased rates in the US and decreased rates in Europe. The system managed to tick along for a while after that but eventually had to be abandoned when changes in the real economies no longer fit the fixed system.0 -

Advertisement

-

I've watched this thread for a while with interest. First a linky, it's a short and easy to essay by Alan Greenspan in 1966 espousing gold

http://www.constitution.org/mon/greenspan_gold.htm

Many of the points are prescient today. Restriction of credit, restriction of deficits, protection of wealth.

Abandonment of the gold standard requires stricter and more responsible fiscal regulation. An easy way to judge this is currency value, how many Lira to the Deutsch-mark where there?

The introduction of the Euro without fiscal union will come to be seen as The Germans giving us enough rope to hang ourselves with. By the time this has played out I am pretty sure we will have fiscal union, we should be pressing for full union.

There will be ructions as we have to give up our 12.5% corpo tax, but out national debt will be subsumed into the EU national debt, the public service will be paid for by Bonn, and road, schools and hospitals will be to the EU standard, not so that shabby, probably better then is likely now.

With the US, UK and Japan trying to devalue their currencies and the Germans refusing to do the same, it's not unlikely that the Euro will be the reserve currency of the future and we'll all be rich!

That...or the whole thing falls apart and we revert to agriculture :pac:0 -

szjon, the same ignorant arrogance of the banker is often displayed on this forum; amazing how it endures, even as the begging bowl is held out.0

-

I would question the feds current course of action aswell, US banks are currently sitting on 1 Trn in excess reserves due to QE1. The fact that they are not lending is less a monetary issue and more to do with a general atmosphere of risk aversion. Unfortunately this is human nature, however as history has shown us this risk aversion will end and growth will begin again. The fed are just trying to speed up this transition. Inflation in the US is currently running at just above 1%, when these excess reserves are finally put to use the fed can intervene once again by contracting the money supply and helping holders of the dollar.

OK, so explain T.A.R.P. If these troubled assets were taken from the banks to the feds balance sheet why are they risk averse? With no troubled assets the banks are free to take risks? How is the fed going to treat the losses from these troubled assets? Is it not that there is a whole shed load of troubled assets still out there? Namely every mortgage granted in the last 10 - 20 years? This mortgage scandal is starting to get interesting, financials down 5%ish last night on the news of full investigation. Lawsuits flying around like confetti and people repossesing their repossesed homes from the banks while the police look on.

Of course, the holders of the securitised products made up of mortgages are the second wave of trouble, then the insurers of said products.

I don't believe inflation figures, even if I did the 30 odd percent rise in soft commodities over the last few months is in the pipeline, currently knocking on to producers, then vendors, finally will be sitting in the lap of the people in the months to come.

As for mopping up the excess liquidity, why do you trust them to get this right? the reverse repo is in place and has been tested but in tiny amounts and the timing here is crucial, they are going to overun and the effects of mopping up will be as bad as slipping on the spill in the first place. IMHO

Stability on a global scale would become extinct. massive volatility worldwide = recipe for disaster.Why do you see the end of the dollar as global reserve currency as catastrophic,

Agree, this would make more sense but hard to wean the US off the power trip.personally I think a basket currency basis for global reserve would be much healthier for both the US and global economies in the long run.

no need, I see where you are coming from but thanks.I apologise for the presumption.

They get what they deserve. This is what fuels conspiracy theories. it is at least corrupt, human nature dictates this.Indeed GS are probably recognised as the closest thing to an embodiment of pure evil these days. However the Feb BOG are political appointees and who they are is a matter for the president and by extension the American people.

I'm afraid I have to leave it here on fed funding and ownership. I can't say I have managed to figure it out yet. Very complex, convoluted system and conflicting information and evidence that many more before have tried to quantify. Needs more time. Bowing out of this one.The fed district banks are owned by the banks in their district, they are not controlled by these banks though. All district banks and the board of governors are subject to full audit by independent accounting firms. There are some dispensations from regular auditing practice in order to preserve the independence of the fed from political interference.

A guarenteed 6% return on the safest bet, US government backed money. That is high by ANY time or standard.The banks receive it as a return for the fed holding their capital reserves, probably seems high at the moment given current interest rates however remember that this rate is set in legislation and does not float with the fed rate.

I was under the impression that the fed could only be audited partially due to maintaining its independence. Recent history can also tell us we can not trust auditors to give us a clear picture. just look at Anglo irish. Again, I am short on knowledge here, will have to read more.You can see, $11bn..... http://www.federalreserve.gov/boarddocs/rptcongress/annual09/sec6/c3.htm

You are probably thinking about the gold held in Manhattan at the Fed offices. This is not their gold, it is held in trust mainly on behalf of foreign nations and Swiss banks (who do not report their gold holdings)

The markets detached from reality a long time ago, no longer used for what they were designed for, investing in companies. Markets are not rational and anything they predict has been overshadowed by the complete lack of predicting this mess we are now in. Just look at the number of 'surprise' rises and 'unexpected' falls in the last few years.And the market is intelligent enough to know to look into these figures, you will see that they did not react to the inclusion of census figures, but instead base their decisions on the long term employment figures. Unfortunately in Ireland there is not the same public analysis of government figures that is carried out in the US.

I think this purely monetary viewpoint is where the argument collapses, I will elaborate further at the end, you completely ignore the social/political implications. ie. Confidence.Commodities are a temporary store of wealth, which during periods of expected inflation rise beyond their real value, but will return to mean once economies return to normal. See oil in 2008, from $70/$80 up to $150 down to $30 and back to $70/$80. Currencies rise and fall, see the yen, however a complete collapse of a currency requires one of two things - an unmanangeable amount of foreign denominated debt or an inability to use the currency to purchase necessary imports. The US and the dollar faces neither of these problems as US debt is dollar denominated and the US is still one of the most prosperous countries in the world and more than able to purchase imports, moreover most of these imports are themselves denominated in dollars.

This is nothing more than a dead cat bounce, BIG, VERY DEAD cat = BIG bounce. On a scale we have never seen caused by a massive growth in the supply of cheap money.US GDP up between 2% and 3%, DowJones up 65% from it's trough, Unemployment down 0.5% from it's peak in Oct 2010. What more do you want to see?, it's not a stunning recovery but a long way from the collapse of the dollar.

.Hey we could be looking at fusion power within 50 years, what kind of a world will we be living in then. Add to that advances in genetic engineering and it's possible we have only begun to exploit the biological capacity of the planet

We could also be looking at a collapse of civilisation as we know it due to the lack of energy. these advances are not guarenteed and are subject to us having a limitless, cheap supply of energy to be able to make them happen. (Something no-one can guarantee) Peak oil is not about running out but the implications of a drastic rise in price leaving us unable to finance these alternatives, how do you build a nuclear reactor without oil? How do you fertilise, transport crops? How do you store things? Plastics etc. The implications of peak oil go far beyond the supply of energy. Also, if oil hasn't run out by the time we get round to coming up with these advances, prices will have risen due to the massive escalating costs of production. how much will a reactor cost with oil at $200 a barrel? What effect would it have on economies if it cost more to produce the plastic bottle than the product inside it. Peak oil is real, we have been living on a fossil fuel overdraft since before the industrial revolution.

You conveniently skipped over quite a few mass culls of the populus in that statement and you know it. It has happened before and will again. Preparing for the unknowns of the future is not pessimism it is pragmatism. I hope to protect my childrens future by enjoying a lower standard of living myself. This is something the last generation lost sight of, spending their futures and their childrens futures to have lots of chinese tat and go travelling. Keeping up with the joneses has taken us to this level of discontent and upcoming social unrest. Guess what, people like my kids will be the joneses of the future. My life is lived, I have children, everything I do now is to secure their future. if that means I don't upgrade my phone so be it. If that means I don't need all those lovely 'can't do withouts' then so be it. I've never been to Thailand, what have I lost?I'm sorry you feel so pessimistic about the future of mankind, but life is for living and you should go out and live it instead of worrying about the holocaust around the corner that may never come. Human development has been inexorably and exponentially upwards since the neolithic revolution 10,000 years ago - absenting a period of religious irrationality in the 1st century - and there is no reason to think it is going to stop now. Be prepared by all means but don't forget to live your life.

People have lost sight of the fact that life is for living, consumption is not living. Allowing kids to borrow to go to uni just shows the greed and selfishness of the parents. My kids will be paid from my responsibility.

I stand to lose €50 if this is true. i have a 3 year old bet on dollar collapse within 10 years, that gives me till 2017. personally I don't see it.The dollar will recover the way it has always recovered, through US innovation and exports, helped by a weaker dollar.

This brings me to the social/political aspect, largely ignored by defenders of the current system.

1. The tea party. Not to be ignored political change in America.

2. Waves of strikes across Europe. Not seen on this scale in a long time.

3. Massive anger at political and financial establishments. Worldwide.

4. China's ascendance to global super-power.

5. The decline of America, consumed itself to death.

6. Unknowns - those terrorists have been quiet for a while, calm before the storm?

7. Russia, Putin is waiting in the wings for what? Absolute power in Russia has been concentrated to a few. Will they turn off the gas again this year?

8. Iran. Israel will most likely attack the reactor if it succesfully brought on line. Stuxnet was a warm up. They did it in Iraq. how will such middle-east volatility help the recovery? Iran is presiding over OPEC now too.

9. Dollar confidence. Plummetting by the day. How long before suppliers won't want it?

10. European union. Can Germany keep us all afloat while its exports are getting too expensive?

That's just a few. The monetary arguments are well and good but without the socio/political situation they are pointless IMO. We have as a populace enjoyed a standard of living at levels we cannot maintain, this is the reckoning. Monetary policies are not going to get us out of this one in my opinion. you can't just replace all the future capital that has already been spent. On assets that are depreciating or were over valued to begin with. just look at the quality of housing built in the last 20 years in Ireland, people have paid massive amounts for houses you could knock down in a day with a hammer. good for 50 - 100 years if we're lucky.0 -

Another aspect of all this is the US attitude to it all. America is the only military hyperpower and has a National Security Strategy that says that it's military might will be used to protect it's pre-eminence in the world. This is quite possibly what will sustain the dollar in the face of other challenges.0

-

Another aspect of all this is the US attitude to it all. America is the only military hyperpower and has a National Security Strategy that says that it's military might will be used to protect it's pre-eminence in the world. This is quite possibly what will sustain the dollar in the face of other challenges.

This is my real concern, history shows the decline of empires are never pretty, America could have some spectacular death throes before it gives up its 'rightful' place in the world.

They won't go down easy, I know this as I used to 'date' an american girl.;)0 -

I thought China had surpassed America or was that just a load of public Bullshít?0

Advertisement