Advertisement

Help Keep Boards Alive. Support us by going ad free today. See here: https://subscriptions.boards.ie/.

https://www.boards.ie/group/1878-subscribers-forum

Private Group for paid up members of Boards.ie. Join the club.

Private Group for paid up members of Boards.ie. Join the club.

Hi all, please see this major site announcement: https://www.boards.ie/discussion/2058427594/boards-ie-2026

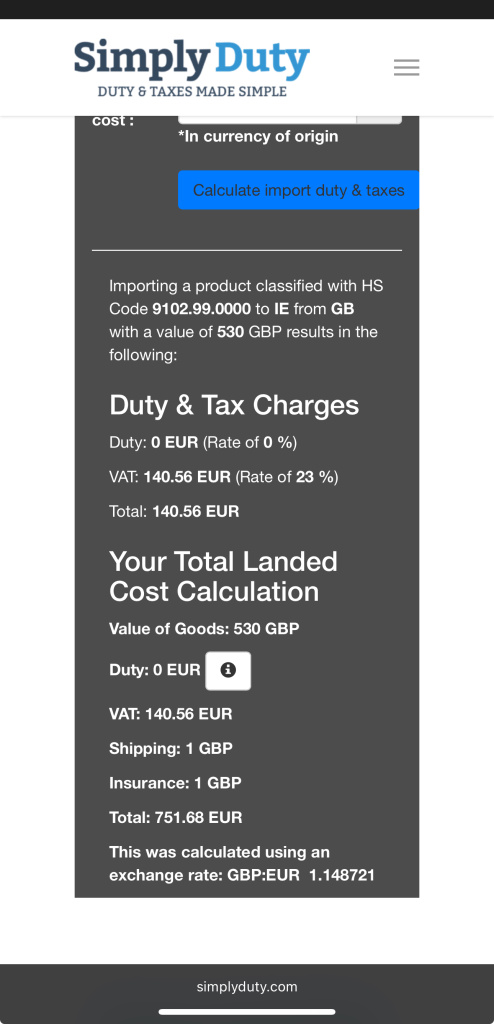

% rate Custom Import duties from UK

-

06-08-2025 08:18PM#1

Comments

Advertisement