Advertisement

If you have a new account but are having problems posting or verifying your account, please email us on hello@boards.ie for help. Thanks :)

Hello all! Please ensure that you are posting a new thread or question in the appropriate forum. The Feedback forum is overwhelmed with questions that are having to be moved elsewhere. If you need help to verify your account contact hello@boards.ie

The effect of cheap oil on American policy

-

23-12-2014 9:03pm#1With oil prices in free fall, some of the more hard-nosed Americans are preening their feathers and putting a positive spin on things.

For example, this polemic on Fox News from a spokesman for the Heritage Foundation, one of the most right-wing think tanks, seems to suggest that OPEC is running scared, that it will soon break up and that the US will rule the roost as not only the world's military superpower but its largest oil exporter. But is he right to be so optimistic?

Some comments from the piece linked to above:

since 2008 the U.S. has increased our domestic supply by a gigantic 50 percent..[as]..a result of the astounding shale oil and gas revolution made possible by made-in-America technologies like hydraulic fracturing that's fracking, to you and me, MF and horizontal drilling. Already thanks to these inventions, the US has become the number one producer of natural gas. But oil production in states like Oklahoma, Texas and North Dakota has doubled in just six years.

...

When the radical greens carry around signs saying "No to Fracking," they couldn't be promoting a more anti-America message. It would be like Nebraska not growing corn.

....

Here's another reason to love the oil and gas bonanza in America. It's breaking the back of OPEC. Saudi Arabia is deluging the world with oil right now, which is driving the world price relentlessly lower. The Arabs understand - as too few in Washington do - that shale energy boom is no short term fad. It could make energy cheaper for decades to come.

..we will soon overtake Saudi Arabia as the dominant player in world energy markets.

Now I am no oil expert but it seems to me that the big disadvantage of extraction techniques like fracking and shale drilling are that they are inherently more expensive than the method used in the middle east, which by comparison is something like "dig a hole and watch the stuff gush out".

The OPEC countries, dominated by the middle eastern Arab nations, are driving the price of oil down because they can. Will the US producers with their inherently more expensive extraction costs be able to stay in business in the short term? Will they need government support in the form of subsidies and/or tariffs to to withstand such competition? How will the likes of the Heritage Foundation be able to call for such government support for industry with a straight face?

And what sort of effect will all this have on foreign policy? America wants cheap oil but not so cheap as to put its domestic suppliers out of business. Other countries that need, as opposed to want, the price of oil to rise include Russia and Venezuela because of the dependence of their economies on revenues from the stuff.

Could the US be courting some very strange bed fellows in forthcoming months?

And of course we haven't mentioned the environmental impact of a world newly awash with cheap oil.........0

Comments

-

merica wants cheap oil but not so cheap as to put its domestic suppliers out of business

I don't know if we have any domestic suppliers. The big oil companies, even the ones headquartered in the US, are more like multinationals who happen to have some operations in the US. We want cheap oil, we're getting cheap oil from somewhere, everyone's happy. Plus, face it, it's a lot easier to get crude from Oklahoma to the Chevron refinery here in California than it is to bring it in from Saudi Arabia. Those extra costs of extraction are likely counterbalanced by the cheaper cost of transport.

However, in the long term, who cares? If the US is economically disincentivised from pumping up its own oil for a decade or two, all the better that the nation has the reserves later.0 -

Manic Moran wrote: »

in the long term, who cares? If the US is economically disincentivised from pumping up its own oil for a decade or two, all the better that the nation has the reserves later.

Yes, but that's not the way capitalism works, is it? The only good buck is a fast buck. If you invest a few million, or billion, in developing fracking or shale-extraction technology, and in acquiring the necessary rights to operate on territory where it is abundant, you will want a return on that investment and pronto. You don't want to wait "a decade or two".

I just think this will be a factor in determining American geo-political policy in the near future. And which may explain some moves that would otherwise appear ironic or downright contradictory. (eg cosying up to Putin; being nice to Venezuela, an OPEC member; reminding Saudi Arabia that they were more responsible for 9/11 than the Iraqis ever were etc)0 -

I'm thinking from the point of national security, not shareholder benefit.0

-

Moderators, Category Moderators, Science, Health & Environment Moderators, Society & Culture Moderators Posts: 47,218 CMod ✭✭✭✭

Join Date:Posts: 36365

Join Date:Posts: 36365

Domestic and Canadian-USA pipeline policies will more than likely change when the Republicans once again gain control of both houses of Congress late January 2015, claiming the loss in oil corporation jobs as part of the incentive to finish the lines.

So long as Obama is president, they will not be able to start a war with oil rich Iran to temporarily create an artificial scarcity to drive down the world supply and drive up of the costs/profits. After November 2016, who knows?0 -

Energy policy/practices change so fast anyway that it wouldn't be surprising if gas was $4+ gallon this summer. A few years ago companies spent $750m on two LNG terminals in my state that go mostly unused now since the bottom dropped out on imported NG. Then they switched power plants and many households over to NG and now electricity prices have/are gone/going up 30-50% because they claim the internal NG piping network can't keep up with the demand. Roads and transportation infrastructure is in a pretty bad state and people already think they are taxed heavily on fuel when really they are not. Although I am a bit of a hypocrite and chose a vehicle that gets terrible MPG even on highway. I think the national fuel tax hasn't increased since the 1980s. Then people have the goldfish memories when it comes to buying vehicles when gas is cheap and then complain later. OPEC is a monopoly anyway and I don't know why any of these countries are allowed in the WTO. I don't have a problem with nuclear or renewables but nuclear plant that is closest to where I live seems to shut down frequently and they keep the spent fuel on site awaiting a national storage facility. Windmills people don't even want offshore or away from population centers so you get to add lots of litigation money to any large - or even small - proposal.0

-

Advertisement

-

Ireland gets their petrol at about the same price as the states. Currently, many places in the states are paying about $2 for a gallon with lows of $1.50 in Oklahoma and Idaho.

That's about €0.44 per liter back on the auld sod, correct?

Looks like the price of a gallon in Ireland is about $4.70.

Cheap oil is not definitely not affecting Irish policy!0 -

The Heritage Foundation is more or less right when they state how the decrease in oil prices is due to massive rise in supply of oil, mostly from American producers.

http://www.bloomberg.com/graphics/2014-america-shakes-off-oil-addiction/

The second slide is most telling. If you add an extra 5 million barrels of oil to the world supply expect a reaction in prices.

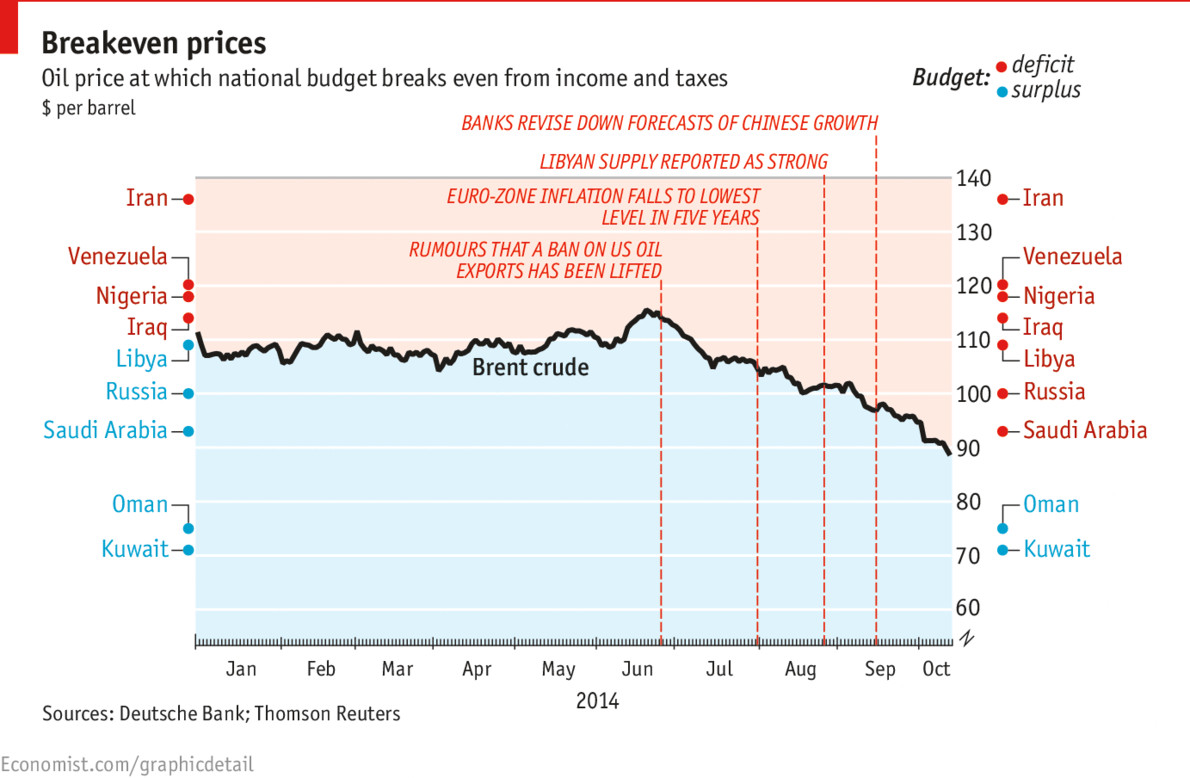

Also, even though many domestic American oil companies will be hit which will cause bond defaults and unemployment is some scale, they are not the most expensive producers in the world. In fact they are cheaper than Iran, Libya, Russia among many others.

http://www.bloomberg.com/news/2014-10-17/oil-is-cheap-but-not-so-cheap-that-americans-won-t-profit-from-it.html

0

0 -

Oil price falls normally boosts GDP by shifting resources from producers to consumers, who spend their gains locally than going to the wealthy oil producing countries. If increased supply is the driving force, the effect is likely to be bigger—as in America. China is the world’s second-largest net importer of oil. Cheaper oil will also help the government clean up China’s filthy air by phasing out dirty vehicle fuels, such as diesel.0

-

Thought it would have been the other way around with China? Dearer oil means buying more efficient vehicles that are less polluting?0

-

I didnt know the US had domestic suppliers0

-

Advertisement

-

-

Thought this might be worth a bump after reading this piece by Ambrose Evans Pritchard in the Telegraph yesterday.

If you are blocked by the Telegraph pay wall it is headlined "Texas Shale Oil has fought Saudi Arabia to a standstill" and it is basically saying that technological advances have allowed frackers to cut the price of Shale Oil extraction to the point where it is competitive with the low prices charged today.

Some quotes

"Twenty months after Saudi Arabia took the fateful decision to flood world markets with oil, it has still failed to break the back of the US shale industry.

The Saudi-led Gulf states have certainly succeeded in killing off a string of global mega-projects in deep waters. Investment in upstream exploration from 2014 to 2020 will be $1.8 trillion less than previously assumed, according to consultants IHS. But this is a bitter victory at best.

North America's hydraulic frackers are cutting costs so fast that most can now produce at prices far below levels needed to fund the Saudi welfare state and its military machine, or to cover Opec budget deficits."

"It has been an article of faith among Gulf exporters that hedging contracts had kept US shale companies on life-support and that there would be a brutal cull as these expired in the first half of this year.

No such Gotterdamerung has occurred. A few over-leveraged players have gone bankrupt, but Blackstone, Carlyle and other private equity groups are waiting on the sidelines to buy distressed assets and take over the infrastructure."

"The crucial mid-tier drillers have weathered the downturn. Many are still able to raise funds at low cost. Total output in the US has fallen by 1.2m barrels a day to 8.5m since the peak in April 2015 but production has been bottoming out. Today's frackers can just about cope with oil prices in the $40 to $50 range.

Opec may now have to brace for a longer war of attrition than they ever imagined."

Interesting. Mr Evans Pritchard clearly takes it for granted that the low price of oil over the last few years has been a deliberate ploy by OPEC and that it may not have paid off. Could be interesting times.

Mind you, I'm not sure if we should be welcoming the acceptance of fracking.0 -

I wouldn't consider it the worse thing if the various OPEC members were faced with economic hardships. Could be the impetus needed to force through leadership changes in those countries. How will the House of Saud maintain itself without being able to pay off the military etc?0

-

Now I am no oil expert but it seems to me that the big disadvantage of extraction techniques like fracking and shale drilling are that they are inherently more expensive than the method used in the middle east, which by comparison is something like "dig a hole and watch the stuff gush out".

The OPEC countries, dominated by the middle eastern Arab nations, are driving the price of oil down because they can. Will the US producers with their inherently more expensive extraction costs be able to stay in business in the short term? Will they need government support in the form of subsidies and/or tariffs to to withstand such competition? How will the likes of the Heritage Foundation be able to call for such government support for industry with a straight face?

And what sort of effect will all this have on foreign policy? America wants cheap oil but not so cheap as to put its domestic suppliers out of business. Other countries that need, as opposed to want, the price of oil to rise include Russia and Venezuela because of the dependence of their economies on revenues from the stuff.

The break-even point for most shale companies is estimated at $40 a barrel (if I remember reading correctly, some estimates put them as low as $35 in the mid-term if they're leveraging properly). The only country to match this is Saudi Arabia, their estimated break even is about $10 a barrel but here's the catch:

The US doesn't rely on oil production to generate income. While it provides a huge number of jobs in places like Texas, low oil prices aren't catastrophic to them. Iran and Russia need north of $100 a barrel, Venezuela is probably more (they relied heavily on selling poor quality oil to the US markets but now the US infrastructure is investing in oil sands instead of the gloop that Venezuela produces - hell, the Canadians were pushing hard for their oil pipeline from Alberta into the US for precisely that reason).

The Saudis and Iranians are also spending huge amounts of money on funding costly wars in the Middle East - Saudi Arabia is funding extremists in Syria and Libya, and bombing Yemen.

So while the Arabs/Iranians have a headline lower "break-even" rate, low oil prices will bite into their budgets - the Saudis have had to take their first loan in decades only a few months ago to shore up their current budget, even after slashing welfare and their capital budget.

Shale companies don't need to endure long-term deflated prices, they'll produce the bare minimum or nothing at all, and once prices begin to rise, they'll enter the market again and drive the price back down.0 -

The Duke of Wellington wrote: »here's the catch:

The US doesn't rely on oil production to generate income. While it provides a huge number of jobs in places like Texas, low oil prices aren't catastrophic to them. Iran and Russia need north of $100 a barrel, Venezuela is probably ....

..The Saudis and Iranians are also spending huge amounts of money on funding costly wars in the Middle East - Saudi Arabia is funding extremists in Syria and Libya, and bombing Yemen.

So while the Arabs/Iranians have a headline lower "break-even" rate, low oil prices will bite into their budgets - the Saudis have had to take their first loan in decades only a few months ago to shore up their current budget, even after slashing welfare and their capital budget.

Shale companies don't need to endure long-term deflated prices, they'll produce the bare minimum or nothing at all, and once prices begin to rise, they'll enter the market again and drive the price back down.

First off, have a look at the date of the first post. It was three years ago. And Mr Pritchard's article, only a couple of months old, is basically a resumé of how things have changed in the interim.

The point isn't (and wasn't) that low oil prices are bad for America per se. The point three years ago was that low international oil prices might not be good for frackers and shale oil extracters (who are mainly American) because those methods of fossil fuel extraction were inherently more expensive than others; and that one of the reasons for low oil prices over the last few years was the flooding of cheap oil on to world markets by OPEC countries. That this in turn was a bid by OPEC to discourage frackers from taking the hit on reduced profits, or even losses, emanating from their more costly extraction methods and therefore to put them out of business. Or at least, the fracking business.

Pritchard's article in August this year accepts that such was indeed the strategy of OPEC and goes on to suggest that this strategy has failed as new technology developments have reduced the cost of fracking and low oil prices have not discouraged American producers from forging ahead.

The world has changed.

Now we are hearing a new phrase emanating from the American Right: Energy Dominance. No longer is it enough for America to be self sufficient in energy (which it wasn't for a long time but is becoming so now); it now wants to use energy (oil, gas etc) as an international lever on the world.

Developments since then have seen a significant change in the Great Game. Britain, America's chief sycophant and incidentally an important medium-level oil producer itself, is leaving the EU. A determinedly isolationist America Firster is in the White House. The Middle East is in greater turmoil than usual. The European Union, or its British-free rump, is attempting to assert itself as an entity independent of the constraints of a close relationship with America.

The implications of all this could be very interesting. Will NATO survive, seeing as neither the Europeans (or at least the powerful European countries) nor the Americans seem to want it any more? Will the emergence of Britain as an entity free of the EU inevitably see it cosying up even more closely to the US and (whisper it) Trump's new best friends in Russia? Will the fact that one of the few things each of these countries has in common is an indigenous oil-production industry have implications for their relations with Europe? What is the Free World any more anyway?

Energy Dominance. Learn to fear that term.0 -

I could take some of that last rant seriously - then I got to the new best friends in Russia bit.0

-

server down wrote: »I could take some of that last rant seriously - then I got to the new best friends in Russia bit.

You don't think there is any commonality of interest between the world's joint largest oil producer and the Trump administration packed with energy-lobby diehards? Or that there was ANY collusion between Russian interests and the Trump presidential campaign?

There is a lot of controversy in America about whether such "meddling" from Russia constituted illegality, either by the Russians or by those Americans who were more than happy to be "meddled" with. But nobody now denies that such contacts took place and as such you have to ask yourself, dispassionately and without delving into the depths of fanciful conspiracy theory, why this happened.

Cui bono?0 -

Oh and er, this article from the Guardian has been posted on another thread here.

The Russians seem to be very keen to make friends with some people in both US and UK. And there are some who are only too pleased to be their friends. Even their new best friends.0 -

You don't think there is any commonality of interest between the world's joint largest oil producer and the Trump administration packed with energy-lobby diehards? Or that there was ANY collusion between Russian interests and the Trump presidential campaign?

No, I think thats the democrats and the deep state.There is a lot of controversy in America about whether such "meddling" from Russia constituted illegality, either by the Russians or by those Americans who were more than happy to be "meddled" with. But nobody now denies that such contacts took place and as such you have to ask yourself, dispassionately and without delving into the depths of fanciful conspiracy theory, why this happened.

Cui bono?

I think that we should leave American conspiracy theories in America. Meetings between American business people happen across all levels of political classes and with all countries in the world.

Cohen has an agenda, by the way.0 -

server down wrote: »No, I think thats the democrats and the deep state.

Now you're talking mumbo jumbo.server down wrote: »I think that we should leave American conspiracy theories in America. Meetings between American business people happen across all levels of political classes and with all countries in the world.

I'm not engaged in a conspiracy theory. I am trying to make sense of acknowledged facts, both from history and from current, or very recent, affairs.

Oil is a huge political football. And, to keep the analogy with the American version of that game, for the first time in a century America actually has possession of the football rather than trying to wrest it away from other players.

This is going to have a major effect on the strategic alignment of the world. And other events play into that too. Including Brexit, which was not even an issue when the OP was posted.

I think the picture in Europe is going to realign along the old war time alliance between US, Britain and Russia. Except this time they are up against ALL of the rest of Europe and not just the Germans and a few racist hangers on. UK, US and USSR were pretty unlikely bed partners in the 1940s but the alliance endured....for a time.

They don't have to like or admire each other all that much to do much the same thing again.0 -

Advertisement

-

The recent developments in oil, and the ineffectiveness, or supposed ineffectiveness, of OPEC to influence the market in the face of increased US output, has put OPEC on the back foot.

The big question is how long the US can continue this increased level of output and keep prices down. Its now looking unlikely we'll see prices increase above the mid-$50 range in the foreseeable future.

Not sure I've any time for a US/Russia conspiracy to be honest. The UK will do, as they've always done, what the US does. As a net energy importer, they've no real choice. That hasn't changed since about 1945...0 -

The recent developments in oil, and the ineffectiveness, or supposed ineffectiveness, of OPEC to influence the market in the face of increased US output, has put OPEC on the back foot.

The big question is how long the US can continue this increased level of output and keep prices down. Its now looking unlikely we'll see prices increase above the mid-$50 range in the foreseeable future.

Not sure I've any time for a US/Russia conspiracy to be honest. The UK will do, as they've always done, what the US does. As a net energy importer, they've no real choice. That hasn't changed since about 1945...

It's not a conspiracy!!!

It's an arms-length informal marriage of convenience based on shared interest in a common commodity. All the more worthy of study because it is NOT formalised or treaty bound.

You think we won't see oil prices rise above $50/bbl in the "foreseeable future"? Depends what you mean by foreseeable. It's not too hard to imagine them shooting up (in Europe at any rate) by more than that within a couple of years because the EU will not have ANY indigenous producers of any size by then. But then, who knows what "events" will have occurred and have to be thrown into the mix by then?0 -

Sorry, I should have clarified the "foreseeable future" bit. Certainly its hard to see anything changing drastically price-wise before the end of next year (2018).

But you're right of course, that has to come with a massive disclaimer too. All we need is, God forbid, a conflict in the Middle East or North Korea (anywhere really, I suppose) for that to change everything. All I know is, given where we're situated, we're the ones who'll end up paying for it!0 -

Now you're talking mumbo jumbo.

Which word was mumbo jumbo- democrats or deep state?I'm not engaged in a conspiracy theory. I am trying to make sense of acknowledged facts, both from history and from current, or very recent, affairs.

Even if Russia is actually interfering in the US in the way claimed, it is still very much a conspiracy theory.Oil is a huge political football. And, to keep the analogy with the American version of that game, for the first time in a century America actually has possession of the football rather than trying to wrest it away from other players.

This is going to have a major effect on the strategic alignment of the world. And other events play into that too. Including Brexit, which was not even an issue when the OP was posted.

I think the picture in Europe is going to realign along the old war time alliance between US, Britain and Russia. Except this time they are up against ALL of the rest of Europe and not just the Germans and a few racist hangers on. UK, US and USSR were pretty unlikely bed partners in the 1940s but the alliance endured....for a time.

They don't have to like or admire each other all that much to do much the same thing again.

Once again the first paragraph makes sense, the US will become an oil producer of note. From that we move onto an old war time alliance ( the WWII I suppose) because of no reason whatsoever. If America becomes an oil producer then it harms, not helps, the Russians. The UK may become an even greater ally ( read foot stool) of the US because of Brexit, but nothing to do with oil.0 -

server down wrote: »Which word was mumbo jumbo- democrats or deep state?

Given that both came without any context or clarification and were clearly meant as "triggers": both.server down wrote: »Once again the first paragraph makes sense, the US will become an oil producer of note. From that we move onto an old war time alliance ( the WWII I suppose) because of no reason whatsoever. If America becomes an oil producer then it harms, not helps, the Russians. The UK may become an even greater ally ( read foot stool) of the US because of Brexit, but nothing to do with oil.

One of the biggest threats to the oil business at the moment is the determination (in varying degrees) of people to move away from dependency on it. In the long run, we may well live in a world that will be, if not "oil free" then far less oil critical. But there's a long way to go before that.

In the meantime, those who have oil are in a strong position to use it as a lever over those who don't. All it takes is a little collaboration and cartelling. OPEC has known that for years. And now the US is coming to the table with a strong hand of cards. And its relations with Britain and Russia are changing: Britain because of Brexit and Russia for a number of factors, not least of which is a US or at least a Trumpian desire to de-emphasise its ties to NATO.

The world has changed, and oil is a factor. As it has been for much of the past 150 years.

PS Foot stool is right 0

0 -

Its now looking unlikely we'll see prices increase above the mid-$50 range in the foreseeable future.Sorry, I should have clarified the "foreseeable future" bit. Certainly its hard to see anything changing drastically price-wise before the end of next year (2018).

It's the middle of 2018 and Brent Crude is (according to one website) $79.28 at the moment of typing.

So you didn't see that coming, did you?But you're right of course, that has to come with a massive disclaimer too. All we need is, God forbid, a conflict in the Middle East or North Korea (anywhere really, I suppose) for that to change everything.

OK. Maybe you did 0

0 -

Black Swan wrote: »Domestic and Canadian-USA pipeline policies will more than likely change when the Republicans once again gain control of both houses of Congress late January 2015, claiming the loss in oil corporation jobs as part of the incentive to finish the lines.

So long as Obama is president, they will not be able to start a war with oil rich Iran to temporarily create an artificial scarcity to drive down the world supply and drive up of the costs/profits. After November 2016, who knows?

Not happening in Canada currently and the PM is pro pipeline.0

Advertisement