Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

Hi all,

Vanilla are planning an update to the site on April 24th (next Wednesday). It is a major PHP8 update which is expected to boost performance across the site. The site will be down from 7pm and it is expected to take about an hour to complete. We appreciate your patience during the update.

Thanks all.

Vanilla are planning an update to the site on April 24th (next Wednesday). It is a major PHP8 update which is expected to boost performance across the site. The site will be down from 7pm and it is expected to take about an hour to complete. We appreciate your patience during the update.

Thanks all.

Economic principles and cycles

-

06-01-2019 5:22pm#1

Ray Dalio posted this recently

https://www.linkedin.com/pulse/help-put-recent-economic-market-moves-perspective-ray-dalioHow the Market and Economic Machines Work

At the biggest picture level, there are three big forces that interact to drive market and economic conditions over time. They are 1) productivity growth, 2) the short-term debt cycle (which typically takes about 5-10 years), and 3) the long-term debt cycle (which typically takes about 50-75 years). These factors also affect geopolitics both within and between countries, which also affects the market and economic conditions.

Just wondering where you guys think we are in regards the economic cycle and how best to profit from it.0

Comments

-

https://youtu.be/PHe0bXAIuk0

Ray Dalio posted this recently https://www.linkedin.com/pulse/help-put-recent-economic-market-moves-perspective-ray-dalio

Just wondering where you guys think we are in regards the economic cycle and how best to profit from it.

OK Ill hazard my opinion in the hope others will chip in

Only one mans opinion (and probably ill informed in someways)

I suspect world economy is close to the beginning of that large drop at the end of the long term debt cycle....you know the bit where stock markets crash, spending reduces and deleveraging begins....the cracks were only papered over since 2008 imo

Individual countries may not be at that point but a lot of them will inevitably caught up in a slowdown

Profit by not taking on Debt......and finding a way to preserve the ability to buy assets when the time is right......profit by patience.0 -

Only one mans opinion (and probably ill informed in someways)

I suspect world economy is close to the beginning of that large drop at the end of the long term debt cycle....you know the bit where stock markets crash, spending reduces and deleveraging begins....the cracks were only papered over since 2008 imo

Right with you on that one - opinions make a market.

I'm not trying to build a wall of worry, there is already enough of that going on...

https://www.ft.com/content/1acdfbe0-00be-11e9-99df-6183d3002ee1US credit markets are grinding to a halt with fund managers refusing to bankroll buyouts and investors shunning high-yield bond sales as rising interest rates and market volatility weigh on sentiment.

Not a single company has borrowed money through the $1.2tn US high-yield corporate bond market this month. If that drought persists, it would be the first month since November 2008 that not a single high-yield bond priced in the market, according to data providers Informa and Dealogic.

In the leveraged loan market, two transactions were postponed last week after Barclays, Deutsche Bank, UBS and Wells Fargo failed to find buyers for the debt packages, a rarity in what has been one of the hottest corners of credit markets this year.

The deals could be the first of several transactions pulled from the market this year, bankers and investors said, as mutual funds and managers of collateralised loan obligations — one of the largest buyers of leveraged loans — wait out the uncertainty.

https://www.bloomberg.com/news/articles/2019-01-03/property-markets-from-hong-kong-to-sydney-join-global-downturnWhile prices are still about 60 percent higher than they were in 2012, meaning few existing homeowners are actually underwater, it’s economist forecasts of a further 10 percent fall that’s making nervous investors think twice about extraneous spending.

The central bank is also worried that a prolonged downturn will drag on consumption and with the main opposition Labor party pledging to curb tax perks for property investors if it wins an election expected in May, confidence is likely to be hit further.

Treasurer Josh Frydenberg on Thursday urged the nation’s banks not to tighten credit any more as the deepening downturn threatens to weigh on the economy

https://www.reuters.com/article/us-usa-fed-consumers-analysis-idUSKBN1JA33DThe European Central Bank on Thursday said it would scale back its longstanding asset purchase program in September and end it in December, a day after the U.S. Federal Reserve approved its seventh rate increase since 2015 and outlined plans for steady rate rises to come. The Fed is also drawing down its $4 trillion portfolio of bonds, putting further pressure on interest rates.

While the ECB has pledged not to actually raise its target interest rate for more than a year, the global shift in central bank policy is starting to be felt.

... Which, if what Dalio speaks about is true, those links are going to scare the bejasus out of some.

The reason for the thread is basically to ask rhe one question every kid asks on a journey (substitute for the longest unloved bull market of all time) "are we there yet?"

I can't definitely answer the question, but when the response with a little look over the left shoulder is "No, I think we are lost" it is a good practice to first find out where you are(excuses can be made later).

With that in mind I'm just trying to figure out where we're at and what others are thinking. The amount of doom and gloom pieces I've read while trying to research this is unhealthy for the mind.

So where are we?0 -

I think we're getting toward bubble territory, or at least America is. Despite record stock buy-backs the Dow ended the year below where it started. Full employment is being hit in many places while the tax rates have been cut in pro-cyclical moves that weren't necessary.0

-

Well I'm not at all surprised theres a slowdown in purchases of debt or collateralised loan obligations

If you are afraid there is going to be a slowdown then you definitely don't want to be buying collections of debt whose chances of being repaid look to be getting smaller the worse the economy goes...nevermind the fact that the collateral they are based on will in all probability devalue too.0 -

GDP GDP YoY GDP QoQ Interest rate Inflation rate Jobless rate Gov. Budget Debt/GDP Current Account Currency Population

United States

19391 3.00% 3.40% 2.50% 2.20% 3.90% -3.50% 105.40% -2.40 95.68 325.72

Euro Area

12590 1.60% 0.20% 0.00% 1.60% 8.10% -0.90% 86.70% 3.50 1.15 340.72

China

12238 6.50% 1.60% 4.35% 2.20% 3.82% -3.50% 47.60% 1.30 6.85 1390.08

Japan

4872 0.00% -0.60% -0.10% 0.80% 2.50% -4.50% 253.00% 4.02 108.67 126.71

Germany

3677 1.10% -0.20% 0.00% 1.70% 3.30% 1.30% 64.10% 8.00 1.15 82.85

United Kingdom

2622 1.50% 0.60% 0.75% 2.30% 4.10% -2.30% 85.30% -4.10 1.28 66.19

India

2597 7.10% 1.90% 6.50% 2.33% 3.52% -3.53% 68.70% -1.90 69.88 1283.60

France

2583 1.40% 0.30% 0.00% 1.60% 9.10% -2.60% 97.00% -0.80 1.15 67.19

Brazil

2056 1.30% 0.80% 6.50% 4.05% 11.60% -7.80% 74.04% -0.48 3.71 207.66

Italy

1935 0.70% -0.10% 0.00% 1.10% 10.60% -2.30% 131.80% 2.80 1.15 60.48

Canada

1653 1.90% 0.50% 1.75% 1.70% 5.60% -0.90% 89.60% -3.00 1.33 36.96

Russia

1578 1.50% 0.90% 7.75% 3.80% 4.80% -1.50% 12.60% 2.20 66.75 146.90

South Korea

1531 2.00% 0.60% 1.75% 1.30% 3.80% -2.00% 38.00% 5.60 1117.85 51.45

Australia

1323 2.80% 0.30% 1.50% 1.90% 5.10% -1.90% 41.90% -3.10 0.71 24.70

Spain

1311 2.40% 0.60% 0.00% 1.20% 14.55% -3.10% 98.30% 1.90 1.15 46.66

Mexico

1150 2.50% 0.80% 8.25% 4.72% 3.30% -2.90% 46.40% -1.60 19.34 123.52

Indonesia

1016 5.17% 3.09% 6.00% 3.13% 5.34% -1.76% 28.70% -1.70 14085.00 261.90

Turkey

851 1.60% -1.10% 24.00% 20.30% 11.40% -1.50% 28.30% -5.50 5.38 80.81

Netherlands

826 2.40% 0.20% 0.00% 2.00% 3.50% 1.10% 56.70% 10.20 1.15 17.12

Saudi Arabia

684 2.50% -0.05% 3.00% 2.80% 6.00% -8.90% 17.20% 2.20 3.75 32.61

Switzerland

679 2.40% -0.20% -0.75% 0.90% 2.50% 1.20% 29.70% 9.80 0.98 8.48

Argentina

638 -3.50% -0.70% 59.29% 48.00% 9.00% -3.90% 57.10% -4.80 37.34 44.05

Taiwan

579 2.27% 0.38% 1.38% 0.31% 3.69% -1.40% 31.20% 14.70 30.80 23.57

Sweden

538 1.60% -0.20% -0.25% 2.00% 5.50% 1.30% 40.60% 3.20 8.89 10.12

Poland

525 5.10% 1.70% 1.50% 1.30% 5.70% -1.70% 50.60% 0.30 3.74 37.98

Belgium

493 1.60% 0.30% 0.00% 2.34% 6.20% -1.00% 103.10% -0.20 1.15 11.41

Venezuela

482 -16.60% 6.80% 20.84% 1300000.00% 7.30% -20.00% 23.00% 2.00 248520.90 31.43

Thailand

455 3.30% 0.00% 1.75% 0.36% 1.00% -2.70% 41.80% 10.60 31.98 66.19

Iran

440 1.80% 18.00% 39.90% 12.10% -1.80% 39.50% 4.26 42000.00 80.90

Austria

417 2.20% 0.40% 0.00% 2.20% 8.70% -0.70% 78.40% 1.90 1.15 8.82

Norway

399 1.10% 0.60% 0.75% 3.50% 4.00% 4.40% 36.20% 5.70 8.53 5.30

United Arab Emirates

383 0.80% 0.80% 2.75% 1.30% 1.72% -2.60% 20.70% 7.30 3.67 9.40

Nigeria

376 1.81% 9.50% 14.00% 11.28% 23.10% -5.10% 21.30% 2.00 307.00 190.89

Israel

351 3.10% 0.50% 0.25% 1.20% 4.10% -2.15% 60.90% 4.10 3.70 8.81

South Africa

349 1.10% 2.20% 6.75% 5.20% 27.50% -4.60% 53.10% -2.50 13.86 57.73

Hong Kong

341 2.90% 0.10% 2.75% 2.60% 2.80% 2.20% 38.40% 4.20 7.83 7.41

Ireland

334 4.90% 0.90% 0.00% 0.60% 5.30% -0.30% 68.00% 12.50 1.15 4.84

Denmark

325 2.30% 0.70% -0.65% 0.80% 3.90% 1.00% 36.40% 7.90 6.51 5.78

Singapore

324 2.20% 1.60% 1.97% 0.30% 2.10% 0.30% 110.60% 19.50 1.36 5.61

Malaysia

315 4.40% 1.60% 3.25% 0.20% 3.30% -3.00% 50.90% 1.30 4.11 32.05

Philippines

314 6.10% 1.40% 4.75% 5.10% 5.10% -2.20% 42.10% -0.80 52.43 104.90

Colombia

309 2.70% 0.20% 4.25% 3.18% 8.80% -3.00% 48.50% -3.30 3192.65 49.29

Pakistan

305 5.79% 4.71% 10.00% 6.17% 5.90% -5.80% 67.20% -4.70 138.70 200.16

Chile

277 2.80% 0.30% 2.75% 2.80% 6.80% -2.80% 23.60% -1.50 680.86 18.37

Finland

252 2.40% 0.40% 0.00% 1.30% 6.20% -0.60% 61.40% 0.70 1.15 5.51

Bangladesh

250 7.30% 7.30% 6.00% 5.35% 4.20% -4.80% 27.10% -2.60 83.90 161.80

Egypt

235 5.40% 5.40% 16.75% 15.70% 10.00% -9.50% 101.20% -6.50 17.88 96.20

Vietnam

224 7.31% 6.88% 6.25% 2.98% 2.20% -3.50% 61.50% 2.90 23198.00 95.50

Portugal

218 2.10% 0.30% 0.00% 0.70% 6.70% -3.00% 125.70% 0.50 1.15 10.29

https://tradingeconomics.com/ (Click on the Country in the link for a more in depth info)

It is a big world out there, I doubt every Country, is in the same cycle. If nothing else it might be fun to track different economies for the year.

Form a nice orderly queue lads and pick a Country, research it, own it and post on it for the year. You will/should start to see opportunities present themselves. (for the more experienced pick a Country you know nothing about).

If we make a few bob along the way, all the better.:cool:0 -

Advertisement

-

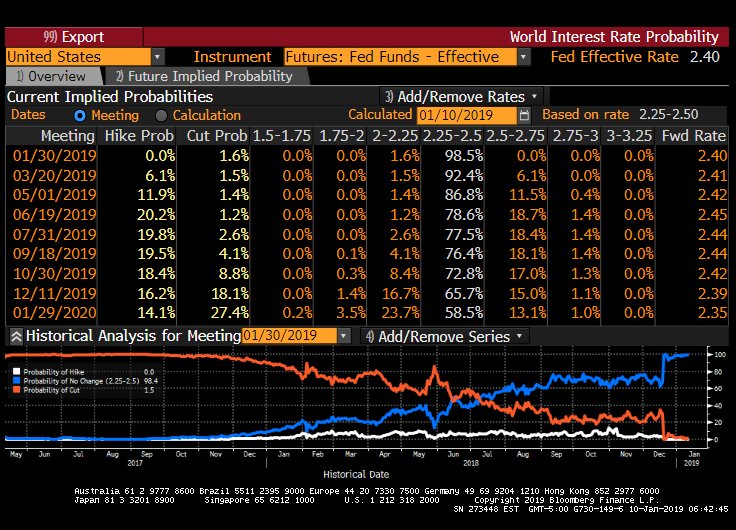

Not much been priced in for a Fed rate hike in 2019.

Not much been priced in for a ECB rate hike in 2019.

https://www.reuters.com/article/eurozone-moneymarket/ecb-rate-hike-now-unlikely-before-mid-2020-money-markets-bet-idUSL8N1Z82DTThe difference between the overnight and forward Eonia interest rates — bank-to-bank interest rates for the euro area that provide some indication of how investors view the ECB rate trajectory — imply a 10-basis-point rate hike is now only fully priced in around the middle of 2020.

So investors have not only scaled back bets on a rate rise this year — current pricing suggests a roughly 45 percent chance of a hike by year-end — they have also pushed back the expected date of a first move by the ECB by months rather than the usual month or two.

Quantitative tightening continuing by the Fed...

https://www.cnbc.com/2019/01/10/powell-says-balance-sheet-will-be-substantially-smaller.htmlThe Fed had been holding about $4.5 trillion worth of mostly Treasurys and mortgage-backed securities that it accrued during three rounds of monetary stimulus during and after the financial crisis.

Starting in October 2016, the Fed began allowing a fixed cap of proceeds from those bonds to run off each month, with the level now reaching a ceiling of $50 billion. The Treasury and MBS holdings have contracted by about $400 billion since the operation began. The overall balance sheet is now below $4 trillion.

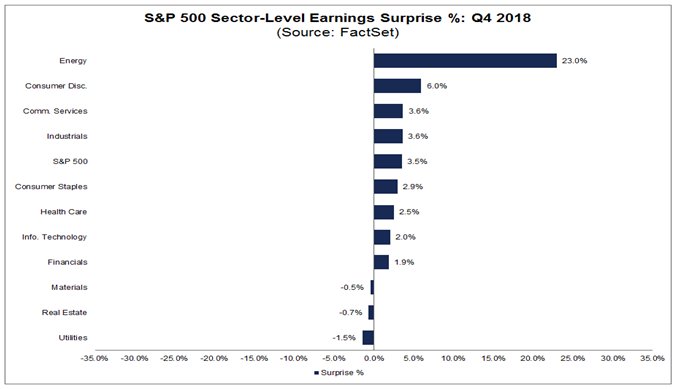

... which have led the quants to believe that this is how much it will take off the the value of different sectors.. Robin Wigglesworth

Robin Wigglesworth

@RobinWigg

Morgan Stanley's quant team calculates that every $20bn decline in the Fed's MBS holdings shaves 0.37% off the S&P 500.

Quantitative tightening by the ECB starting? ( we'll just put april 1 every year until further notice :D:D) 0

:D:D) 0 -

Who'd of thought?0

Advertisement

https://www.youtube.com/watch?v=PHe0bXAIuk0

https://www.youtube.com/watch?v=PHe0bXAIuk0![[Deleted User]](https://www.boards.ie/applications/dashboard/design/images/banned.png)