Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi all! We have been experiencing an issue on site where threads have been missing the latest postings. The platform host Vanilla are working on this issue. A workaround that has been used by some is to navigate back from 1 to 10+ pages to re-sync the thread and this will then show the latest posts. Thanks, Mike.

Hi there,

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

There is an issue with role permissions that is being worked on at the moment.

If you are having trouble with access or permissions on regional forums please post here to get access: https://www.boards.ie/discussion/2058365403/you-do-not-have-permission-for-that#latest

Should Ireland Leave the EU?

Comments

-

But the argument you're making - apparently against what I've said - doesn't seem to have anything to do with what I've said. We seem to be on to "central planners", whoever they're supposed to be - what next, the argument that "fiat currencies" are invariably doomed, or that Goldman Sachs controls the whole thing anyway?

As far as I can see, you believe that things are going to get much worse - which is, as I pointed out, a projection - but you seem to be arguing that one cannot believe that things aren't getting much worse because any argument that claims that relies on...projections.

So it seems to me that you don't have any real issue with projections as such - despite putting it that way - but rather with projections that don't agree with your view of where things are going. The difference is hardly subtle.

cordially,

Scofflaw

Give me strength!

How many times do I have to explain this to you?

I am not using projections, but observations.

I am not saying that things are going to get much worse, I am saying they have gotten worse recently based on the data. I am looking in the rear view mirror, if you like...not through the windscreen.

(I do happen to believe that things will continue to get worse, but thats besides the point).0 -

Give me strength!

How many times do I have to explain this to you?

I am not using projections, but observations.

But using only observations, one can form no views about the likely future course of the crisis - unless one uses them to make projections. On the other hand, if you're claiming that using observations leads one to conclude that the depth of the problems is much greater than first officially believed, then I'd obviously agree. Stating that that's a deterioration begs the question - relative to what? Because if it's relative to where official claims should have the situation, then, again, that's hardly something I'd disagree with.

I don't think, though, that you're claiming those things - I think you're claiming that the situation is actually getting worse (that is, actively disimproving rather than more of it coming into view as it unfolds), and, more importantly, that it will continue to do so, presumably to some kind of point of failure. And that seems to me to be a matter of projection.

Edit: caught up with your edit there. I think we're arguing over whether more of the crisis has unfolded, or whether it has really become worse. My view is the former, yours is the latter, yes? I'm not sure how projections are relevant, though.

cordially,

Scofflaw0 -

But using only observations, one can form no views about the likely future course of the crisis

Correct...observations tell you what has happened...not what will happen.

You can take a point, lets say, 6 months ago and compare it, say, with the most recent data and arrive at a conclusion about the two "snapshots"...which can broadly be better, worse or the same. I am arguing that the situation is worse now than it has recently been.On the other hand, if you're claiming that using observations leads one to conclude that the depth of the problems is much greater than first officially believed, then I'd obviously agree. Stating that that's a deterioration begs the question - relative to what?

Not that the crisis is greater than officially believed (though clearly it is) but (to use your word) that the situation is disimproving based on recent data.

Relative to...before. Take any starting point you like as your baseline.

FYI, I am specifically thinking about the last few quarters as the baseline...but clearly, you could argue that we are in worse shape than the period around the Lehman blowup...we just haven't had the fireworks go off yet, but they are primed and ready to blow.

I think the situation has deteriorated in terms of debt loads and costs, wages, unemployment, GDP growth etc. They are all ticking in the wrong direction based on the latest data.Because if it's relative to where official claims should have the situation, then, again, that's hardly something I'd disagree with.

Ok.I don't think, though, that you're claiming those things - I think you're claiming that the situation is actually getting worse (that is, actively disimproving rather than more of it coming into view as it unfolds),

I am claiming that it has gotten worse based in the data.and, more importantly, that it will continue to do so,

This seems like a relatively safe bet to me...but I could be wrong and wouldn't bet the farm on it.

There is a lot of bad news yet to come from the banking system and a lot of debts that need to be rolled over in banks and sovereigns. I am not sure how this can be accomplished in a sustainable way.presumably to some kind of point of failure. And that seems to me to be a matter of projection.

Some point of failure? A failure of what? Currency union in its current form? No idea about that one. Ask Germany.

This would be a projection, as it hasn't happened yet.0 -

There is no mechanism by which the EU can take powers from the Member States that the Member States do not give to it. Even where the ECJ rules that a power granted to the EU by the Member States in a treaty implies or requires that the EU exercise another power, reversal of the ruling only requires a clarification be inserted into the next Treaty.

So if, as a result of this crisis, the Member States (or the eurozone ones) decide to use the EU as a forum for jointly making economic decisions, that's what will happen - and if not, not. The EU cannot make it happen, because the EU doesn't write the EU Treaties.

Really, there's no excuse for this kind of ignorance of the basic legal processes of the EU.

regards,

Scofflaw

You are right technically, my point wasn't about the legal processes, but about the desire of the EU to want to take more and more powers away from the member states, and about the way the EU tries to prevent those member states having a democratic vote, as they know that many, if not most, people across the EU don't want that.

They will use any tools to take powers away from the member states, even if those tools are undemocratic. They are politicians, after all! And I bet this time wil lbe no different, and they will end up brow-beating us all, and forcing us to hand over tax and fiscal powers to the EU, and away from the member states. I'll bet anyone that they will use the crises they have created to try to do just that.0 -

You are right technically, my point wasn't about the legal processes, but about the desire of the EU to want to take more and more powers away from the member states, and about the way the EU tries to prevent those member states having a democratic vote, as they know that many, if not most, people across the EU don't want that.

They will use any tools to take powers away from the member states, even if those tools are undemocratic. They are politicians, after all! And I bet this time wil lbe no different, and they will end up brow-beating us all, and forcing us to hand over tax and fiscal powers to the EU, and away from the member states. I'll bet anyone that they will use the crises they have created to try to do just that.

We seem to be well over the boundary of conspiracy theories here - the EU "created" the crises? And "the EU" prevents countries operating according to their own internal rules about democracy? "They" are politicians? "They" will "force us to hand over tax and fiscal powers"?

Seriously, this is a Politics forum - so the "technical" issue that the EU has no powers to do any of what you've claimed is relevant. If your views are going to be based on conspiracy theory, they're not really at home in this forum.

I can repeat that warning with my mod hat on if you prefer. Conspiracy theories of how the EU works were part of the forum's remit during the Lisbon debates, because they were a regrettably large feature of the campaign, but outside such times, there's no real reason why they should pretend to the status of political discussion any more than the Bilderberger NWO stuff gets to.

regards,

Scofflaw0 -

We seem to be well over the boundary of conspiracy theories here - the EU "created" the crises? And "the EU" prevents countries operating according to their own internal rules about democracy? "They" are politicians? "They" will "force us to hand over tax and fiscal powers"?

Seriously, this is a Politics forum - so the "technical" issue that the EU has no powers to do any of what you've claimed is relevant. If your views are going to be based on conspiracy theory, they're not really at home in this forum.

I can repeat that warning with my mod hat on if you prefer. Conspiracy theories of how the EU works were part of the forum's remit during the Lisbon debates, because they were a regrettably large feature of the campaign, but outside such times, there's no real reason why they should pretend to the status of political discussion any more than the Bilderberger NWO stuff gets to.

regards,

Scofflaw

The EU created the crises by creating the Euro in the first place. The Euro was created as a political project, and as was predicted at the time it would not work, and would end in disaster, which seems to be what has happened.

It seems impossible that no one in the EU was aware of the arguments at the time, and events seem to have proved the arguments correct.

I have no idea what Bilderberger is, or what relevance it has. Or what conspiracy theories have to do with Bilderberger, or anything else..

Of course, it is a fact that domestic politicians from around Europe have given various powers away from their countries to the EU. To pretend there has been no pressure from the EU to do so is a judgment, and perhaps we differ in that. Certainly, it is unlikely that the people of Europe would vote to do so, if asked, but again that's a judgment we all have to make for ourselves.

However, I'll bet that the EU will try to use the present crises to encourage, or force, countries to cede power to the Eu in the areas of tax and fiscal competences.

Would anyone care to make a bet?0 -

The EU created the crises by creating the Euro in the first place. The Euro was created as a political project, and as was predicted at the time it would not work, and would end in disaster, which seems to be what has happened.

It seems impossible that no one in the EU was aware of the arguments at the time, and events seem to have proved the arguments correct.

But surely you must concede that in time someone was going to be proved right given all virtually all predictions were on the table regarding the Euro? So that one of those predictions came about was inevitable and it is fairly crazy to say they knowingly set it up for this purpose.

If anything it shows politicians believe if they talk up something enough, their talking will come through and given the business they are in, it is inevitable that they have this character flaw and the more successful they are, the larger this character flaw usually is.

I wouldn't say they planned this to force further integration but are too incompetent at setting up systems for pretty much anything to have any real success at it which is why they usually request expensive reports and then a report on those reports to try to work out what the hell they should do whenever they are asked to make a real decision.

I think it is the same reason I would never trust a salesman to make a purchasing decision because he will buy from the person with the best sales pitch no matter what nonsense was in it rather than examining the actual capabilities of each product.0 -

The EU created the crises by creating the Euro in the first place. The Euro was created as a political project, and as was predicted at the time it would not work, and would end in disaster, which seems to be what has happened.

It seems impossible that no one in the EU was aware of the arguments at the time, and events seem to have proved the arguments correct.

I have no idea what Bilderberger is, or what relevance it has. Or what conspiracy theories have to do with Bilderberger, or anything else..

Of course, it is a fact that domestic politicians from around Europe have given various powers away from their countries to the EU. To pretend there has been no pressure from the EU to do so is a judgment, and perhaps we differ in that. Certainly, it is unlikely that the people of Europe would vote to do so, if asked, but again that's a judgment we all have to make for ourselves.

However, I'll bet that the EU will try to use the present crises to encourage, or force, countries to cede power to the Eu in the areas of tax and fiscal competences.

Would anyone care to make a bet?

Not really, because of the Member States decide to pool sovereignty on any tax or fiscal matters, you'll believe that you've won your bet.

Again, "the EU" didn't create the euro - the euro was created by the Member States. The EU simply doesn't have any legal power to do something like that - unfortunately, discussing it with you is pointless, since it's completely true and something you can't accept.

Tell you what - for the sake of discussion, how do you believe "the EU" does these things that you believe they do, and would you be prepared to offer a convincing example of the EU doing one of these things? "Convincing" there means with rather more impressive evidence than "it happened, the EU was the beneficiary, QED".

cordially,

Scofflaw0 -

You are right technically, my point wasn't about the legal processes, but about the desire of the EU to want to take more and more powers away from the member states, and about the way the EU tries to prevent those member states having a democratic vote, as they know that many, if not most, people across the EU don't want that.

As has been pointed out before, it is the member states of the EU who have the sole right to decide what the EU has the power to do or not to do.

Were I re-write part of your paragraph as follows:My point wasn't about the legal processes, but about the desire of the Dail to want to take more and more powers away from the TDs, and about the way the Dail tries to prevent those TDs having a democratic vote, as they know that many, if not most, people across the country don't want that.

then this - if you'll excuse the slight re-writing - is essentially what you are claiming is happening at EU level. That claim is wrong just as the above re-writing is wrong.

But, just as it is the TDs who are masters of the Dail, so also it is the member states who are masters of the EU in this regard.

This is what the Bundesverfassungsgericht (Germany's Supreme Court) in its judgment on the Lisbon Treaty classified as the "Kompetenz-Kompetenz Frage" - that is to say "Who has the Competence to decide the Competence of the EU?" Its answer was clear - the member states do.0 -

There's obviously a political vision behind the Euro. No project of such magnitude is simply whipped up out of thin air. The fact that it's political is not the problem. It's more that certain constituent members have not been taking sustainable political and economic decisions to buttress their treaty commitments.The EU created the crises by creating the Euro in the first place. The Euro was created as a political project, and as was predicted at the time it would not work, and would end in disaster, which seems to be what has happened.

There's a lot to play for yet. Much of the unfolding crisis is being forced with a view to getting certain countries to prove their bona fides, and their fitness to function in a single currency in the coming decades.

I personally think it's a mistake to interpret every reported negative event as proof of actual failure. To my mind the bad news is part of a corrective process. Which is not to say that it won't be painful for some. Particularly Greece.0 -

Advertisement

-

Yes, new competences must be expressly transferred by the member states in line with their constitutional procedures. Furthermore, national sovereignty concerns dictate that the transfers of such competences are not permanent and irrevocable. Although in practice, the reclaiming of competences would probably require an exit from the EU. Truly a nuclear option. But an option that is there for any member state, and an option which keeps manners on the EU project overall.But, just as it is the TDs who are masters of the Dail, so also it is the member states who are masters of the EU in this regard.

This is what the Bundesverfassungsgericht (Germany's Supreme Court) in its judgment on the Lisbon Treaty classified as the "Kompetenz-Kompetenz Frage" - that is to say "Who has the Competence to decide the Competence of the EU?" Its answer was clear - the member states do.0 -

We seem to be well over the boundary of conspiracy theories here - the EU "created" the crises? And "the EU" prevents countries operating according to their own internal rules about democracy? "They" are politicians? "They" will "force us to hand over tax and fiscal powers"?

Seriously, this is a Politics forum - so the "technical" issue that the EU has no powers to do any of what you've claimed is relevant. If your views are going to be based on conspiracy theory, they're not really at home in this forum.

I can repeat that warning with my mod hat on if you prefer. Conspiracy theories of how the EU works were part of the forum's remit during the Lisbon debates, because they were a regrettably large feature of the campaign, but outside such times, there's no real reason why they should pretend to the status of political discussion any more than the Bilderberger NWO stuff gets to.

regards,

Scofflaw

Certainly the EU created the Euro crises. It certainly wasn't created by the Australians, or the Chinese, or anyone else other than the EU. The EU consists of all the countries making up the EU, and if you think that's a conspiracy then I can't agree.

Being honest, your reply is a little bizarre. You appear to be saying that the EU has, for example, no powers to create the Euro, but the evidence is that the Euro has been created by the very same EU to which I belong. So I must be not reading you correctly, even if that appears to be what you are saying.

In any case, its not really relevant to what is happening today. What we appear to be witnessing today is the final death dance of the Euro. In addition China's economic slowdown coupled with America's inability to create jobs, and the EU's economic meltdown means we are in probably a more serious situation than the World was in the 1920's, and the great economic depression.

But these problems are minor compared to the elephant in the room, which is that the USA and most EU economies are only able to function by borrowing mind bogglingly enormous amounts of money every year. If that funding either dries up or becomes more expensive, then the current crises will seem like a fond memory as the world is plunged into a deep and prolonged depression, which will impoverish much of the developed world for years to come.

Many judge that the bond market has become a bond bubble, and like all bubbles it is only a matter of time until it bursts. Like the Irish housing market,

in 1995, foreign exchange reserves held by the world’s central banks stood at about $1.4 trillion. It is now $9.7 trillion, and is a classic bubble.

The bond bubble is dangerous because, in recent years, our governments have become used to borrowing cheap money on the bond markets, and spending it like drunken sailors, hailing the results as growth in their economies, and even claiming it as proff of their wonderful stewardship of the economy.

The growth turned out to be illusory, and now that the real costs are coming home to roost, just as the cost of the borrowing in shooting up, the USA and EU are likely to be crippled with more and more expensive debt for years.

What we are seeing in the EU now is the death dance of the Euro, as the strains on the various economies become impossible to bear. the German people, many of whom work productively until they are 65 or 70, will not let the German government spend their hard earned savings and their current taxes, to allow the financial aid to allow greek postal worker to retire at 50. In turn the Greek postal workers are prepared to take to the streets and become violent to protect what they see as their hard earned right to retire at 50 taken away, and having to work to 65 instead.

The leaders flop about unsure what to do, and the crises is teh proverbial can which is being kicked down the road. At this stage, it's been kicked down the road so often its amazing there is any road left, but as we can all see the crises deepens the longer action is put off.

Truly, we live in the most worrying time for over one hundred years, and its hard to see a chink of light for years ahead.0 -

-

Certainly the EU created the Euro crises. It certainly wasn't created by the Australians, or the Chinese, or anyone else other than the EU. The EU consists of all the countries making up the EU, and if you think that's a conspiracy then I can't agree.

Being honest, your reply is a little bizarre. You appear to be saying that the EU has, for example, no powers to create the Euro, but the evidence is that the Euro has been created by the very same EU to which I belong. So I must be not reading you correctly, even if that appears to be what you are saying.

To be honest, I consider the failure to distinguish between "the EU as a set of institutions created by the Member States" and the Member States themselves as members of the EU deplorable in itself, since it leads to misleading statements like "the EU writes the EU Treaties" or "the EU always votes more powers for the EU", which imply something completely false by mixing up two senses of "EU".

cordially,

Scofflaw0 -

I think either the waters are muddied in your head, or else you're trying to muddy them to create your own "spin".

:rolleyes: Certainly you hit the nail on the head as to what Scofflaw was saying there.Certainly the EU created the Euro crises. It certainly wasn't created by the Australians, or the Chinese, or anyone else other than the EU.

Certainly, the EU does consist of all member states "making up the EU", however that's certainly not true of the Eurozone.The EU consists of all the countries making up the EU, and if you think that's a conspiracy then I can't agree.

This is why I think you are just confused and not trying to "spin".Being honest, your reply is a little bizarre. You appear to be saying that the EU has, for example, no powers to create the Euro, but the evidence is that the Euro has been created by the very same EU to which I belong. So I must be not reading you correctly, even if that appears to be what you are saying.

Firstly, you do not belong to the EU. You are a sovereign of Ireland which has voted to become a member state of the EU. Yes, Article 20(1) of the Treaty on the Functioning of the European Union gives you "citizenship" of the EU, but it does not afford you direct and personal membership of the European Union. Ireland is a member of the EU, you are not.

Secondly, the European Union did not create the Euro (€) currency. Certain Member States of the EU (10 or 11) opted to create a Single European Currency under the new EC pillar developed by the Maastrict Treaty which set guidelines for countries which were going to join this Economic and Monetary Union.

The "EU" as we know it today didn't actually exist in its current form until we ratified Lisbon in 2009.

Are you partially correct... yes and no. One thing that the Eurozone Member States did as part of the Euro/Maastrict bundle was give governance to essentially nobody. Yes, the ECB is in charge of interest, but nobody really has the ability to make larger fiscal policy decisions. In retrospect, the Euro Group should have been given much more policy and decision power in the Euro.

Just not going to happen. It really isn't. The Euro must survive in one form or another, its decline would cripple the world economy so it must be saved - simple as that. We need to do an orderly wind-down of Greece, but the Euro will live on.In any case, its not really relevant to what is happening today. What we appear to be witnessing today is the final death dance of the Euro.

I think it's too early to tell... the U.S. has their problems, but they are nearing a large decision in relation to spending and taxes at the moment.In addition China's economic slowdown coupled with America's inability to create jobs, and the EU's economic meltdown means we are in probably a more serious situation than the World was in the 1920's, and the great economic depression.

It won't really ever dry up in the US. Also, go back a few posts - this is a liquidity and, probably more specifically, a liquidity confidence issue at the moment. The major central banks announced 2 weeks ago that there is enough liquidity and guaranteed that this would be the case.But these problems are minor compared to the elephant in the room, which is that the USA and most EU economies are only able to function by borrowing mind bogglingly enormous amounts of money every year. If that funding either dries up or becomes more expensive, then the current crises will seem like a fond memory as the world is plunged into a deep and prolonged depression, which will impoverish much of the developed world for years to come.

Source?Many judge that the bond market has become a bond bubble, and like all bubbles it is only a matter of time until it bursts. Like the Irish housing market,

in 1995, foreign exchange reserves held by the world’s central banks stood at about $1.4 trillion. It is now $9.7 trillion, and is a classic bubble.

I agree that we need stronger leadership. One thing that worries me is that we have had no real plan put forward by the leaders of the Eurozone Member States or, in fact, any EU leaders as to how to solve the problem.The bond bubble is dangerous because, in recent years, our governments have become used to borrowing cheap money on the bond markets, and spending it like drunken sailors, hailing the results as growth in their economies, and even claiming it as proff of their wonderful stewardship of the economy.

The growth turned out to be illusory, and now that the real costs are coming home to roost, just as the cost of the borrowing in shooting up, the USA and EU are likely to be crippled with more and more expensive debt for years.

What we are seeing in the EU now is the death dance of the Euro, as the strains on the various economies become impossible to bear. the German people, many of whom work productively until they are 65 or 70, will not let the German government spend their hard earned savings and their current taxes, to allow the financial aid to allow greek postal worker to retire at 50. In turn the Greek postal workers are prepared to take to the streets and become violent to protect what they see as their hard earned right to retire at 50 taken away, and having to work to 65 instead.

The leaders flop about unsure what to do, and the crises is teh proverbial can which is being kicked down the road. At this stage, it's been kicked down the road so often its amazing there is any road left, but as we can all see the crises deepens the longer action is put off.

Truly, we live in the most worrying time for over one hundred years, and its hard to see a chink of light for years ahead.

I think mainly because of Greece - they're doing damage control and Greece is volatile. Watch this space... the EU will deal with Greece in one way or another over the next month or two and then go on to deal with the systemic issue.

The Euro isn't dead... it simply cannot go without causing mayhem. Anyone who suggests otherwise is merely posturing or fearmongering. There is no viable alternative and no reason for the Euro to collapse. We have been promised liquidity and really that's all we need to care about right now.0 -

To be honest, I consider the failure to distinguish between "the EU as a set of institutions created by the Member States" and the Member States themselves as members of the EU deplorable in itself, since it leads to misleading statements like "the EU writes the EU Treaties" or "the EU always votes more powers for the EU", which imply something completely false by mixing up two senses of "EU".

cordially,

Scofflaw

I agree it can be confusing, and many find it so, and if your main worry is about misleading statements, raher than the magnitude, and actual, and potential effects of the crises in which we find ourselves, that suggests a slightly unbalanced view.FreudianSlippers wrote: »

Certainly, the EU does consist of all member states "making up the EU", however that's certainly not true of the Eurozone.

.

Of course, I assume everyone knows that the UK, and Denmark, Norway, Sweden and so on all opted not to join the Euro. And now they are all rejoycing every day at the wisdom of their decision, not to be part of a currency which has all but imploded.FreudianSlippers wrote: »

Firstly, you do not belong to the EU. You are a sovereign of Ireland which has voted to become a member state of the EU. Yes, Article 20(1) of the Treaty on the Functioning of the European Union gives you "citizenship" of the EU, but it does not afford you direct and personal membership of the European Union. Ireland is a member of the EU, you are not.

.

On a point of accuracy, I am not a sovereign of Ireland, and why you should assume that I am is uncertain. I make no such assumptions about you, or anyone else, and why you should do so is uncertain, but I take the point you make nonetheless, and I had assumed most of us alredy knew that.

However, it's curious how, for example, passports issued to citizens of Europe all now state “European Union” on the front, which seems to imply at least a loose association with the holder of the passport and the EU. I can see just why Scofflaw is confused. Imagine how us less intelligent mortals feel! If I am not a member of the EU, why is your passport issued saying its from the “European Union”? Why is Scofflaw's and everyone elses's who gets a passport in the EU?

I don't agree that citizens of the EU are not also in the EU, and belong to the EU. I am aware of the difference between being a paid up member of the EU, so to speak, (countries) and being in the EU(individuals) .FreudianSlippers wrote: »2009.

Are you partially correct... yes and no. One thing that the Eurozone Member States did as part of the Euro/Maastrict bundle was give governance to essentially nobody. Yes, the ECB is in charge of interest, but nobody really has the ability to make larger fiscal policy decisions. In retrospect, the Euro Group should have been given much more policy and decision power in the Euro.

I guess that comes into the category of coulda woulda shoulda. It seems even now the leaders flop about seemingly unable to make decisions. That was always going to be the weakness in the Euro, and it's not as if that wasn't flagged at the time, and the potential for disaster also flagged a the time. However, the EU ignored the warnings and ploughed on regardless, the results of which we can see today.FreudianSlippers wrote: »

The Euro must survive in one form or another, its decline would cripple the world economy so it must be saved - simple as that.

You may not have noticed, but the Euro's inevitable, and avoidable, outcome has crippled Europe already. And we're not finished yet with its poisonous tentacles, which have spread to all those countries not in the Euro, and we have not seen the end of its destructive hand yet. I'm sure all those Irish developers also said that their companies “must” survive sincerely meant it too, but statements of desire don't really make good economic policy, as we have seen with the Euro itself, which was founded on many wonderful political statements, and the hubris was that the politicians thought that they could control it, and that they could ignore the problems which were ponted out and which were predicted to cause the very dangerous instability that the Euro has caused.FreudianSlippers wrote: »

It won't really ever dry up in the US. Also, go back a few posts - this is a liquidity and, probably more specifically, a liquidity confidence issue at the moment. The major central banks announced 2 weeks ago that there is enough liquidity and guaranteed that this would be the case.

.

Again, fine intentions don't make markets work. If you think all the billions owed to French and German banks, the American banks and all the others by Greece, Italy, Portugal, Spain, Ireland, the UK, the USA and so on is just a confidence issue, as opposed to a real problem involving billions and billions of whatever currency you're having yourself, then you seem to be in a very small minority of people who think its just a matter of instilling a bit of confidence somewhere or other and the problems will evaporate. It's this kind of woolly thinking which ignored the warnings which gave us the Euro, and we can see where that leads.FreudianSlippers wrote: »

I agree that we need stronger leadership. One thing that worries me is that we have had no real plan put forward by the leaders of the Eurozone Member States or, in fact, any EU leaders as to how to solve the problem.

I think mainly because of Greece - they're doing damage control and Greece is volatile. Watch this space... the EU will deal with Greece in one way or another over the next month or two and then go on to deal with the systemic issue.

The Euro isn't dead... it simply cannot go without causing mayhem. Anyone who suggests otherwise is merely posturing or fearmongering. There is no viable alternative and no reason for the Euro to collapse. We have been promised liquidity and really that's all we need to care about right now.

I suppose that could be said to be the bolting-the-stable-door-after-the-horse-has-bolted strategy. The time for stronger leadership was when the Euro was created, and which would have not ignored the warnings and plughed ahead with a project for hubristic reasons, the results of which has taken the EU to the brink of disaster with the Euro. The Euro isn't dead, and to say it “simply can't go away without causing mayhen” might be ironic if it wasn't so serious. Perhaps you hadn't noticed, but the Euro has already casued more than it's fair share of “mayhem”, and has plunged the whole Eu into crises, which I'd categorise as a lttle more than just “mayhem”. As to the future, we can disagree on that, but my guess is that the Euro will not be around in the form as we know it for much longer.

What the politicians and EU officials need to learn is that they can't buck, or control, the markets, and their attempts to do so by introducing the Euro in teh form they did will probably be the most expensive lesson is history of that principle. Unfortunately, in your post here you seem to believe also that someone somewhere can just wave a magic want and make all this go away. The only way this will go away is when the problems causing it are resolved.0 -

The fact that you’ve repeatedly demonstrated a fundamental misunderstanding of “the crisis” suggests a slightly unbalanced view.I agree it can be confusing, and many find it so, and if your main worry is about misleading statements, raher than the magnitude, and actual, and potential effects of the crises in which we find ourselves, that suggests a slightly unbalanced view.

Norway is not a member of the EU. As for the UK, “wisdom” had little to do with it – there is absolutely no way Britain will adopt a currency that doesn’t have a British monarch on it anytime soon. Besides, you’re aware that the British Pound is worth far less relative to the Euro than it was, say, five years ago?Of course, I assume everyone knows that the UK, and Denmark, Norway, Sweden and so on all opted not to join the Euro. And now they are all rejoycing every day at the wisdom of their decision, not to be part of a currency which has all but imploded.

Define “crippled”. The lights are still on, trains are running on time, post offices are open ... help me out here.You may not have noticed, but the Euro's inevitable, and avoidable, outcome has crippled Europe already.

So Greece’s, Ireland’s and Portugal’s instability was caused by the Euro? Not by the complete inability of respective governments to balance the books?... as we have seen with the Euro itself, which was founded on many wonderful political statements, and the hubris was that the politicians thought that they could control it, and that they could ignore the problems which were ponted out and which were predicted to cause the very dangerous instability that the Euro has caused.

Let’s put a figure on that, shall we? How much does Ireland owe to French and German banks?If you think all the billions owed to French and German banks, the American banks and all the others by Greece, Italy, Portugal, Spain, Ireland, the UK, the USA and so on is just a confidence issue, as opposed to a real problem involving billions and billions of whatever currency you're having yourself...

Eh, surely the introduction of the Euro gave individual governments less control of “the markets”?What the politicians and EU officials need to learn is that they can't buck, or control, the markets, and their attempts to do so by introducing the Euro...0 -

FreudianSlippers wrote: »You are a sovereign of Ireland which has voted to become a member state of the EU.

I presume you meant citizen of Ireland here? Sovereigns are Monarchs, I believe.

(Ok - And old coins as well)0 -

Just listening to the radio this morning, I am reminded that another person who predicted this was Bernard Connolly, who wrote a book "The Rotten Heart of Europe", in which he predicted just this crisis for the Euro.

He argued that the single currency project would be used to generate an irresistible momentum for fullscale political union in Europe, dominated by an implicit power-sharing agreement between the German and French political elites. Further, he argued it was a political project which had to be pursued by stealth because neither the peoples, nor the parliaments, of major European nations had ever been willing to support it when it was presented openly as an explicit aim.

He was promptly sacked by the Commission from his job as head of the European Commission's monetary affairs department.

It's an interesting book and I'd recommend anyone to read it to understand how the EU works, from the inside. His book was written in 1995, and its curious how much of what he predicted has come to pass.

Naturally, I expect some here to want to rush to rubbish him, as former head of the European Commission's monetary affairs department, because they don't like what he says. However, I'd ask that we can look beyond the personality, and look at what he said, rather than try to avoid that and throw muck at the person.0 -

Advertisement

-

I just guessed that since you were on an Irish forum waffling on about the EU and the Euro that you were Irish.On a point of accuracy, I am not a sovereign of Ireland, and why you should assume that I am is uncertain. I make no such assumptions about you, or anyone else, and why you should do so is uncertain, but I take the point you make nonetheless, and I had assumed most of us alredy knew that.

However, it's curious how, for example, passports issued to citizens of Europe all now state “European Union” on the front, which seems to imply at least a loose association with the holder of the passport and the EU. I can see just why Scofflaw is confused. Imagine how us less intelligent mortals feel! If I am not a member of the EU, why is your passport issued saying its from the “European Union”? Why is Scofflaw's and everyone elses's who gets a passport in the EU?

I don't agree that citizens of the EU are not also in the EU, and belong to the EU. I am aware of the difference between being a paid up member of the EU, so to speak, (countries) and being in the EU(individuals) .

I really don't care where you're from, you're just plain wrong, and your strange hypothesis about your membership of the European Union is baffling and illogical (almost up there with Freeman strangeness).

Tell you what, go to Brussels and demand a seat since you're a "member of the EU" and see how far you get, ok?A bunch of rubbish 0

0 -

-

Interesting.... the "Connolly" PR machine always uses that line: "... was promptly sacked by the Commission."Just listening to the radio this morning, I am reminded that another person who predicted this was Bernard Connolly, who wrote a book "The Rotten Heart of Europe", in which he predicted just this crisis for the Euro.

He argued that the single currency project would be used to generate an irresistible momentum for fullscale political union in Europe, dominated by an implicit power-sharing agreement between the German and French political elites. Further, he argued it was a political project which had to be pursued by stealth because neither the peoples, nor the parliaments, of major European nations had ever been willing to support it when it was presented openly as an explicit aim.

He was promptly sacked by the Commission from his job as head of the European Commission's monetary affairs department.

It's an interesting book and I'd recommend anyone to read it to understand how the EU works, from the inside. His book was written in 1995, and its curious how much of what he predicted has come to pass.

Naturally, I expect some here to want to rush to rubbish him, as former head of the European Commission's monetary affairs department, because they don't like what he says. However, I'd ask that we can look beyond the personality, and look at what he said, rather than try to avoid that and throw muck at the person.

Every single time that Bernard Connolly is brought up: "Mr Connolly was promptly sacked by the Commission."

I suspect your anti-European viewpoint is heavily influenced by the propaganda machine or else you're a large part of it.

In any event, Connolly was sacked because he published a book specifically criticising his co-workers and the commission he worked for at the time. You think your employer would like to keep you on if you were publishing a bunch of negative things about them while you were still an employee? Also, he was only advising Britain, he was not the head of the EFA department.0 -

FreudianSlippers wrote: »Interesting.... the "Connolly" PR machine always uses that line: "... was promptly sacked by the Commission."

Every single time that Bernard Connolly is brought up: "Mr Connolly was promptly sacked by the Commission."

I suspect your anti-European viewpoint is heavily influenced by the propaganda machine or else you're a large part of it.

In any event, Connolly was sacked because he published a book specifically criticising his co-workers and the commission he worked for at the time. You think your employer would like to keep you on if you were publishing a bunch of negative things about them while you were still an employee? Also, he was only advising Britain, he was not the head of the EFA department.

it's curious how many of the "negative" things Bernard Connolly predicted have come to pass.

I myself predicted that you would attack the man and not what he said, and that seems to have come to pass also.

It's a shame you can't argue the points, rather than avoid them and attack the individual.

In answer to your question, my employer would welcome anyone who was able to point out that his business was on a path to failing, and he was able to take action to prevent it.0 -

Many of the predictions of Nostradamus have come to pass too... it just depends on what spin you want to put on it.it's curious how many of the "negative" things Bernard Connolly predicted have come to pass.

I myself predicted that you would attack the man and not what he said, and that seems to have come to pass also.

It's a shame you can't argue the points, rather than avoid them and attack the individual.

In answer to your question, my employer would welcome anyone who was able to point out that his business was on a path to failing, and he was able to take action to prevent it.

I don't agree that Connolly was at all right and I see the Euro up to the current crisis as being a phenomenal success.0 -

FreudianSlippers wrote: »Many of the predictions of Nostradamus have come to pass too... it just depends on what spin you want to put on it.

I don't agree that Connolly was at all right and I see the Euro up to the current crisis as being a phenomenal success.

I am not asking anyone to agree with the facts outlined earlier, as facts are facts and don't require anyone to agree with them. What Bernard Connolly said in his book is there for all to see, and whether or not you agree that he predicted, for example, that the single currency project would be used to generate an irresistible momentum for fullscale political union in Europe is a fact, as it's in his book in black and white. Your opinion may well be that he didn't predict that, but its there in black and white is his book for others to judge that for themselves.

Again, if you judge the Euro as being a "phenomenal success" up to some point in the past, that implies that you think latterly it's not been a success, whether phenomenal or otherwise.

Again, its a fact the Ireland lost control of the ability to control the interest rate of its currency, as a result of signing up to the Euro. This was a factor which played its not inconsiderable part in the Irish property boom which has in turn helped to create the losses at Anglo Irish Bank (and other banks), which in turn has plunged the country into the biggest debt spiral in its history. This presumably happened during at least some of the time you considered the Euro as being a "phenomenal success".

I don't consider that a phenomenal success, or even a non-phenomenal success, so on that point our opinions will have to differ.

I don't put much faith in either of our opinions, and would rather the facts speak for themselves, which show that much of what Bernard Connolly predicted in his book has come to pass. No amount of opinions can change those facts.0 -

Advertisement

-

I am not asking anyone to agree with the facts outlined earlier, as facts are facts and don't require anyone to agree with them. What Bernard Connolly said in his book is there for all to see, and whether or not you agree that he predicted, for example, that the single currency project would be used to generate an irresistible momentum for fullscale political union in Europe is a fact, as it's in his book in black and white. Your opinion may well be that he didn't predict that, but its there in black and white is his book for others to judge that for themselves.

But what he says in the book hasn't happened, and certainly getting countries to be more financially prudent is not a bad thing. Hundreds of predictions are made every day, some will turn out to be so, it doesn't mean there was any great foreknowledge of events. I'll wait and see if he even guessed right.Again, its a fact the Ireland lost control of the ability to control the interest rate of its currency, as a result of signing up to the Euro. This was a factor which played its not inconsiderable part in the Irish property boom which has in turn helped to create the losses at Anglo Irish Bank (and other banks), which in turn has plunged the country into the biggest debt spiral in its history. This presumably happened during at least some of the time you considered the Euro as being a "phenomenal success".

The world was awash with cheap credit. Nothing about the Euro made us borrow way too much with little regulation about who got the money and how much they got. We did that.0 -

Just about every point you’ve made on this thread has been argued against and, more often than not, shown to be claptrap. It’s a shame you can’t argue the points raised against your own.It's a shame you can't argue the points...

So the politically unionist agenda of the European Union was a big secret before Bernard came along with his book, was it?What Bernard Connolly said in his book is there for all to see, and whether or not you agree that he predicted, for example, that the single currency project would be used to generate an irresistible momentum for fullscale political union in Europe is a fact, as it's in his book in black and white.

Irish government policy was a far bigger factor. The UK had a property boom, but the UK’s not in the Eurozone. Germany is in the Eurozone, but they didn’t have a property boom.Again, its a fact the Ireland lost control of the ability to control the interest rate of its currency, as a result of signing up to the Euro. This was a factor which played its not inconsiderable part in the Irish property boom...

Right. So what?I don't put much faith in either of our opinions, and would rather the facts speak for themselves, which show that much of what Bernard Connolly predicted in his book has come to pass.0 -

FreudianSlippers wrote: »In Ireland the Sovereign are its people.

That isn't what the constitution says. It says the Ireland is a sovereign state and the (less clearly defined) "Irish nation" has a right to make sovereign decisions. That is not to say though that a citizen is sovereign - were that the case, we could all claim that - being sovereign - the laws on taxes didn't apply to us as individuals. 0

0 -

it's curious how many of the "negative" things Bernard Connolly predicted have come to pass.

I myself predicted that you would attack the man and not what he said, and that seems to have come to pass also.

It's a shame you can't argue the points, rather than avoid them and attack the individual.

How exactly did FreudianSlippers attack Mr Connolly in his post?

Mr Connolly broke the staff regulations that he was bound by as an employee and was sacked for doing so. He can hardly have been unaware that he was breaking the regulations when he did so. A clear breech of three separate regulations in hardly a "Oops, I didn't know" slip.0 -

How exactly did FreudianSlippers attack Mr Connolly in his post?

Mr Connolly broke the staff regulations that he was bound by as an employee and was sacked for doing so. He can hardly have been unaware that he was breaking the regulations when he did so. A clear breech of three separate regulations in hardly a "Oops, I didn't know" slip.

Mr Connolly claims that everything he said and did was consistent with his contract of employment, since he revealed no confidential information connected with his duties and wrote the book entirely in his spare time. I have no details myself about his contract of employment, and I have no view about whether he was correctly, or not, sacked. I am guessing you also have no details of it either. Have you?

That he was sacked was not the issue in any case.But what he says in the book hasn't happened, and certainly getting countries to be more financially prudent is not a bad thing. Hundreds of predictions are made every day, some will turn out to be so, it doesn't mean there was any great foreknowledge of events. I'll wait and see if he even guessed right.

The world was awash with cheap credit. Nothing about the Euro made us borrow way too much with little regulation about who got the money and how much they got. We did that.

Of course, you are right that it hasn’t happened yet that, as he argued, argued that the single currency project would be used to generate an irresistible momentum for full political union in Europe, dominated by an implicit power-sharing agreement between the German and French political elites. However, if you think that that’s not what is coming very soon down the pipes, the we’ll have to disagree for now, and wait and see.

The world was awash with cheap credit, and it was the inability of, for example, the Irish Government to increase the price of that credit by controlling interest rates in Ireland, which has greatly exacerbated the problem. By joining the Euro, Ireland gave up the ability to control its rate of interest, and has had to live with rates of interest which have been far too low and helped to create the problem.

It was cheap credit, as well as availability of credit, which cause the problem, and had the Irish government been able to increase interest rates it would have helped take some of the heat out of the property market, which would have reduced the banks exposure to what became completely unsustainable property prices. Thats not to say it would have solved or reduced the problem to zero, but it would have helped scale down the problem, and stopped it becoming the issue which has crippled the Irish nation financially.0 -

Advertisement

-

Once again, so what? Any political union in Europe is going to be “dominated” by the likes of France and Germany, as they are two of the biggest nations on the continent.Of course, you are right that it hasn’t happened yet that, as he argued, argued that the single currency project would be used to generate an irresistible momentum for full political union in Europe, dominated by an implicit power-sharing agreement between the German and French political elites.

The Irish government had plenty of other tools at their disposal, such as the raising of taxes, which could have been used to temper the property boom. Given that the government chose to do precisely the opposite, there is absolutely no reason to believe that things would have unfolded differently had Ireland still been using the punt. The problem was poor governance (and poor choices by the electorate), not the currency.The world was awash with cheap credit, and it was the inability of, for example, the Irish Government to increase the price of that credit by controlling interest rates in Ireland, which has greatly exacerbated the problem.0 -

I was taught (doing constitutional law) and always understood it as the "nation" aspect are the people of Ireland. That is not to say that each individual is (for lack of a better word) individually sovereign, but that the people as a whole (as described in Art.1 as "Irish Nation" are the sovereign.That isn't what the constitution says. It says the Ireland is a sovereign state and the (less clearly defined) "Irish nation" has a right to make sovereign decisions. That is not to say though that a citizen is sovereign - were that the case, we could all claim that - being sovereign - the laws on taxes didn't apply to us as individuals.

It's probably just semantics in any event.0 -

FreudianSlippers wrote: »I was taught (doing constitutional law) and always understood it as the "nation" aspect are the people of Ireland. That is not to say that each individual is (for lack of a better word) individually sovereign, but that the people as a whole (as described in Art.1 as "Irish Nation" are the sovereign.

It's probably just semantics in any event.

Yes, that's how I was taught as well.0 -

Once again, so what? Any political union in Europe is going to be “dominated” by the likes of France and Germany, as they are two of the biggest nations on the continent.

The Irish government had plenty of other tools at their disposal, such as the raising of taxes, which could have been used to temper the property boom. Given that the government chose to do precisely the opposite, there is absolutely no reason to believe that things would have unfolded differently had Ireland still been using the punt. The problem was poor governance (and poor choices by the electorate), not the currency.

Indeed, when the property market initially stalled, all the parties clamoured to reform stamp duty to reignite in. People were giving out about Europe raising interest rates in 06.

The Government chose to double interest rate relief, giving a tax credit of €10/20,000 to single and married first time buyers, basically subsidising mortgages by €2/4,000 cash.

I suppose we could have had higher interest rates if outside the Euro but that actually caused other problems in Iceland!Mad Men's Don Draper : What you call love was invented by guys like me, to sell nylons.

0 -

The economy which Ireland is more akin to is Japan. In fact, Ireland now has the distinction of being the most bankrupt country in the world, and is even more bankrupt now than is Japan.

The level of debt Ireland now has is crippling, and it should be noted that Japan, which in much further down the road with debt levels not as great as Ireland, has taken years with little improvement in its position.

As I noted elsewhere, Japan exports vastly more of its manufactured goods that Ireland, and there has been no sign there that an export led recovery has made much dent in the countries debts. Why should Ireland's much hailed export led recovery prove different?0 -

Is it? Japan’s public debt dwarfs Ireland’s. And while Japan has an aging population (one of the principal economic challenges facing the country), Japan also has a strong manufacturing base and vast capital reserves. I’m failing to see the similarities with Ireland.The economy which Ireland is more akin to is Japan.0 -

In fact, Ireland now has the distinction of being the most bankrupt country in the world, and is even more bankrupt now than is Japan.

I thought it was earlier in this thread I already covered this?

Oh well... how can someone be the "most" bankrupt? I don't think you know what bankruptcy is for some reason.

Not being snarky, perhaps you meant something else, but it isn't bankruptcy.0 -

Irelands debt ratio of debt to GDP is 400, and to GNP it's 494, which makes Ireland debt the highest in the developed world. It's not a competition, and the point is that Irelands debts are crippling, and and we have seen what thhose sorts of levels of debt have done to Japan.

Bankruptcy means you can't pay your liabilities. Ireland currently has no hope of repaying the capital, and little hope of paying the interest on the enormous amount of capital the country has borrowed, and as those borrowings continue to increase every year.

We can disagree with the term, but the substantive point is more serious than semantics.0 -

The most recent figures from Eurostat (2010) puts Ireland's debt:GDP ratio at about 0.96. You’re only off by a factor of 400 or so.Irelands debt ratio of debt to GDP is 400...

Belgium, Italy and Greece all have higher debt:GDP ratios than Ireland. I imagine Japan does too....which makes Ireland debt the highest in the developed world.

Have we? What’s that then?...the point is that Irelands debts are crippling, and and we have seen what thhose sorts of levels of debt have done to Japan.0 -

Irelands debt ratio of debt to GDP is 400, and to GNP it's 494, which makes Ireland debt the highest in the developed world. It's not a competition, and the point is that Irelands debts are crippling, and and we have seen what thhose sorts of levels of debt have done to Japan.

Bankruptcy means you can't pay your liabilities. Ireland currently has no hope of repaying the capital, and little hope of paying the interest on the enormous amount of capital the country has borrowed, and as those borrowings continue to increase every year.

We can disagree with the term, but the substantive point is more serious than semantics.

I assume you're using total debt figures there, which are almost entirely meaningless on their own. Worse, you appear to be conflating them with public debt.

What is the net debt position, and why are private debts relevant to whether Ireland can support its public debt?

regards,

Scofflaw0 -

Advertisement

-

Yeah, the CIA say the same thing.The most recent figures from Eurostat (2010) puts Ireland's debt:GDP ratio at about 0.96. You’re only off by a factor of 400 or so.

Belgium, Italy and Greece all have higher debt:GDP ratios than Ireland. I imagine Japan does too.

Link

We have a high public debt but we're not the worst in the world. I'd be very interested in seeing this 400% source.0 -

Have we? What’s that then?

Short answer....two lost decades as productive private capital is crowded out by the State via artificially low interest rates and Keynesian stimulus programs to preserve zombie banks.

TWO lost decades.

The ISEQ is back to 1995 levels, so all gains from the last 16 years are gone and we are actually facing huge inflation adjusted losses.

The destruction pensions is almost unprecedented.

Sadly, its not over.0 -

-

0

-

-

Mr Connolly claims that everything he said and did was consistent with his contract of employment, since he revealed no confidential information connected with his duties and wrote the book entirely in his spare time. I have no details myself about his contract of employment, and I have no view about whether he was correctly, or not, sacked. I am guessing you also have no details of it either. Have you?

Yes.

Mr Connolly appealed the decision to dismiss him and lost on all points. In other words, in the opinion of the courts, Mr Connolly's dismissal for breech of staff regulations was completely valid.

The link to the judgment is here.0 -

What is the net debt position, and why are private debts relevant to whether Ireland Europe can support Ireland's public debt?

Fixed your post.

The net debt position is interesting, and frightening at the same time. A recent study argues that when debt ratios rise beyond a certain level, financial crises become both more likely and more severe.

Further, Government debt is only one part of the picture, and private corporate and household debt have an obvious adverse effect on an economy, as cash must be diverted to service the debts making it not available to purchase goods and services in the economy, and also making the economies goods more expensive to produce, with the added costs of corporate debt and higher wage demands.

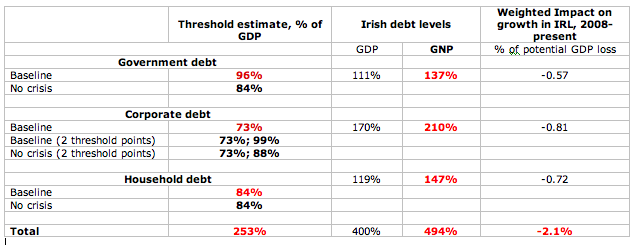

The following table shows Ireland's Governmet, private corporate and household debt.

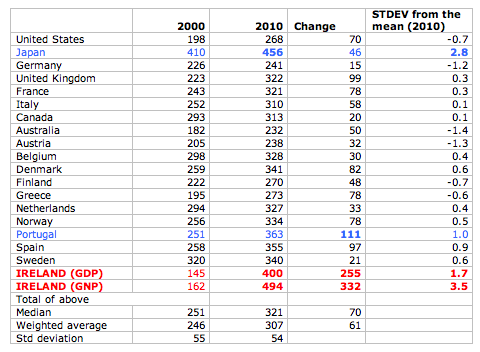

If we then look at a comparison with 18 other countries, we can see Irelands relative position.

We can see Ireland has the highest debt to GNP ratio, the second highest debt to GDP ratio, and the biggest increases across the board.0 -

-

-

Advertisement

-

Are they?Those are the figures supplied in a written answer by the Minister of Finance in answer to a Dail question number 122 on September 14th 2011.

http://debates.oireachtas.ie/dail/2011/09/14/00105.aspMichael Noonan wrote:The Central Bank’s Quarterly Financial Accounts data show that households had outstanding loans amounting to €184.9 billion in the first quarter of the year, representing 147 per cent of forecast GNP for 2011. The stock of household loans has declined by €18 billion or 9 per cent since peaking in the final quarter of 2008. The same data source reveals that non financial corporations had outstanding loans of €264 billion in the first quarter of the year, or 210 per cent of forecast GNP. The stock of such loans has contracted by €62.5 billion or 19 per cent since peaking in the final months of 2009.

Of course the data also show that households and non financial corporations have significant assets as well as liabilities. In the case of households, for example, net financial wealth — the difference between assets and liabilities — was a positive €105 billion (this figure does not include housing assets). This figure has increased by 80 per cent since the first quarter of 2009.

Finally, my Department has forecast General government debt of €173 billion in 2011, which would represent 111 per cent of forecast GDP (137 per cent of GNP). This is up from debt of €148.1 billion in 2010. General government debt as a percentage of GDP is forecast to peak at 118 per cent in 2013 before moderating in the following years.

You’ve got a whole lot of figures in the above tables that are not mentioned by the Minister?0

Advertisement